Live by the sword, die by the sword.

It is the common rendering of the Biblical verse Matthew 26:52, in which the King James version reads, “Then said Jesus unto him, Put up again thy sword into his place: for all they that take the sword shall perish with the sword.”

This bull market reminds me of that poetic verse. Since Election Day on Nov. 8, stocks have surged to more than 32 all-time record highs on the Dow Jones Industrial Average.

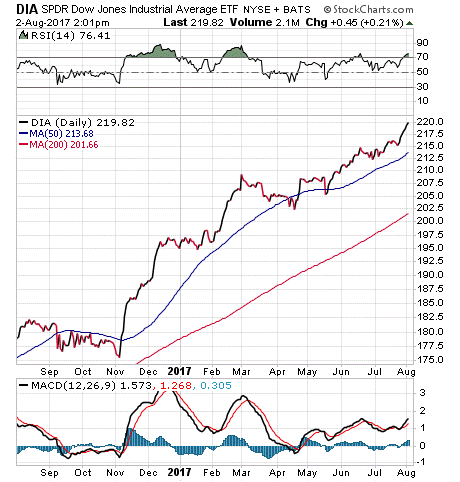

One cursory glance at the SPDR Dow Jones Industrial Average ETF (DIA) shows the near-parabolic surge in markets from Nov. 9 until today.

Remarkably, there have only been two breaches of the 50-day moving average since Election Day. That is what resilient bull markets are all about!

Still, I firmly believe that this bull market has lived by the sword of political hopes.

Those hopes are, of course, rooted in President Trump’s pro-growth economic agenda. That agenda included regulatory reform, Obamacare repeal/replace, an infrastructure spending plan and, most importantly, tax reform that includes a substantive cut in the corporate tax rate.

Well, so far, we’ve had some good regulatory reform via executive order, but that’s largely been on the margins. It’s a good start, but nothing that would justify this sustained bull momentum.

As for Obamacare, well, that must be looked upon as an epic fail by not only President Trump, but also by Republicans in Congress. Despite having majorities in both chambers, the GOP failed to deliver on one of its key platform positions of the past seven years.

Yet interestingly, the failure to repeal/replace Obamacare still didn’t stop this bull market. Nor has the lack of any progress on an infrastructure spending plan. In fact, infrastructure has rarely been mentioned by the White House, despite all of the campaign rhetoric about building a “big, beautiful” border wall and rebuilding the nation’s roads, bridges, dams, etc.

So, it seems like the only sword of hope that has yet to be dulled is tax reform.

On that front, the president and his economic team, along with Congressional leadership, have been painting broad brush strokes on a plan. In a joint statement from administration officials, congressional GOP leaders and the chairmen of the tax-writing committees presented the broad goals for tax legislation. However, the statement lacked the nuts-and-bolts details of the plan, which have yet to be finalized.

I think the president and GOP Congressional leaders had better get their collective act together on tax reform. If they fail to wield this sword properly, i.e., if they fail to get legislation signed into law that brings taxes down and helps corporate bottom lines enough to justify the market’s very high multiples… then this bull market will die by that dull sword.

ETF Talk: The King of Smart-Beta Value Funds

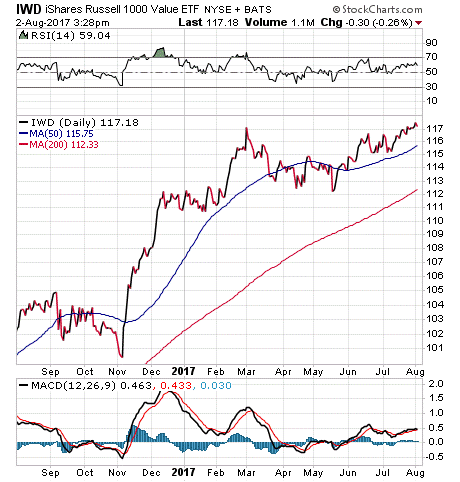

The iShares Russell 1000 Value ETF (IWD), at over $36 billion in assets under management, ranks as the biggest smart-beta fund and as one of the most popular currently on the market.

Smart beta “has emerged as one of the most exciting and hotly debated investment trends of the past 10 years,” according to ETF.com. Going by many different names (strategic beta, fundamental indexing, factor investing and more), smart beta is a catchall term for rules-based strategies that aim to deliver better risk-adjusted returns than traditional market-cap-weighted indexes.

Today, there are hundreds of ETFs and, if you count institutional assets, hundreds of billions of dollars benchmarked against smart-beta indexes. One advantage to owning smart-beta-oriented exchange-traded funds (ETFs) is precision risk management.

Investors looking for a perfect balance between risk and return can make a single purchase of a smart-beta ETF and have access to a select portfolio spread across multiple sectors and companies. This scenario can work a lot better than traditional stock picking, where investors looking for a good risk-return combination would have to sift through thousands of stocks and multiple different sectors to find the ideal combination. At the very least, such an undertaking is a difficult juggling act.

