Exchange-traded funds (ETFs) such as the Vanguard Value ETF (VTV), allow investors to access multiple stocks deemed to be “undervalued” by the market while requiring minimal personal research.

Buying undervalued investments is called “value investing,” a time-honored strategy that has been employed by conservative investors for many years. Brought to the forefront of investors’ awareness by well-known investor and author Benjamin Graham and his classic book “The Intelligent Investor,” value investing uses fundamental analysis to determine when stocks are potentially undervalued by the market, making them ripe to rise when that irrationality is resolved.

By contrast, growth investing aims to pick stocks that have demonstrated better-than-average gains in earnings and are expected to keep delivering high levels of profit growth. But there are no guarantees. As a result, growth stocks tend to be more volatile than their value-based counterparts.

VTV, as one of the largest value ETFs, invests in a spread of more than 330 positions. This significant diversification means that VTV’s return is tied more to the success of the strategy than any one stock’s performance. However, the fund does weight holdings by market cap, which makes it a somewhat stable ETF.

In an article published in The Motley Fool on July 24, VTV was listed as one of the top value ETFs, surpassed only by the mammoth iShares Russell 1000 Value ETF (IWD) with its $36.5 billion in assets under management. Interestingly, all of the funds listed were either iShares or Vanguard funds, which have a reputation for keeping their expense ratios as low as possible. Fittingly, VTV’s expense ratio is only 0.06%.

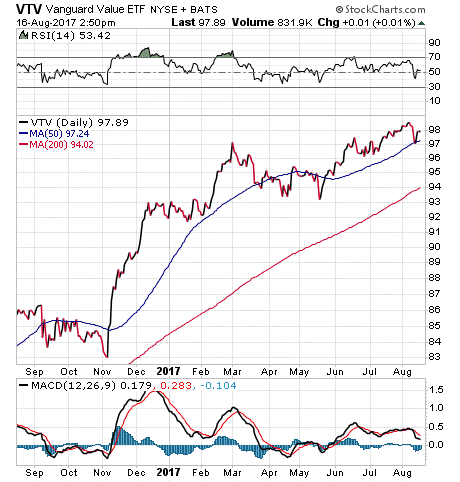

Since 2017 has been a good year for the market and especially growth stocks so far, it is no surprise that VTV has slightly underperformed the S&P 500 in the past 12 months to gain around 10% and 7% year to date. However, value stocks likely will gain favor again at some point, so this fund could have another day in the sun. Assets under management total $32 billion and the fund pays a respectable 2.4% dividend yield.

VTV allocates 26.9% of its assets to its top 10 holdings. These include “value-investing” names such as Microsoft Corp. (MSFT), 4.69%; Johnson & Johnson (JNJ), 3.14%; Exxon Mobil Corp. (XOM), 3.02%; Berkshire Hathaway Inc. (BRK.B), 2.89%; and JPMorgan Chase & Co. (JPM), 2.86%. The most represented sectors are financials, health care and technology.

If you believe in the principle of “buy low and sell high,” consider investing in value stocks. To avoid tying your fortune to only a few companies, the Vanguard Value ETF (VTV) lets you invest in one fund and gain exposure to all of the stocks in its portfolio. Decide if this ETF could be a useful investment for you.