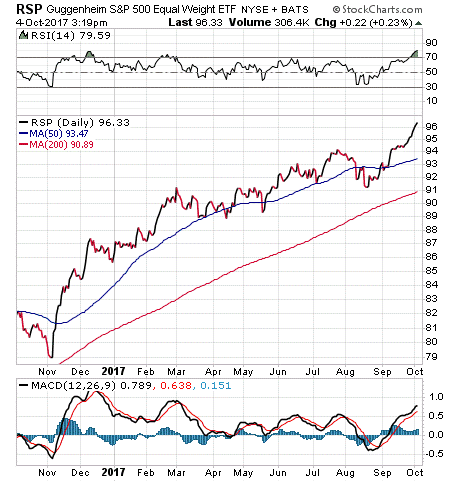

This week’s exchange-traded fund, Guggenheim S&P 500 Equal Weight ETF (RSP), uses an equal-weighting strategy to build its portfolio.

In fact, as probably the best-known equal-weighted ETF on the market, RSP simply takes all the stocks in the S&P 500 and weights them equally, disregarding the market caps of the stocks. As a result, RSP is biased toward the smaller caps in the S&P500 index compared to other similar funds, resulting in a higher beta, or volatility.

However, this strategy also lowers concentration and thus reduces the risk of failure from any one single stock. RSP specifically employs a disciplined rebalancing system.

The EFT assesses and balances its portfolio on a quarterly basis, at which time it employs a contrarian strategy of selling the winners and buying the losers. This strategy is aimed at reallocating the fund’s assets from outperforming to underperforming stocks and market segments, which may provide an opportunity to improve long-term performance.

Since the fund’s strategy is about rebalancing to improve returns in the long run, it holds a stronger appeal for buy-and-hold investors than active traders.

Since it reduced its fee by half in June 2017, RSP’s expense ratio stands at 0.20%, which is relatively low when compared to many other funds with alternate ways of weighting their portfolios.

The fund has $13.66 billion in total assets. Its year-to-date return is 12.04%, compared to a 13.07% year-to-date return for the S&P 500. RSP has a one-year return of 16.32%.

The fund’s top five holdings are Micron Technology Inc. (MU), 0.24%; Range Resources Corp. (RRC), 0.24%; Newfield Exploration Co. (NFX), 0.23%; Concho Resources Inc. (CXO), 0.23%; and Anadarko Petroleum Corp. (APC), 0.23%.

For those seeking a fund that matches closely the performance of the S&P 500, I encourage you to look at Guggenheim S&P 500 Equal Weight ETF (RSP).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.