The PowerShares DB Commodity Index Tracking Fund (DBC) is the first exchange-traded fund (ETF) that we will cover in a series of commodity-themed funds.

A commodity is defined as a raw material or agricultural product that can be traded. In financial terms, a commonly includes energy products such as oil and natural gas, metals such as gold and silver, agricultural products such as wheat and all types of meat and livestock.

The most popular way to invest in commodities is through a futures contract, which is an agreement to buy or sell, in the future, a specific quantity of a commodity at a specific price, according to Investopedia. Direct investment in commodities is possible in most brokerage accounts.

However, the commodities futures market can be very volatile, with big price swings not an uncommon occurrence, making it challenging for even experienced traders to do well. This is where ETFs come in. They offer investors a convenient way to gain exposure to the commodities market and reduced volatility (thanks to diversification) in one package. Some investors hedge against inflation with commodity funds. DBC caps its portfolio exposure to energy at 60% and invests around 20% each in agricultural products and metals.

By far the largest of the commodities ETFs, DBC tracks an index of 14 of the most heavily traded and important physical commodities in the world. It currently has roughly 70% of its $2.60 billion in assets invested in commodities in North America and the United Kingdom. DBC also has a relatively low expense ratio of 0.85% and strong liquidity with a daily trading volume of $3.2 million.

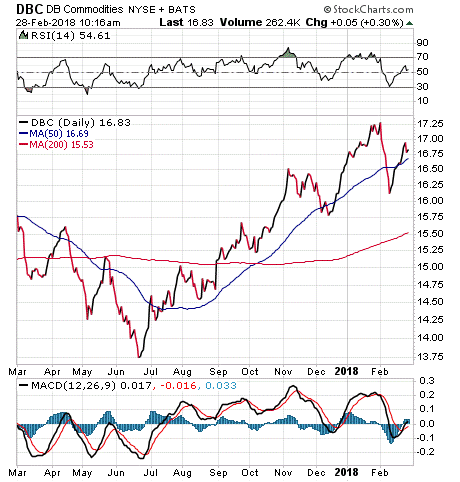

The chart below shows that DBC has been on a downward trend for the first half of 2017, but then moved higher starting in July. Year to date, DBC has returned 2.95%. The volatile nature of commodities can be seen in the past performance of the fund: -27.6% in 2015, 18.6% in 2016 and 4.86% in 2017.

DBC’s top holdings are WTI Crude Futures (March 19), 6.80%; Brent Crude Futures (Jan. 19), 6.39%; Ny Harbor ULSD Futures (June 18), 6.30%; Gasoline RBOB Futures (Jan. 19), 5.97%; and PowerShares Treasury Collateral ETF, 4.84%.

For investors who are seeking a convenient way to make a play on the overall commodities market, I encourage you to look into PowerShares DB Commodity Index Tracking Fund (DBC). Please note that the nature of commodities means that DBC carries with it a higher degree of risk than many other funds on the market.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)