Real estate investment trusts (REITs) have seen a spike in popularity in 2017.

REITs typically purchase office buildings, hotels and other properties to produce income. The Vanguard REIT ETF (VNQ) is a hassle-free play on the U.S. real estate space with a large, well-known investment group.

REITs offer many attractive advantages versus other types of investment vehicles including:

1. High yield – The longer-term average for REITs has been trending in the 7-8% range, well above the yield of the S&P 500 index.

2. Liquidity – REIT shares are bought and sold on a stock exchange, which is a far more efficient and easier market than buying and selling properties directly.

3. Diversification – REITs offer a good way for investors to spread their risk.

4. Simpler tax treatments – distributions from VNQ and other peer ETFs are taxed as ordinary income.

VNQ has $35.33 billion in assets and an expense ratio of just 0.12%. The fund holds a deep basket of 152 companies in its portfolio that covers almost all kinds of real estate. VNQ boasts a huge average daily trading volume of $287.12 million and a very low spread of 0.01%.

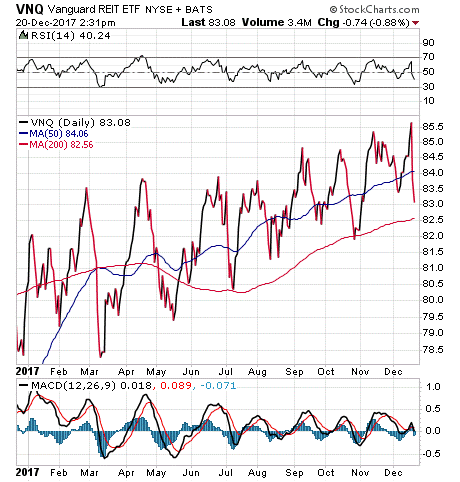

Yield-seeking investors sometimes compare the yields of REITs to bonds. While it is true that bonds offer similar income at a generally lower risk, REITs have a much higher potential for growth. As a result, VNQ’s share prices tend to rise and fall more sharply than funds that hold bonds, which is evident in the chart below.

Year to date, VNQ has returned 6.90%, compared to a 20.07% year-to-date return of the S&P 500. VNQ has a dividend yield of 4.8%.

The REIT’s top five holdings are: Simon Property Group Inc. (SPG), 5.23%; Equinix Inc. (EQIX), 3.76%; Prologis Inc. (PLD), 3.66%; Public Storage (PSA), 3.47%; and AvalonBay Communities Inc. (AVB), 2.60%.

If you are seeking a way to get into the REIT space, consider Vanguard REIT ETF (VNQ) as a potential investment.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.