Hurricane Harvey’s death toll of at least 70 lives lost so far will be accompanied by tens of billions of dollars in property damage that AccuWeather estimates will be worse than any previous storm to hit the United States.

AccuWeather predicts that Hurricane Harvey, which has slammed Texas and flooded much of America’s fourth-largest city of Houston, could become the costliest natural disaster in U.S. history. The extent of the damage from winds and flooding also could hurt the U.S. economy sufficiently to delay the next interest rate hike by the Federal Reserve Bank, predicted Dr. Joel Myers, the founder, president and chairman of AccuWeather.

Specifically, AccuWeather expects the ultimate property damage of Hurricane Harvey to top the combined, inflation-adjusted toll of $70 billion from Hurricane Katrina in August 2005 and Superstorm Sandy in October 2012.

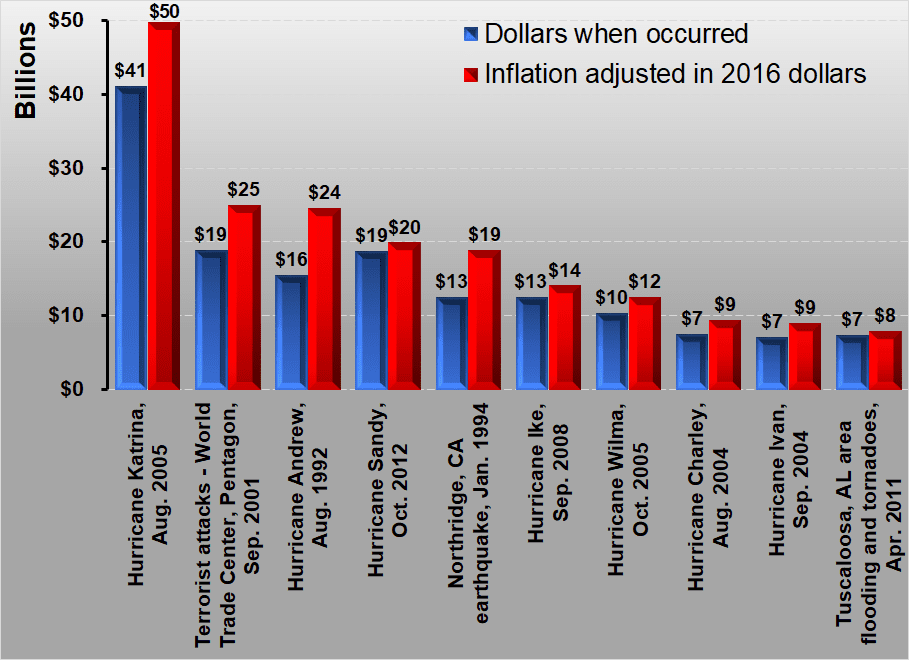

Top 10 Costliest Catastrophes in the United States

The costs include property losses only and excludes flood damage covered by the federally administered National Flood Insurance Program.

The adjusted numbers have been adjusted for inflation through 2016 by ISO using the GDP implicit price deflator.

Data Source: Property Claim Services® (PCS®), a Verisk Analytics® business.

Billions of dollars of insured losses will be borne by major property and casualty insurers that write a large portion of the auto policies in Texas. They include State Farm Mutual Automobile Insurance, Allstate Insurance (NYSE:ALL), Farmers Insurance Exchange, Geico affiliate National Indemnity Company, the Progressive Group (NYSE:PGR) and MetLife (NYSE:MET) unit Metropolitan Property and Casualty Insurance.

Kai Pan, an insurance equity analyst at Morgan Stanley, told The New York Times that insurance stocks generally decline immediately after a natural disaster due to the possibility of big losses, then recover three to six months later as losses “become more defined.”

AccuWeather raised its estimate of Hurricane Harvey’s impact to the nation’s gross national product (GDP), as of Aug. 31, to $190 billion, or a full one percent of GDP, which would far exceed the economic impact of the combined devastation of Hurricane Katrina and Superstorm Sandy. That estimate is based on a current U.S. GDP of $19 trillion and includes both insured and uninsured losses.

As a result, business leaders, the Federal Reserve, major banks, insurance companies and others should begin to factor in the negative impact Hurricane Harvey will wield on business, corporate earnings and employment, Dr. Myers said.

Parts of Houston will be uninhabitable for weeks and possibly months due to water damage, mold, disease-ridden water and all of the ill effects that will follow this “1,000-year flood,” Dr. Myers said.

