The iShares Russell 1000 Growth ETF (IWF) selects mostly large-cap stocks from the Russell 1000 Index that show high-growth characteristics.

With $36.15 billion in total assets under management and average daily trading volume of $184.77 million, IWF is a massive fund with supreme liquidity.

In contrast to its sister fund, the iShares Russell 1000 Value ETF (IWD), which was featured in the previous ETF Talk, IWF is focused on stocks that have high potential for above-average growth relative to the market. But in the short term, they may not necessarily offer a “good value” or even be underpriced.

Growth stocks also may appeal to those who seek capital appreciation rather than dividend income. Indeed, companies focused on growth typically reinvest their earnings and pay either a small or no dividend.

IWF selects stocks based on rankings of three fundamental factors: price-to-book ratio, forecasts for medium-term growth and five-year historical sales growth. The rankings then are standardized and built into a final composite score with a growth variable factored in.

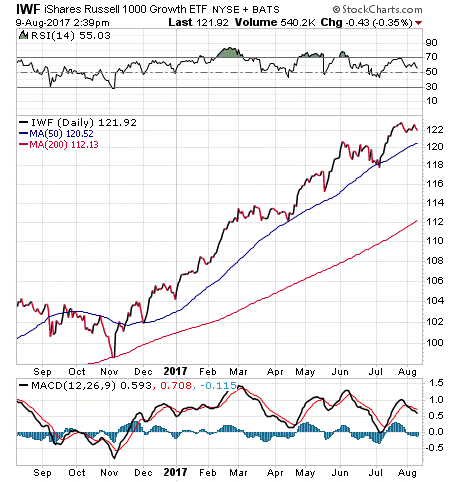

Growth stocks have been in favor so far this year, on the back of a proposed pro-growth political agenda and an earnings season that is turning up strongly. Year to date, IWF has generated a 13.87% return, compared to the S&P 500’s 10.86%. IWF has a distribution yield of 1.23% and an expense ratio of 0.20%.

As a result of its growth-oriented strategy, IWF has a bias towards technology firms. Roughly one-third of its holdings are in the information technology industry, which is an industry typically associated with high volatility and strong potential for growth. Plus, 18% of IWF is in consumer discretionary stocks and 13.5% is in health care.

IWF is somewhat diversified, with 557 total holdings. Its top five holdings are Apple Inc. (AAPL), 7.07%; Microsoft Corp. (MSFT) 4.63%; Facebook (FB), 3.43%; Amazon.com Inc. (AMZN), 3.36%; and Alphabet Inc. Class A (GOOGL), 2.40%.

For those who are looking for future growth, the iShares Russell 1000 Growth ETF (IWF) may be worth adding to your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.