Following a well-deserved pullback for the tech-rich Nasdaq, it was reported this past week by the Semiconductor Industry Association (SIA) that the month of May had the strongest monthly computer chip report in seven years.

Other positive industry commentary gave a boost to technology stocks on Wednesday. Global sales of semiconductors rose 22.6% to $31.9 billion for the month of May to mark the strongest year-over-year growth since September 2010.

Shares of chipmakers and semiconductor equipment makers that had been slammed on heavy profit taking of late snapped a seven-day losing streak and found strong buying interest off of this extremely bullish report. Shares of Micron Technology (MU), Broadcom (AVGO), Nvidia (NVDA), Advanced Micro Devices (AMD) and Intel (INTC) were among the chip stocks moving up, while Applied Materials (AMAT), Lam Research (LRCX) and KLA-Tencor (KLAC) led the chip equipment makers higher on the news.

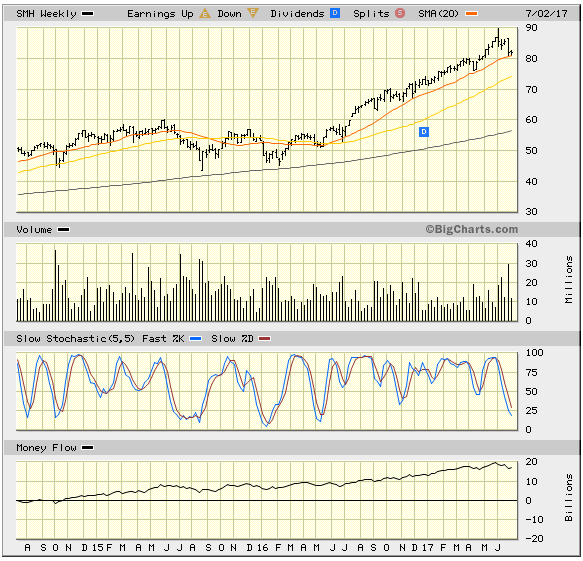

“The global semiconductor market has settled into a period of significant and steady growth in 2017,” said John Neuffer, chief executive officer of the Semiconductor Industry Association, in prepared remarks with the monthly report. The report noted that chip-market growth has been consistent across all major regional markets and semiconductor-product categories, with sales of memory products continuing to lead the way. Below is a weekly chart of the VanEck Vectors Semiconductor ETF (SMH) that illustrates the powerful uptrend the sector is trading on and how a recent pullback to the first 20-week trend line found good technical support and an attractive entry point for new money.

The SIA report said computer chip sales increased across all regions in May from the year-ago quarter, led by a 30.5% growth in the Americas region, followed by China’s 26% rise and Europe at 18% growth. The chip sector led the Nasdaq for the first half of the year to boost the index up over 17%, far outpacing the Dow, S&P and Russell 2000. This takes into account some early earnings upside surprises from a few key software companies, namely Autodesk (ADSK), Adobe Systems (ADBE), Oracle (ORCL) and Red Hat (RHT).

This wave of good news presents income investors with a premium opportunity to build a custom basket of hot tech stocks that already have been blessed by the market that make ideal covered-call and naked-put option candidates. Market volatility is back for a number of reasons: rampant sector rotation, tighter Fed policy, higher interest rates, tough talk on North Korea, more restrictive G20 trade deals, terrorism threats, a breakdown in oil prices and transformational change in the retail sector contributing to a plunge in the price of several formerly leading stocks.

Now is the time to wrap one’s trading head around the notion of putting together a tight-knit group of leading software and semiconductor stocks to sell put and call option premium against. Two great things happen here. First, a strong growth portfolio that is seeing accumulation among fund managers is owned. Second, the heightened level of volatility makes for expanded option premium and hence a powerful stream of immediate monthly income.

This is the center of focus at Quick Income Trader, a weekly advisory service that takes a name like Micron Technology (MU) and provides both a covered-call strategy and a naked-put strategy to subscribers with the investment objective of creating immediate cash returns from the sale of calls and puts coupled with capital appreciation.

Knowing where the market is intensely focused helps to avert portfolio damage from sharp bouts of broad market selling pressure. Staying invested in the few sweet spots that are fundamentally and technically strong, as well as free of politics, regulatory changes and commodity risk, is truly advantageous for the summer trading landscape. Quick Income Trader has a stable of seven hot income trading strategies always at work, each and every week. This is where total return takes on a whole new meaning and it’s worth taking the time to find out about it by simply clicking on this link and getting involved.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)