It is midday Wednesday, Oct. 18, and as I write this week’s e-letter, the Dow Jones Industrial Average has just hit another major milestone.

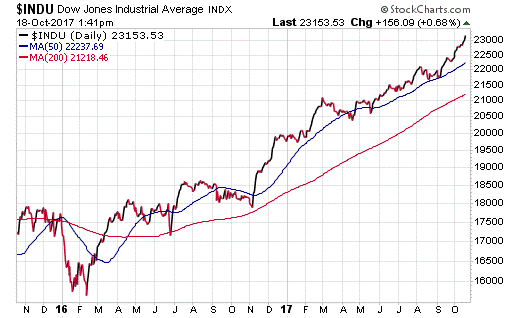

This time it’s the 23,000 mark — a number that was almost unthinkable just nine years ago. Look below at a two-year chart of the Dow to see its remarkable resilience since early 2016.

We also can see that except for a brief pullback below the 200-day moving average in June 2016 due to the “Brexit” scare, the Dow has been in a confirmed bull market since basically March 2016 — or more than 18 months!

To this I say we must pause, bow down to the Dow… and give it respect.

I say that, because this has been the most unloved bull market in my professional lifetime, and one that’s been haunted by the ghosts of the Great Recession, as well as a near-oppressive cloud of skepticism over what’s driven stocks higher.

The main driver, of course, has been the Federal Reserve and its money printing scheme that’s artificially inflated equity prices. While I certainly understand the skepticism brought about by the unprecedented moves by the central bank to pump excess liquidity into the system via the numerous quantitative easing permutations, the fact remains that if you had put money to work in the Dow as that money printing began, you would have more than doubled your money.

Yet the reason the Dow (i.e. the broad market) deserves to be bowed down to is because despite the Fed’s return to rate normalization, 2017 has been one of the best-performing years in recent memory.

The Industrial Average is up over 27% year to date, and that’s been a direct result of the Trump pro-growth hope trade, improving economic data and surprisingly strong corporate earnings.

And, those gains have come despite the Fed hiking rates, and signaling more rate hikes later this year, after announcing its intentions to start reducing its balance sheet.

Yes, there are those elusive “animal spirits” pushing investors into equities this year. Many on the Street (particularly the merchants of doom, who always see a black cloud on the horizon) think those animal spirits are both irrational and too exuberant (Hello, Mr. Greenspan).

Yet until this market proves, via objective price action, that it no longer has the will to continue moving higher, we must continue to bow to the Dow (and the S&P 500, the NASDAQ Composite, the Russell 2000, the NASDAQ 100, semiconductors, super-cap internet, etc., etc., etc.…).

If you’d like to find out how we determine when to be in stocks and, more importantly, when it finally makes sense to be out of stocks, then I invite you to check out my Successful Investing advisory service.

Hey, it’s not like we have a proven track record of winning market calls for the past four decades… oh wait, we do!