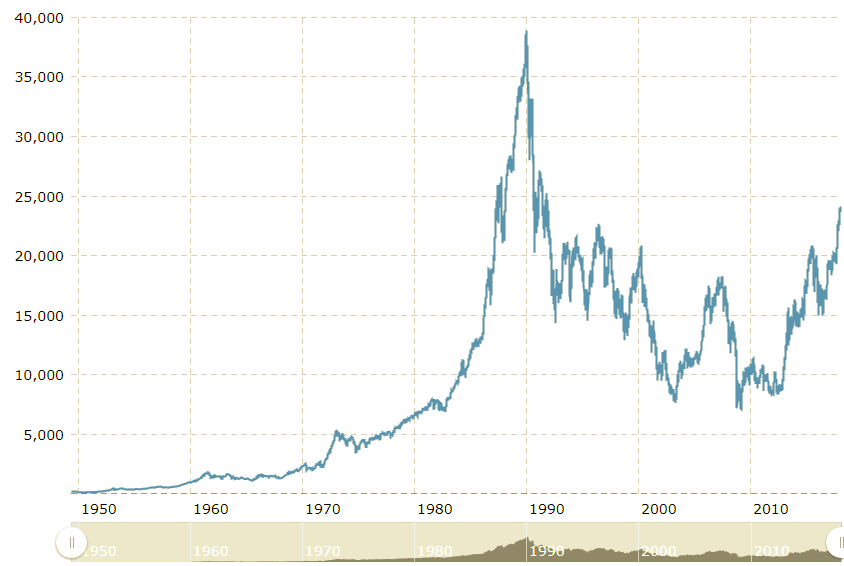

Japanese stocks hit a 26-year high last week to triple in value since hitting bottom in March 2009. See the chart below.

But here’s the real story: The Nikkei Index is still 40% below its all-time high of 39,000, which was hit at the end of December 1989. It took nearly 20 years before the Japanese stock market hit bottom.

I remember the 1980s well, and back then, the Nikkei Index made one new high after another. At one point, I was convinced that Japan would surpass the United States to become the world’s largest economy. Milton Friedman set me straight and said Japan could never match the economic prowess of the versatile, entrepreneurial America. He was right.

Doug Casey predicted the collapse of Japan and said it would be years before the country recovered. He was right.

Beware of Bubbles

There are important lessons here for investors. One is that “when you buy into a massive bubble, you may not live long enough to see the recovery — even if you have four decades still ahead of you,” to quote Alex Green, investment director of the Oxford Club and author of “The Gone Fishin’ Portfolio.”

Americans are, by nature, optimists. Bear markets are inevitable, but we believe that they never last long. It took six years (2000-2006) for the bear market to end for the Dow. The Nasdaq took a little longer — 15 years (2000-2015) — because it got caught up in the dotcom bubble. But Japanese investors have been waiting 28 years and counting to get back to an all-time high. Their market was the mother of all bubbles.

You can never bet that stocks will inevitably keep rising. You can never assume that bull markets last forever. The source of America’s strength is its free enterprise system. If that market-friendly environment ends, all bets are off.

But the United States is exceptional. I dare say no country has had a better investment track record over the long term.

Special Note for Subscribers in Southern California: Next Monday, I begin my popular “Financial Economics” class at Chapman University in Orange, California, where I will talk about my own investment strategies and highlight the contributions of the great financial economists, such as Robert Shiller, Jeremy Siegel, Eugene Fama, Rob Arnott and others. It takes place Mondays and Wednesdays in the early evening, 5:30-6:45 p.m. If you want to sit in on a few sessions, contact me at mskousen@chapman.edu and I will provide the details. This course is not available on Skype.

You Nailed It! Pro-Business Move by France’s Macron

“The complex labor laws have historically been the No. 1 obstacle to the competitiveness and attractiveness of France.”

— Olivier Marchal, chairman of Bain & Co. France

When I teach about labor economics to my students at Chapman University, I explain the unintended consequences of laws restricting firing workers, like they do in Europe. The downside is that when companies can’t fire workers, they are less likely to hire them. That explains the high levels of unemployment in European countries such as Spain, Portugal and France, all of which have had double-digit unemployment rates for years.

That’s now changing in France with the election of the young and resourceful new President Emmanuel Macron. Under his directives, France is now allowing companies to negotiate job cuts and restructuring without approval from collective bargaining agreements.

The New York Times, of course, preferred to highlight the job cuts going on now in France instead of the numerous new businesses being created. Economic growth has picked up for the first time in five years in France, and many companies such as Amazon, Facebook and Google have announced new plants and investments in Europe.

Bravo! Bien joue!