Those much-anticipated tax cuts appear as though they soon may become a reality.

That’s very good news for the markets, as the gains in the equity markets over the past 12-plus months have largely been built on tax reform — particularly corporate tax cuts — becoming the law of the land. Yet assuming tax cuts do pass (an assumption we should never take for granted given the Washington swamp), just how much of an impact will tax reform have on the markets going forward, and what will the impact of tax reform be on equity market valuations?

It is an interesting question, and one that requires the analysis of one of the smartest guys I know in this business, my friend and colleague Tom Essaye of the Sevens Report.

Going into my conversation with Tom about tax cuts and the impact they likely will have on equity market valuation, we both agreed that on a historic basis, the stock market is richly valued. In fact, most valuation metrics today are reminiscent of periods in the market such as 1929 and 2000, two periods that obviously strike fear into the hearts of equity investors the world over.

Here’s an excerpt of the conversation I had with Tom about the tax cut valuation math. I think you’ll find it sheds some interesting light on this market’s future prospects.

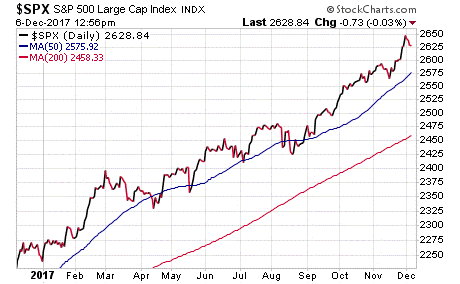

Jim Woods: I know you’ve said in the past, and I agree, that high valuations alone do not kill bull markets. In fact, markets can stay highly valued longer than most people think reasonable, or even possible. We know that because for the past year or so, the S&P 500 has traded around 17.5-18 times next year’s S&P 500 earnings per share (EPS) estimates. But now that tax cuts are almost here, what impact will that have on the valuation math?

Tom Essaye: Consider that the S&P 500 spent most of the summer “stuck” around 2,450, which is close to 17.5*139. Then, the S&P 500 moved higher on good economic data and increased hopes of tax cuts, pushing the S&P 500 to the current 2,650 level, and a whopping 19X 2018 S&P 500 EPS valuation, a number that likely isn’t sustainable on its face. But understand that 19X multiple is misleading, because with tax cuts now expected, tax cuts are going to increase 2018 S&P 500 EPS — the only question is by how much. The answer will tell us how much further the market can run before it gets to a valuation ceiling (likely around 18X earnings).

JW: So, and this is the big question, how do we begin to determine the effect of tax cuts on 2018 S&P 500 EPS?

TE: This is the million-dollar question, and it needs a rigorous answer. To find that answer, I researched various firms’ earnings estimates for how much the lower corporate tax rate will boost S&P 500 earnings. The lowest expectation I found was from UBS, which believed the tax cuts could boost 2018 S&P 500 earnings by 6.5%. The highest estimate I found was from Goldman Sachs, which thought the tax cuts could boost 2018 S&P 500 earnings by 12%. So, I did a valuation analysis using A) The low end of the range, B) The high end of the range, and C) An average of the two.

JW: Please tell me the result of that analysis.

TE: Sure. Let’s start with what I call the “worst case scenario,” and that is that the market is fully valued. At the low end of additional earnings growth (6.5%), the new-expected 2018 S&P 500 EPS would be $148/share (the current $139/share plus an additional 6.5% increase). Based on that number, the S&P 500 now is trading at 17.9X next year’s earnings, basically the top of the recent range. The takeaway from this is that in this scenario, we will need something other than taxes to propel stocks materially higher from here.

The second scenario is the “best case,” which is 6% or more upside in markets. At the high end of the range (12.5%), the new expected 2018 S&P 500 EPS would be $155/share. Based on this number, stocks are only trading at 17X next year’s earnings, which means we likely will see further upside until the market is trading at 18X, or 18*155 = 2,790, or another 6% higher from here.