Investors also may be attracted to smart-beta ETFs for their lower-cost fees. While a mutual fund can charge 0.5-1.0% in management fees, smart-beta funds tend to have expense ratios south of 0.50%, with some even as low as 0.08%. As an iShares fund, IWD has a higher cost of 0.2% than some similar funds, such as the Vanguard Value ETF (VTV) with its 0.06% fees. But IWD still is very modest in the broader scope of expense ratios for ETFs.

IWD offers exposure to a range of large- and mid-cap U.S. companies that are considered to be undervalued by the wider market. Year to date, the fund has underperformed the S&P 500, only generating a 4-5% return. Yet this is largely because the market is currently favoring growth stocks, which lean toward the technology and health care sectors, among others.

By contrast, value investing favors currently beaten-down sectors such as energy and financials. However, a lot of analysts believe that the market’s preference for growth could be coming to an end soon.

IWD has a massive portfolio, with more than 700 current holdings. Its top 10 holdings are all well-known, household names and currently comprise 22% of total assets. The top five holdings are Exxon Mobil Corp. (XOM), 2.83%; Berkshire Hathaway Class B (BRK-B), 2.81%; JPMorgan Chase & Co. (JPM), 2.71%; Johnson & Johnson (JNJ), 2.53%; and Wells Fargo (WFC), 2.02%.

For those investors who want the risk and cost benefits associated with smart-beta ETFs, the iShares Russell 1000 Value ETF (IWD) is a very visible choice. The fund also offers the potential for further upside, if the market begins to favor value-oriented sectors again.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

Sitting Between Investing’s Doom and Gloom

The Federal Reserve has spoken, and it has done so via the Federal Open Market Committee’s (FOMC) decision to leave interest rates unchanged. And while any change in the benchmark fed funds rates from the current range of 1% and 1.25% wasn’t expected, what was highly anticipated was any language in the FOMC statement signaling how and when Fed Chair Janet Yellen and company plan to unwind the balance sheet.

On that front, there was a development, as the Fed changed the language in Paragraph 5 of the FOMC statement to signal that balance sheet reduction will begin “relatively soon.”

What this basically means is that the Fed will begin unwinding its balance sheet (likely very slowly) beginning with the September FOMC meeting. That also means that we most likely will get one more quarter-point rate hike this year, and that would likely come at the December meeting.

Now, the one potential wild card in the FOMC statement was the Fed’s outlook on inflation, but that also turned out to basically be as expected. The Fed did acknowledge the recent weakness in inflation, saying inflation measures “have declined and are running below 2%.” Yet importantly, the Fed retained language saying that the near-term risks to the economic outlook appear to be “roughly balanced.”

The bottom line with respect to the latest Fed statement is basically that it was “as expected” by Wall Street. And while we’ve all learned to live with the Fed and to interpret its short-term machinations, the broader issue of massive central bank money printing still is a huge underlying unknown for global financial markets and the global economy.

Indeed, the issue of the Fed and the potential mess that might be heading down the road was one of the subjects of an investment panel I was on recently at the FreedomFest conference in Las Vegas. Here I am, seated between two of the world’s most-famous market Cassandra’s, Jim Rogers (on the left) and Peter Schiff (on the right).

While both of these gentlemen have interesting thoughts on the markets, the Fed and the future of the global economy, both are bearish on U.S. equities and on the economy. Also, both warn of a coming debt-fueled collapse somewhere down the road.

Now, I do admire both men’s always-strident opinions, and I think much of what they say is interesting theoretically. The issue I have with their ideas is that I think by constantly sounding the gloom-and-doom alarm, they’re missing out on the current opportunities open to all of us to own great companies in a bull market.

I do not share the idea that one should shun great companies because somewhere down the road there may be another financial crisis, or a dollar crisis, or a debt crisis. And though I do think the Fed’s grand quantitative easing (QE) experiment could potentially end very badly, I don’t want to sit on the sidelines and miss out on the opportunities in front of our very eyes.

In my Successful ETF Investing service, we currently are riding this bull market to big gains — both for income investors and growth investors. If you’d like to discover how we’ve done it, and also how we avoid big market meltdowns, I invite you to check out Successful ETF Investing today.

Tucker on Error

“People and institutions that refuse to admit error eventually discredit themselves.”

— Jeffrey Tucker

The great free-market economist, champion of liberty and proponent of sartorial splendor is full of profundities. In this quote, he gives us one simple profound statement that you don’t have to be an economist to understand. Because of the nature of reality, humans frequently will make mistakes. And, there’s nothing wrong with admitting when we do. The only real error is to refuse to admit when we’ve made a mistake, as that will crush our credibility. So, if you’re wrong, just own it. Admit your error and learn from it, as defeat often is the very best tutor.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)