The Financial Select Sector SPDR Fund (XLF) seeks to provide its investors with opportunities to take tactical and targeted positions rather than pursue broad-market investing.

XLF has holdings in a diverse array of financial companies, ranging from banks such as JPMorgan Chase & Co. (JPM) and Wells Fargo & Company (WFC), to insurers like Berkshire Hathaway Inc. Class B (BRK.B). Financial companies play a large role in the proper functioning of the global economy, so they are important to have in a successful long-term portfolio.

Due to the campaign promises and early actions of President Donald Trump, it appears that regulations for the financial sector will continue to be reduced. This is good news for XLF and its holdings, since reduced regulations should open up more capital for investment.

The financial services industry continues to grow as time goes on. Almost every business transaction, except for those that involve cash, relies on some sort of financial service. As the economy improves and business transactions increase, the use of financial services is likely to grow as well. In other words, as the economy improves, so should XLF.

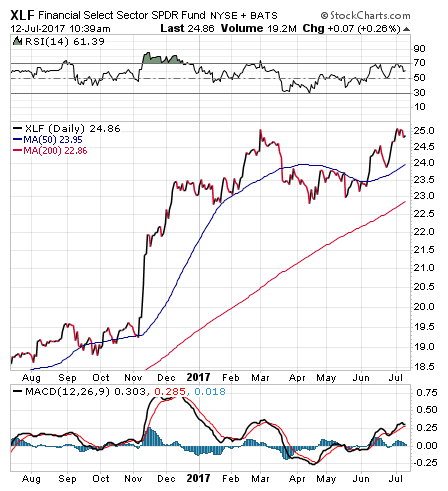

Created on December 16, 1998, XLF has grown somewhat slowly to rise roughly 3.76% since its inception. XLF’s holdings were slammed by the 2008 financial crisis and the fund fell. But XLF has been on the ascent since early 2009. The fund specifically has grown by almost 7% year to date and by more than 35% in the past year alone, as the following chart shows. In addition, XLF is expected to grow roughly 11% in the next several years.

The fund currently holds 68 positions and is approximately 45% in banks, 20% in capital markets, 19% in insurance, 11% in diversified financial services and 5% in consumer finance.

XLF has a dividend yield of roughly 1.5% and a gross expense ratio of 0.14%. Considering that it has more than $25 million worth of assets, the fund is doing quite well for itself. Its top five holdings, as of July 11, are JPMorgan Chase & Co. (JPM), 10.85%; Berkshire Hathaway Inc. Class B (BRK.B), 10.57%; Wells Fargo & Company (WFC), 8.14%; Bank of America Corporation (BAC), 8.05%; and Citigroup Inc. (C), 6.05%.

If you want a stable investment in the financial sector with potential for long-term growth, then the Financial Select Sector SPDR Fund (XLF) may be a good choice.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)