The final scenario is the “middle case,” which translates into about 3% more upside from here. I get here based on taking the average of the two firms’ estimates (6.5% and 12%) which is 9.25%. That would result in new expected 2018 S&P 500 EPS of $152/share. Based on this number, stocks are trading just under 17.5X next year’s earnings, which means we will likely see further upside until the market is trading at 18X or 18*151 = 2,718, or another 3% from here.

JW: So, the takeaway here from your valuation analysis is that just based on tax cut projections, we are looking at a gain of, at most, 6% from current levels on the S&P 500?

TE: That’s correct. At worst the tax cuts will validate current market valuations. At best they’ll spur additional upside of about 6%. Of course, there are other factors involved in spurring market upside, but just based upon the valuation math, that’s our best estimate going forward.

JW: Thanks Tom, as usual you’ve helped me see things clearer.

TE: My pleasure.

I hope you found this excerpt from my conversation with Tom Essaye valuable. I know I did. And, if you want to check out his website, along with his various publications, I strongly encourage you to do so at http://sevensreport.com/.

P.S. Have you been hesitant to get into this market because of high valuations? Do you want to invest, but are fearful of getting caught in the next market correction? By following the investment plan in my Successful Investing advisory service, you’ll never have to worry about knowing when to get out (and when to get back in).

If you’d like to find out how to invest right now with a proven safety switch in place, then I invite you to check out Successful Investing today!

*************************************************************

ETF Talk: Income Fund Caters to Longer-Term Investors

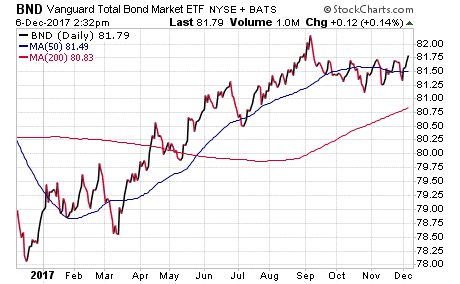

The exchange-traded fund (ETF) Vanguard Total Bond Market ETF (BND) is a large one under the Vanguard umbrella and in the bond sector.

BND’s objective is to match the returns of the U.S. bond market. The ETF satisfies this objective by providing investors with broad exposure to U.S. investment-grade bonds — over 10,000 types of bond securities with varying maturities of least one year.

All of the bonds in BND’s portfolio are rated Baa or higher. Since BND’s share values tend to rise and fall in modest proportions, investors often look to BND for a reliable income stream over either a medium- or long-term time frame, as well as for a way to diversify portfolios.

The fund does face the risk of rate hikes being proposed by the Fed, which most experts say will have a negative impact on bond yields. Currently, the fund manages $36.30 billion in total assets and has an expense ratio of 0.05%. This gives BND an expense ratio that is 93% lower than the fees charged by other funds with similar holdings. BND’s liquidity also is fairly high for a bond fund, with a daily trading volume of $155.44 million.

Year to date, BND has returned around 3.15%, which is about the average for the bond fund sector. The S&P 500 has returned 18% year to date. BND pays a monthly dividend with a current yield of 2.52%. The last dividend paid was $0.17.

Around 39.40% of BND’s portfolio is in U.S. Treasuries, while the bulk of the other holdings are in corporate and mortgage-backed pass-through securities.

BND’s top five holdings and their weightings in the portfolio are the U.S. Treasury Note 2.125%, 0.50%; U.S. Treasury Note 2.25%, 0.49%; U.S. Treasury Note 2.625%, 0.45%; U.S. Treasury Note 1.5%, 0.45%; and U.S. Treasury Note 1.375%, 0.44%. BND holds 800-900 million shares of each of these top five holdings.

If you are seeking broad exposure to U.S. treasury bonds, consider the Vanguard Total Bond Market ETF (BND) as a potential investment.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*********************************************************************

Wisdom from “The Boss”

Out here the nights are long, the days are lonely

I think of you, and I’m working on a dream

I’m working on a dream…

— Bruce Springsteen, “Working On A Dream”

When it comes to working on a dream, there is no better tool than disciplined investing. That’s because investing, and not just trading, involves delaying gratification today for a greater reward later. In other words, saving today for the comfort of a dream retirement. Or, as the great Bruce Springsteen might musically say… we’re all just working on a dream.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods