“A bull market is one that can shake off even bad news.” — Don Gimpel

In addition to the old saying on Wall Street above, there‘s another one that says: “bull markets climb a wall of worry.” (All of these are found in my book “The Maxims of Wall Street” — to order, see below.)

Last week was a case in point. Saber-rattling between President Donald Trump and North Korea’s militant dictator Kim Jong-un knocked the market down, but only temporarily. My Korean contacts, who have lived with North Korea’s empty threats for more than 50 years, aren’t worried and consider Kim Jong-un a paper tiger who engages in never-ending rhetoric. He knows his regime would be annihilated by vastly superior U.S. weapons. I was at a Yankee baseball game last week with Steve Forbes, and he told me that he favors strong sanctions against North Korea, but he agrees that rationally Kim Jong-un should back off. But is the dictator crazy like a fox, or just crazy?

Stocks are back on track to hit another all-time high. Oil and gold are making a recovery, and we are invested in both.

Earlier this week, I watched Jeremy Siegel, the Oracle of Wall Street, and Robert Shiller, the Yale perma-bear, debate each other on Yahoo Finance TV. Shiller rightly pointed out that stocks are richly priced, but Siegel countered that interest rates are near historic lows. With potential tax reform, stocks could move substantially higher. I’m firmly in Siegel’s camp these days, and staying 100% invested. The golden age of investing is still with us. Even long-term Treasuries are in an upward trend!

And yet average investors are running away from the market, thinking all the profits have been made. Mutual funds are seeing a net withdrawal this year. Even the majority of Wall Street analysts are skeptical that stocks can continue to rise.

If the bull market continues into next year, it will be the longest running bull market in history. And guess what? We’ve been 100% fully invested the entire time and beating the market to boot.

That deserves some kind of award, don’t you think?

The Lessons of History

“Normally and generally men are judged by their ability to produce — except in war, when they are ranked according to their ability to destroy.”

— Will and Ariel Durant

Famed historians Will and Ariel Durant, after writing 11 fat volumes of the story of civilization, penned a little book called “The Lessons of History,” in which they noted that during some 3,500 years of recorded history, only 289 years were peaceful. At FreedomFest last month, we presented a valuable session with several veterans giving their advice based on years of experience on Wall Street. Legendary investor Jim Rogers (author of “Street Smarts”) told attendees that there is a constant war between the bull and the bears. Happily, the bulls win most of the time. But Rogers warned that the ups and downs of the business cycle have not been outlawed, and wise investors know that the most recent collapse (2008-09) won’t be the last. Don’t get killed in the marketplace! That’s why we use protective stops — to minimize our risks.

The Perfect Gift — the Wit & Wisdom of Wall Street

Jim is a big fan of my collection of investment sayings, “The Maxims of Wall Street,” now in its fifth edition with 25,000 in print. He’s quoted twice. Now that we are entering the fall and the holiday season, now is the time to consider buying copies as gifts. A former Goldman Sachs executive says it’s the best gift he’s received in years. “There’s more wisdom in your book that four years of college education!”

Half off Sale on “Maxims of Wall Street” — only $10 each

I sell copies at a bargain to encourage gift giving to friends, relatives, clients, business colleagues, investors and your favorite stockbroker and money manager. You pay only $20 for the first copy, and all additional copies are only $10 each. All are personally autographed and I pay the postage for all domestic orders. (For orders outside of the United States, add $15 postage for the first book and $5 for each additional copy.)

Many people buy an entire box of 32 copies for only $300 postpaid.

To order your copies at this super discount, call Harold at Ensign Publishing, toll-free 1-866-254-2057, or go to https://www.miracleofamerica.com/products/maxims-of-wall-street.

In case you missed it, I encourage you to read my e-letter from last week about my view regarding the basic universal income plan for everyone.

Upcoming Appearances

Toronto MoneyShow, Sept. 8-9: The focus of this MoneyShow will be on gold mining stocks and investing in marijuana, since Canada plans to legalize its use nationwide next year. I will be moderating a panel on “Preparing for the New Gold Rush,” and doing a breakout seminar on “Golden Opportunity: How to Invest in Mining Stocks Without Taking Huge Risks.” Other speakers include Ralph Acampora, Edward Yardini, Peter Schiff, Steve Moore and Brien Lundin. For your complimentary tickets, go to Skousen.TorontoMoneyShow.com.

Dallas MoneyShow, October 5-6: I’m delighted to be back in Dallas to moderate a main stage panel, “Washington Policy: How It Effects Your Portfolio,” with Steve Forbes, Steve Moore, Peter Schiff and Edward Yardeni. I’ll also be doing an encore of the “great debate” with Mike Turner on “The Economics Professor vs. the Mathematician: Buy-and-Hold vs. Market Timing.” Finally, I’m on a panel to pick the next big winners with Bart DiLiddo, John Dobosz, Cody Willard and Kelley Wright. To sign up for your complimentary tickets, go to Skousen.DallasMoneyShow.com.

