The exchange-traded fund iShares Select Dividend ETF (DVY) focuses on holding equities with a history of consistent income instead of equities with potential future dividend increases.

All DVY’s holdings have at least a 5-year record of paying dividends. DVY invests its $17.5 billion in total assets in roughly 100 stocks based on dividend yield from a broad market-cap universe.

Unlike many other funds that weigh their holdings according to market cap, DVY weighs its holdings by dividend per share. This results in a skew toward smaller firms that pay consistent dividends.

With its high asset base and great liquidity of $46.15 million in daily trading volume, DVY is one of the most accessible funds on the market for reliable dividend income. Around 30% of the fund’s portfolio is in utilities, which is one of the sectors with the highest yields, although utilities also tend to be rate sensitive and relatively slow-growing.

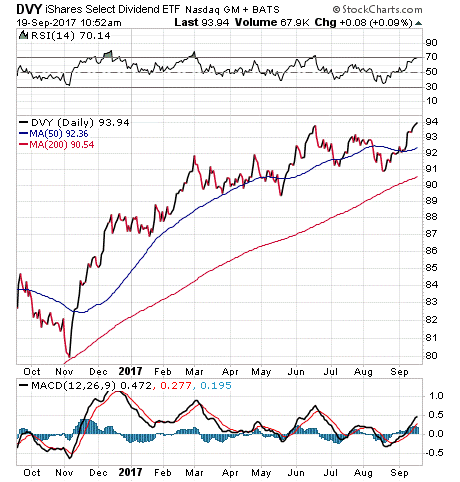

Year to date, DVY has returned 7.64%, versus the S&P 500’s 11.91%. While the fund’s gain may not seem impressive, it is worth noting that by holding only dividend payers with a consistent track record, DVY sacrifices some of its gains in a bull market but lowers its risk in a bear market. DVY’s strategy has garnered it a 14.2% return during the last five years while the S&P 500 returned 13.6%.

DVY has an expense ratio of 0.39%. The distribution yield is 3.17%. This is a fund that is suitable for passive long-term investors who want to reduce the risk of their portfolio.

The fund’s top five holdings are Lockheed Martin (LMT), 4.16%; CME Group (CME), 3.16%; McDonald’s (MCD), 2.32%; Chevron (CVX), 2.29%; and NextEra Energy (NEE), 2.27%.

For those seeking consistent dividend income for the long term, I encourage you to look at iShares Select Dividend ETF (DVY).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.