Catastrophic flooding is continuing in Houston, even though the rain has ended. Flooding also is causing post-storm havoc in communities ranging from Beaumont and Port Arthur, Texas, to Lake Charles, Louisiana.

To put Hurricane Harvey into historical context, if the 1900 Galveston hurricane occurred in 2016, it would have caused $41.7 billion in insured losses, based on adjustments for inflation, growth and value of coastal properties and increases in property insurance coverage, according to Karen Clark and Company.

The insured value of properties in coastal areas of Texas totaled $1.2 trillion in 2013, accounting for 26 percent of the state’s total insured property exposure,” according to an analysis by AIR Worldwide.

Texas previously has been hit by two of the most costly hurricanes in U.S. history. According to the Insurance Information Institute, insured losses reached $9.8 billion from Hurricane Ike in 2008 and $2 billion from Hurricane Rita in 2005. The damage in 2015 dollars, according to the Insurance Services Office Inc. (ISO), would total $10.9 billion for Hurricane Ike and $2.4 billion for Hurricane Rita.

But these losses do not include damage from flooding, which typically is not covered in standard homeowners’ insurance policies. Flood insurance instead is covered by the National Flood Insurance Program (NFIP) of the Federal Emergency Management Agency (FEMA). Public programs have assumed big obligations to pay for storm damage. They include:

- 587,692 flood insurance policies covered under the NFIP in Texas in 2015, based on the most recent information available.

- NFIP payouts from Superstorm Sandy in October 2012 of $8.4 billion, as of January 2017, trail only 2005’s Hurricane Katrina with $16.3 billion in NFIP payouts.

- The NFIP totaling 130,622 claims from Superstorm Sandy as of January 2017. The average paid loss was $64,331, compared with 167,984 claims from Hurricane Katrina, with an average paid loss of $97,141.

- The Texas Windstorm Insurance Association (TWIA), the state’s insurer of last resort for wind and hail coverage for Texas Gulf Coast residential and commercial property owners in the event of catastrophic loss. TWIA covers wind and hail in 14 coastal counties and parts of Harris County.

- TWIA issuing 272,304 residential policies and 14,556 commercial policies for a total of 286,860 policies in force for fiscal year 2015, according to the Property Insurance Plans Office (PIPSO). The TWIA’s exposure to loss was $78.6 billion in 2015, PIPSO reported.

The Insurance Council of Texas reported that only about 20% of the state’s homeowners have flood insurance, with most of the coverage provided through the NFIP, which is already nearly $25 billion in debt.

Hurricane Harvey may push the NFIP up against its borrowing limit of $30 billion and spur action by lawmakers to reform the program, which is due to be reauthorized at the end of September 2017. In Harris County, Texas, the home county of Houston, the NFIP holds more than 240,000 policies totaling $60 billion-plus in coverage.

The number of people who live in coastal areas in Texas rose by 0.8 million, or 10 percent, from 8.3 million in 2000 to 9.1 million in 2015, according to the U.S. Census Bureau. About one-third of the total population of Texas lived in coastal areas in 2015.

Standard homeowners and renters insurance will cover wind damage from Hurricane Harvey. Flood coverage, however, is excluded and currently is available through the NFIP and a few private insurers. Congress created the NFIP in 1968 in response to the rising cost of taxpayer-funded disaster relief for flood victims and an increasing amount of damage from floods.

The NFIP provides coverage for up to $250,000 for the structure of a home and $100,000 for personal possessions. Replacement cost coverage is available for a home’s structure but only actual cash value coverage is available for possessions. Replacement cost coverage pays to rebuild a home as it was before the damage. Actual cash value factors in depreciation, reducing compensation for possessions based on their age.

Paul Dykewicz is the editorial director of Eagle Financial Publications, editor of StockInvestor.com and DividendInvestor.com, a columnist for Townhall and Townhall Finance, a commentator and the author of an inspirational book, “ Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain with a Foreword by legendary football coach Lou Holtz. Visit Paul’s website at www.holysmokesbook.com and follow him on Twitter @PaulDykewicz.

Paul Dykewicz is the editorial director of Eagle Financial Publications, editor of StockInvestor.com and DividendInvestor.com, a columnist for Townhall and Townhall Finance, a commentator and the author of an inspirational book, “ Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain with a Foreword by legendary football coach Lou Holtz. Visit Paul’s website at www.holysmokesbook.com and follow him on Twitter @PaulDykewicz.