Main Street Capital Corporation (NYSE: MAIN) is a business development company (BDC) that has found a unique and profitable niche of financing and investing in small and medium-sized businesses to produce consistent growth and pay an enticing monthly dividend yield of 5.9 percent.

The BDC outperformed all its peers with a net asset value that rose 19.12 percent in the past year and 52.18 percent for the last three years, while its expense ratio of 5.62 percent ranked well below the industry average of 9.21 percent. Key barriers to entry that prevent potential competitors from trying to match Main Street Capital’s success include its special tax knowledge that others lack to guide businesses in its niche, relationships with clients and equity ownership in many companies it serves.

Main Street Capital Corporation announced on Jan. 3 that Chief Executive Officer and Chairman Vince Foster, 61, plans to become the company’s executive chairman during the fourth quarter, when Dwayne Hyzak, 45, its current president and chief operating officer, will take the reins as CEO. In an exclusive phone interview after the announcement, Hyzak told me he had no plans to change anything.

In a separate exclusive interview, Foster said he gained valuable expertise upon first arriving in Houston during 1981 to work in the tax department of Arthur Andersen. Foster, who also has a law degree, said his training in law and accounting proved to be “more valuable” to Arthur Andersen than simply using tax attorneys.

“We’re like the sumo wrestlers who eat seaweed all year to prepare for a 15-second match,” Foster said.

The tax experts are brought in “at the end” of the process to complete a transaction and need to “act quickly,” Foster said.

Houston has become a headquarters for public companies, such as Waste Management and Browning-Ferris Industries, among other “industry consolidators,” Foster said.

“Thousands of small businesses were acquired during the ‘80s and ‘90s,” Foster said. “To rapidly build scale, you buy companies.”

Family-run businesses, also known as “lower-middle-market businesses,” often needed guidance to prepare them for sale, Foster continued. Main Street Capital is commonly the first institution to invest in these types of companies.

“When you’re the first one in, you need the specialized tax and accounting expertise to properly evaluate the company,” Foster said.

A key reason is that existing family-run businesses typically do not produce Generally Accepted Accounting Principle (GAAP) financial statements.

“The first move is to convert financial statements into GAAP earnings that could go into a public company’s financials,” Foster said. “That is kind of a special skill.”

The use of GAAP earnings is essential for the seller and the buyer, said Foster, who called making the conversion efficiently a “real art.”

Founded in 1997, Main Street Capital has been able to find buyers for companies that did not have a public company in their industry to acquire them, Foster said. Such transactions are important for larger companies that depend on acquiring smaller ones for growth, he added.

One example is car dealers, which until the mid-to-late ‘90s did not include any publicly traded companies, Foster said. The reality was that a competitor may not have the financial wherewithal to buy another dealership until some of the largest ones began to go public, he continued.

When Congress enacted the Sarbanes-Oxley Act in 2002, it “turbocharged” the opportunity for Main Street Capital to help companies which lacked the internal controls to meet the standards of a public company auditor, Foster said.

Main Street Capital now has more than $3.7 billion in capital under management and investments in close to 200 companies. It provides debt financing and equity investments in lower-middle-market companies, along with debt financing for middle-market companies. A unique characteristic of lower-middle-market companies is that they have a reduced correlation to broader debt and equity markets.

The company’s business model has produced “two decades of success,” including the last 10 years as a public company, Hyzak told me.

Main Street Capital converted in 2002 to a small business investment company (SBIC) that was licensed by the Small Business Administration to supply small businesses with financing. SBICs borrow funds with an SBA guarantee to make equity and debt investments in qualifying small businesses.

The company’s start-up capital largely came from high-net-worth individuals in Houston and West Texas, where the company is based.

Small businesses, which typically have 500 employees or less, initially became the niche served by Main Street Capital before its management chose to go public in 2007 to provide non-SBA-regulated financing to mid-sized companies.

Main Street Capital grew its net investment income 8 percent to $115.8 million, or $2.23 a share, in 2016, compared to 2015. Further growth is projected to be revealed when the company reports its 2017 financial results on Feb. 22.

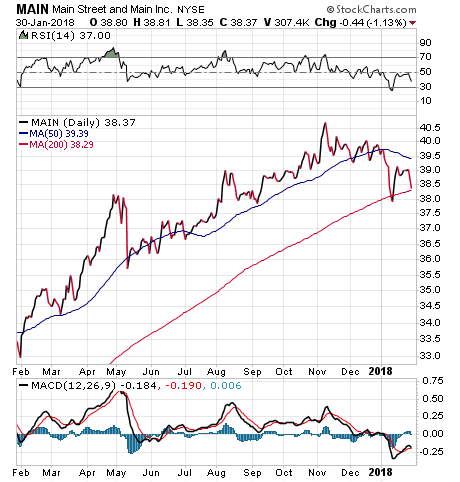

IHS Markit upgraded its rating on Main Street Capital to “neutral” from “negative” on Jan. 28, but Dr. Mark Skousen, who writes the monthly Forecasts & Strategies investment newsletter, has recommended the stock since April 23, 2012, to produce a total return of 120.10%, including dividends. The Raymond James investment firm boosted its rating for MAIN to “market perform” from “underperform” on November 7, 2017.

Main Street Capital’s President and COO Dwayne Hyzak and CEO and Chairman Vince Foster meet with Dr. Mark Skousen, of Forecasts & Strategies.

Main Street Capital is among the BDCs whose yields at least double the federal government’s long-term bond yields. The yield on the U.S. government’s benchmark 10-year note topped 2.70% on Jan. 29 to reach its highest mark since April 2014, but the 30-year yield is at 2.949% — well below its 2017 peak of 3.194%.

Main Street Capital has been providing its investors gains from both capital appreciation and dividend payments. A recent pullback in the price of the shares gives those who have been waiting on the sidelines an opportunity to invest at a reduced price.

Paul Dykewicz is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and dividendinvestor.com, a writer for both websites and the columnist of the weekly Global Guru investment e-letter. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of a daily newspaper in Baltimore. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)