The Vanguard Value ETF (VTV) is a low-cost flagship for value investing that is up nearly 9% over the last three months.

With a spread of more than 300 holdings, this exchange-traded fund offers a simple way to employ a value investing strategy without having to carefully select individual holdings. VTV covers a broad segment of the market and invests in all the big names in value standbys, thus creating a convenient investment vehicle that doesn’t rely too strongly on individual company performance.

By value investing, I mean that the stocks and companies included in this fund generally have lower prices as compared to their book value than others. This is often because they are expected to see less growth in their bottom line, but it can also indicate that their prices are too low and will rise.

An October 2017 article found on CNBC had an interesting insight about the performance of growth stocks versus value-oriented ones so far this year. To summarize, growth stocks began to significantly outperform value stocks after the 2016 presidential election on optimism that the incoming Trump administration would be good for business and the economy. However, value stocks began to make something of a rebound a few months back as the high valuations of surging growth stocks began to be more seriously questioned by investors.

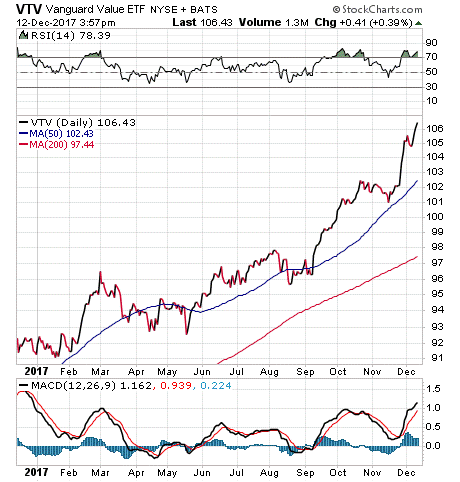

You can see something of this change in the winds by looking at the performance chart of VTV below. The fund traded mildly upward through the first nine months of the year before suddenly accelerating in September. While the fund is up close to 15% in the past 12 months, roughly 9% of that gain has come in the last 90 days.

For comparison, though, the S&P 500 has returned 20.55% year to date and VTV’s sister ETF, the Vanguard Growth ETF (VUG), is up 25.67% year to date. VTV carries a very low 0.06% expense ratio and pays a dividend of 2.36%. Assets managed total $63.6 billion.

The most prominent sectors in this fund are financials, technology, health care and industrials. The top ten holdings comprise 27.5% of assets and include such stalwarts as Microsoft Corp. (MSFT), 5.4%; Johnson & Johnson (JNJ), 3.1%; Berkshire Hathaway Inc. (BRK-B), 3.1%; JPMorgan Chase & Co. (JPM), 3.0%; and Exxon Mobil Corp. (XOM), 3.0%.

If you are looking for a way to invest in some of the biggest and most stable American companies on the market, Vanguard Value ETF (VTV) may be a useful instrument to consider.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)