The latest polls indicate that the political environment in Washington is the top economic risk cited by every age, income, gender, racial/ethnic group and political affiliation.

This isn’t a stretch given the fluidity of recent events. In the long run, stock prices will reflect whether President Trump’s policies create more disposable income, boost profits and raise salaries. Cutting taxes does that in the short term, but the long-range goal is to beat inflation through higher salaries and boost retirement plans, which hasn’t been the case for most working families.

Treasury Secretary Steven Mnuchin said Trump’s tax reform will create 1.7 million new jobs, save families $4,600 per year, raise wages by 8% and bring to an end corporate inversions that eliminate incentives to offshore profits and jobs that would prompt corporations to expand and reinvest in U.S. manufacturing. It all sounds good and the stock market has been in rally mode with bated breath leading up to this pronouncement of the “Make America Great Again” tax plan that now has to work its way through Congress.

Critics are already fanning the flames over pitfalls of the Trump tax plan, stating that if it doesn’t find a way to replace lost tax revenue in the early years, the government will have to borrow trillions of dollars to pay its bills. The new tax plan assumes the incentives will result in a 4% rate of gross domestic product (GDP) growth that will drive organic tax receipts, making the plan revenue neutral. After the economy posted first-quarter GDP growth of only 0.7%, which was Trump’s first quarter in office, it’s no surprise the doubters of this grand stimulus scheme are making lots of noise.

The naysayers warn that another $2 trillion of deficit spending not matched by revenues will blow a hole in the bond market with all bets off. It could mean rating reductions for U.S. debt, weaker demand for Treasuries, soaring interest rates and inflation. But these are the same critics who refuse to tangle with the biggest and most threatening of all fiscal forces — entitlement spending that soaks up over 60% of every dollar of the federal budget and rising. You’d think that the logic would go something like “we better grow the economy at 4% or better, or we’ll drown in entitlement spending.”