New Orleans Investment Conference, New Orleans Hilton, Oct. 25-28: I’ve spoken at this “granddaddy of hard-money conferences” since 1977! This year’s keynote speakers include Fox News host Tucker Carlson, Fox contributor Charles Krauthammer, real estate mogul Robert Kiyosaki and commodity guru Dennis Gartman. For full information, go to http://neworleansconference.com/wp-content/uploads/2017/07/NOIC2017_skousen.html or call toll-free 1-800-648-8411. Be sure to mention you are a subscriber of mine for a discount on the registration fee.

You Nailed It!

What’s in a Name? Ask Forbes!

Mark and Jo Ann Skousen with Steve Forbes on his 70th birthday.

Why has Forbes magazine and Forbes.com been so successful, more than their competitors such as Business Week and Fortune magazines?

This was one of my questions at this year’s FreedomFest when we celebrated the 100th anniversary of Forbes magazine and the 70th birthday of Steve Forbes.

It might have something to do with the name! According to a study in the June 2017 issue of American Economic Review, “Eponymous Entrepreneurs,” the authors conclude that companies that bear the name of their owner are “linked to superior firm performance.” But that only 19% of all firms are named after their owners.

But there’s nothing automatic about success in business, even if you have a famous name. Three generations of Forbes — B. C., Malcolm and Steve — have had their share of challenges, and there were times when Forbes magazine was on the ropes. But they always made a comeback.

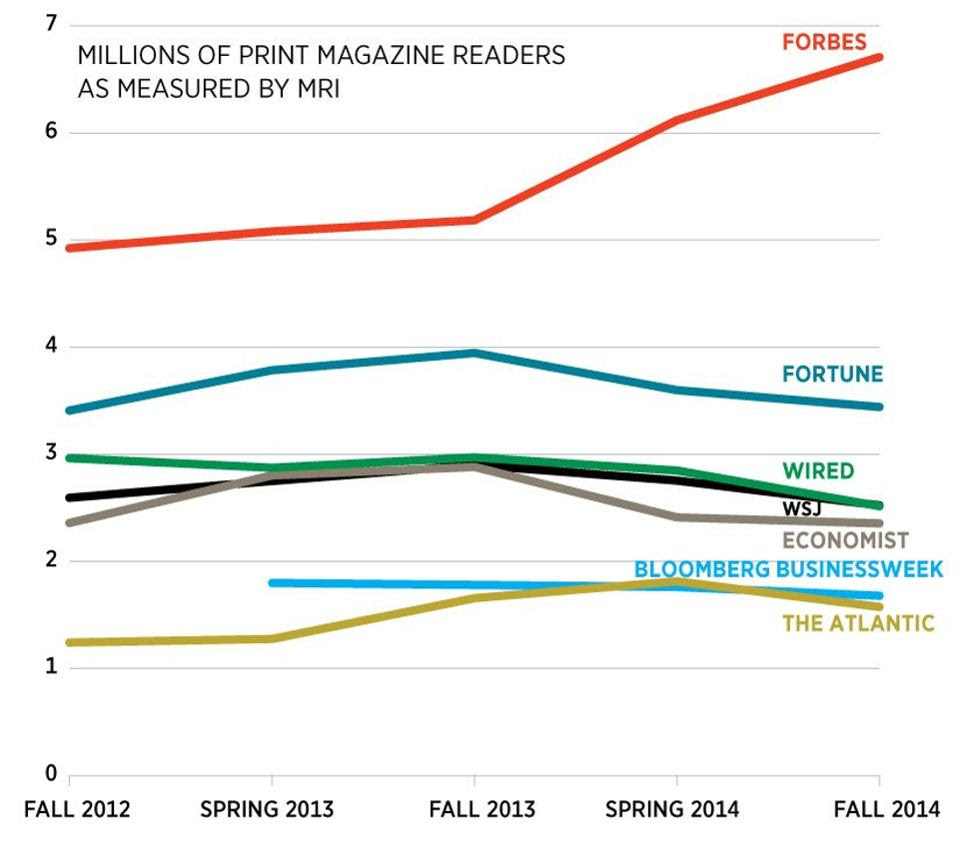

With the advent of the digital age, most economists predict the demise of the print magazine. That’s certainly been the case for Newsweek and other weekly magazines. Circulation of the printed version of the Wall Street Journal, Business Week, Fortune and the Economist are down. See chart below.

But not Forbes. Long live Forbes!