I have a clear indicator that tells me when markets are feeling uneasy. I call it the “S.W.A.T. Guy” gauge, and here’s how it works.

I live on a small horse ranch in Southern California, and I have the good fortune of having some great neighbors. My closest neighbor is a retired deputy sheriff, and former S.W.A.T. team leader.

In addition to being an all-around cool guy, he’s also the kind of neighbor you want, and the kind that’s always got your back. I also try to be that same kind of neighbor, and that’s why when he asks me about the equity markets and investing, I’m always there to try and help him make sense of it.

On Tuesday, when the Dow Jones Industrial Average was down about 400 points, I got a call from S.W.A.T Guy asking me what was going on, and what to do about it.

What I told him was this market is finally starting to see something that we haven’t really seen in about two years, and that is the return of volatility.

Last week, that volatility started to rear its head, at least on an intraday basis, as we saw big intraday moves last Wednesday, and then again last Thursday. Yet despite the intraday price action in the majors, when the final bell rang in each of those respective trading sessions, stocks basically had closed unchanged.

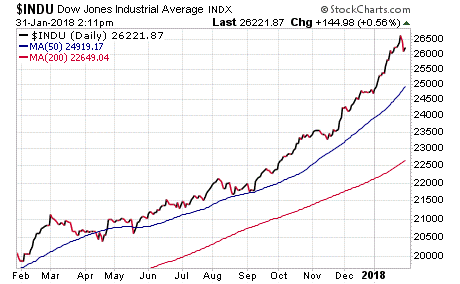

Then last Friday, stocks rebounded sharply, but that didn’t last. On Monday of this week, the selling resumed, with the Dow closing the session down 0.67%. Of course, the real selling took place Tuesday, with Industrials down some 1.37%, or 363 points.

As of this writing, the Dow is up about 0.60% in Wednesday’s trade. And here again, we are seeing this market display some intraday volatility, as stocks opened the session much higher.

So, why are we finally seeing the return of volatility?

Well, there are a number of reasons why, including reactions to mixed, but overall good, earnings reports. Remember, we are in the heart of earnings season, and while there have been a few high-profile disappointments (Colgate-Palmolive Co. (CL), Johnson & Johnson (JNJ)) we’ve also seen some great reports from 3M (MMM), Boeing (BA), Caterpillar (CAT) and Intel (INTC).

Then there’s also the uncertainty over the pace of rising interest rates; the overbought status of markets, geopolitics, domestic politics (a.k.a. the Mueller Russia investigation), and the lack of a big upside catalyst such as tax cuts, which, of course, are already a known quantity for markets.

Yet more important than the short-term causes of volatility, what I told S.W.A.T Guy is that one must look at markets with a wider lens than just the daily price action.

For example, the Dow is on track for its 10th-consecutive monthly gain, and we should close out the month with a 5.5% Dow win. The wider S&P 500 Index also had a great month, also logging its 10th-consecutive monthly gain, up about 5%. To round out the major indices, the NASDAQ Composite is on track to close out January with a 6% monthly gain.

And, if we look at things from an even wider perspective, we see the Dow has logged a one-year gain of 32% while the S&P 500 has gained 24.1%. The NASDAQ just edged out the Dow for top honors, with a one-year gain of 32.3%.

After gains like these, the market is bound to see some profit taking from time to time. In fact, I am surprised we haven’t seen much more profit taking over the past several months.

The bottom line here is that if you are invested in this market, there is no reason to panic, and no reason to exit. The bullish tailwinds of a strong economy, strong labor market, favorable tax and regulatory environment, strong corporate earnings and not-aggressive global central banks means this market’s default setting is “higher.”

Until those tailwinds die down, neither S.W.A.T. Guy, nor you, should be too nervous.

Navy Yard Wisdom

“Every job is a self-portrait of the person who did it. Autograph your work with excellence.”

— Anonymous

This week’s pearl of wisdom comes to us from reader John H., who told me he had first seen the above quote at a Philadelphia Navy Yard exposition in the early 1990s. I had never seen this quote before, but I love it. Moreover, it’s how I try to live my life every moment. You see, we have but one life that we are certain of, and this is it. So, if you want to make that life excellent, then you must autograph that life with excellence. And, the best way to do that is to take extreme ownership of your work.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.