The Direxion Daily Aerospace & Defense Bull 3X Shares ETF (DFEN), with just $43.43 million in assets under management, is a relatively small exchange-traded fund (ETF) in the aerospace and defense sector compared to many peer funds, but it also is triple-leveraged for those seeking to bet big.

DFEN tracks the Dow Jones U.S. Select Aerospace and Defense Index. Unlike many other ETFs, however, DFEN’s objective is to obtain 300% of the return of that index through high leverage, but only for a single day.

Investors should not expect DFEN to provide such a high return for periods greater than a day. Unleveraged exposure to the same index can be found in the iShares Dow Jones US Aerospace & Def ETF (ITA), which is another popular fund in the aerospace and defense field.

DFEN had a very high relative trading volume of 57,430 shares on average for the past three months with its total $43.43 million in assets. To put it in perspective, PowerShares Aerospace and Defense (PPA), the fund covered in last week’s ETF Talk, boasts total assets of more than $800 million but had a relatively modest daily trading volume of 92,256 shares on average for the past three months.

In the DFEN fund manager’s own words, the ETF is designed to take advantage of short-term trends while letting its investors stay liquid. Moreover, DFEN is designed for trading more than investing, which matches the goal of the fund — to seek high short-term returns that likely are not sustainable in the long run.

DFEN has an expense ratio of 1.09%, which is higher than some of its peer funds such as PPA and its 0.64% expense ratio. Due to the fund’s day-trading nature, analysts have recommended that interested investors pay more attention to the trading volume and bid/ask pricing rather than the expense ratio.

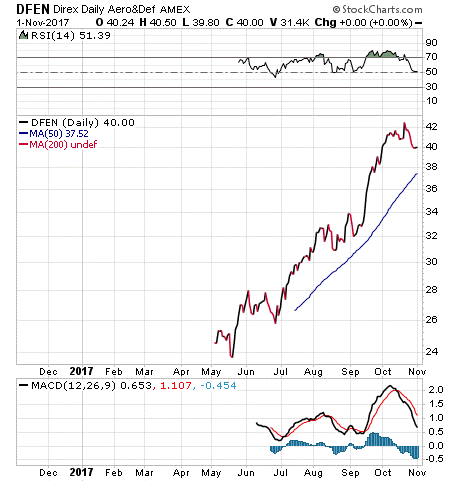

Launched on May 3, 2017, DFEN is a newcomer to the aerospace and defense field. However, its price has increased by more than 66% in a span of just five months, indicating that DFEN’s strategy has so far paid off handsomely. For comparison, the S&P 500 returned 6.63% over the last six months.

The top five holdings are The Boeing Company (BA), 10.14%; United Technologies (UTX), 7.87%; Lockheed Martin (LMT), 7.37%; General Dynamics (GD), 6.40%; and Raytheon Company (RTN), 6.19%.

For those seeking high potential returns in the aerospace and defense segment, I encourage you to look into Direxion Daily Aerospace & Defense Bull 3X Shares ETF (DFEN).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)