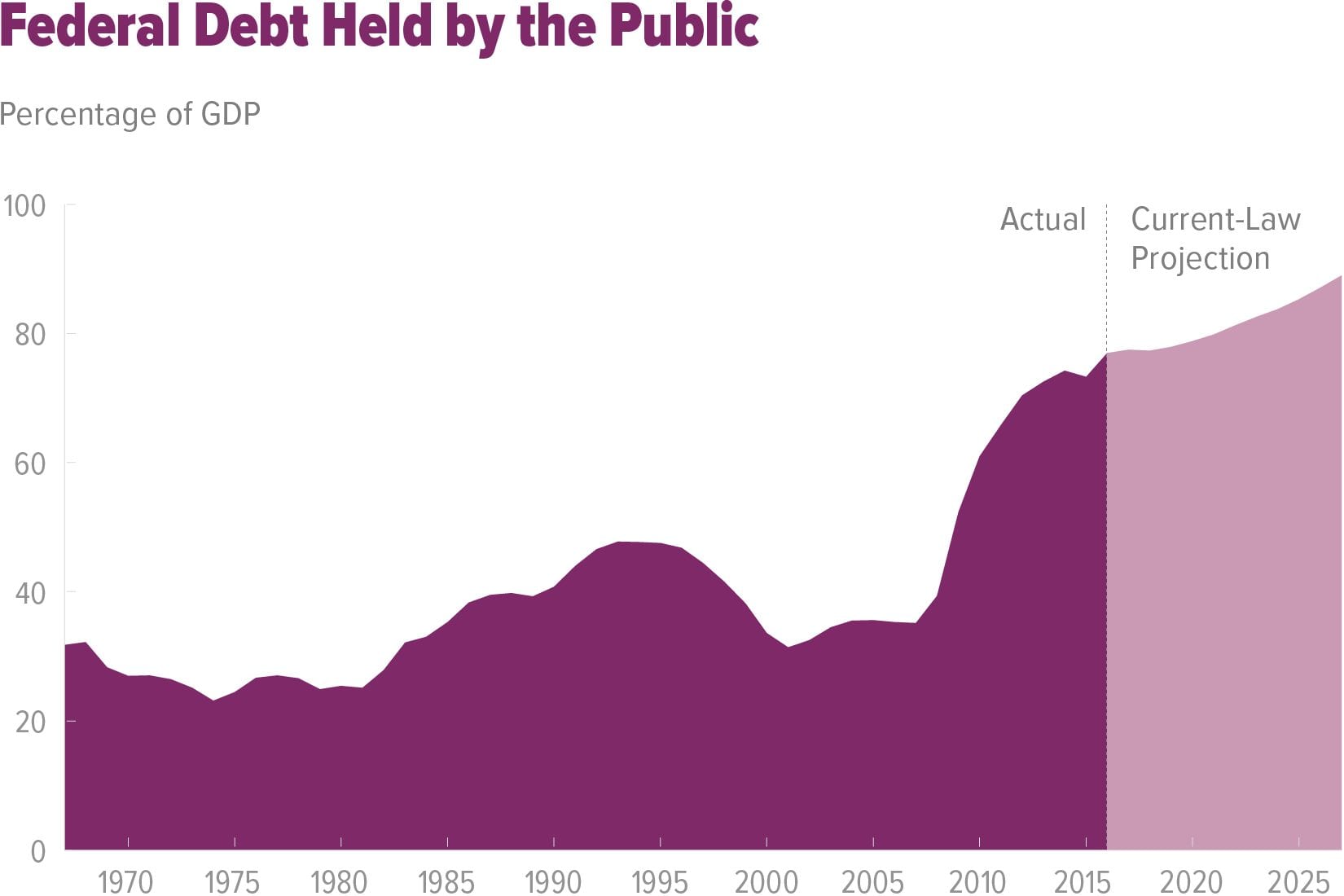

After seven years of modest declines, the federal budget deficit is projected to swell again, adding nearly $10 trillion to the federal debt over the next 10 years, according to projections from the nonpartisan Congressional Budget Office if the status quo for the current tax system is maintained. The numbers reveal the strain that government debt could have on the economy as President Trump presses to slash taxes and ramp up spending.

The deficit figures will be a major challenge to House Republicans, who were swept to power in 2010 on fears of a bloated deficit, after making controlling red ink a major part of their agenda under former President Barack Obama. Statutory caps imposed in 2011 on domestic and military spending have helped temper the deficit. But those controls are likely to be swamped by health care and Social Security spending that will rise with an aging population and are toxic political fodder to raise in balancing the budget legislation.

Now, congressional leaders will have to choose between the cause of fiscal prudence and the demands of the new president, who wants $1 trillion in infrastructure work over 10 years, a surge in military spending and large tax cuts for individuals and corporations. Democrats are likely to oppose large tax cuts, but they will press Mr. Trump to make good on his promise to spend big on infrastructure. Senate Democrats will likely go along with the $1 trillion plan to rebuild the nation’s roads, bridges, rails, transit systems, airports, sewer systems and power grid. But “we will not cut middle-class programs like education and health care to pay for it,” said Senator Chuck Schumer of New York, the Democratic leader. And so goes the conundrum for the Congressional budget committee for the next few months.

With that in mind, and in what is shaping up to be one of the greatest Congressional donnybrooks of all time, what are income investors to do while this all gets sorted out? The most logical answer is to stay invested in a powerful dividend growth strategy. Companies with strong and durable businesses that have the ability to double their dividends every six to seven years reflect pristine balance sheets and fiscal prudence to shareholders. The tax plan, as it is proposed, stands to greatly benefit corporations with robust stock buyback and dividend policies. It behooves investors to ride those coattails all the way to the bank.

One also can spice up their dividend growth portfolio by adding an effective covered-call strategy to drive extra income, essentially doubling or tripling the yield on an income-generating portfolio. One simple and easy method is to follow my covered-call advisory Quick Income Trader by clicking here. In that trading service, I manage a stable of no more than seven live trades, updated weekly and designed to pay monthly call premium to investors seeking a low turnover, affordable method to maximize return. No matter what the net effect of the tax plan is going to result in, we can all put to work a plan to stay ahead of taxes and inflation. Quick Income Trader is just the ticket and doesn’t take an act of Congress to put into place.

In case you missed it, I encourage you to read my e-letter from last week about how the current market movements benefit investing in assets that generate dividend income.