The exchange-traded fund (ETF) Vanguard Total Bond Market ETF (BND) is a large fund under the Vanguard umbrella and one of the biggest names in the bond sector.

BND’s objective is to match the returns of the U.S. bond market. It satisfies this objective by providing investors with broad exposure to U.S. investment-grade bonds — over 10,000 types of bond securities with varying maturities of least one year. All of the bonds in BND’s portfolio are rated Baa or higher.

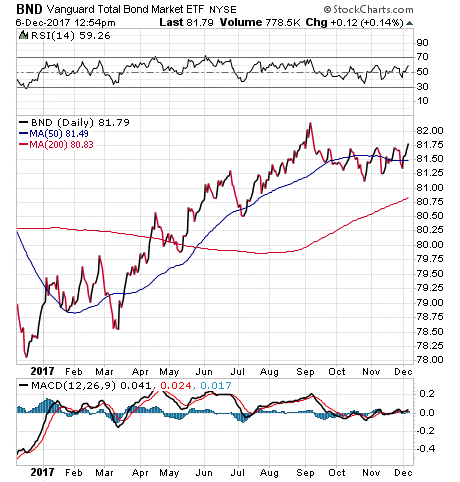

Since BND’s share values tend to rise and fall in modest proportions, investors often look to BND for a reliable income stream over either a medium- or long-term timeframe, as well as for a way to diversify portfolios. The fund does face the risk of rate hikes being proposed by the Fed, which most experts say will have a negative impact on bond yields.

Currently, the fund manages $36.30 billion in total assets and has an expense ratio of 0.05%. This gives BND an expense ratio that is 93% lower than the fees charged by other funds with similar holdings. BND’s liquidity also is fairly high for a bond fund, with a daily trading volume of $155.44 million.

Year to date, BND has returned around 3.15%, which is about the average for the bond fund sector. The S&P 500 has returned 18% year to date. BND pays a monthly dividend with a current yield of 2.52%. The last dividend paid was $0.17.

Around 39.40% of BND’s portfolio is in U.S. treasuries, while the bulk of the other holdings are in corporate and mortgage-backed pass-through securities.

BND’s top five holdings and their weightings in the portfolio are the U.S. Treasury Note 2.125%, 0.50%; U.S. Treasury Note 2.25%, 0.49%; U.S. Treasury Note 2.625%, 0.45%; U.S. Treasury Note 1.5%, 0.45%; and U.S. Treasury Note 1.375%, 0.44%. BND holds 800-900 million shares of each of these top five holdings.

If you are seeking broad exposure to U.S. treasuries bonds, consider looking into the Vanguard Total Bond Market ETF (BND) as a potential investment.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.