WisdomTree Emerging Markets High Dividend Fund (DEM) has been delivering market-beating returns for more than a year by tracking the performance of high-dividend-paying companies in economically ascending emerging markets.

The lure of income is a key reason to own a dividend-paying fund, but DEM also has surged in share price during the past year and could outperform again in 2018 as the World Bank forecasts emerging markets will grow 4.5 percent, compared to 2.2 percent for advanced economies. Another plus with dividend-paying investments is that they tend to retain their value better than non-dividend-payers when the market falls.

DEM has produced a total return of 27.24 percent during the past 12 months, as of March 12, compared to 22.46 percent for the MSCI ACWI Ex USA NR index, which tracks large- and mid-capitalization non-U.S. equities, 17.30 percent for the S&P 500 and 20.45 percent for the Dow Jones Industrial Average. The fund’s share price also has shown recent momentum by rising 68 cents a share, up 1.43 percent, on Friday, March 9, to close at $48.30, before climbing 10 cents a share, or 0.21 percent, to $48.40, on Monday, March 12.

Those gains boosted DEM’s year-to-date total return to 6.73 percent through March 12, compared to 4.09 percent for the S&P 500 and 1.86 percent for the Dow Jones Industrial Average. DEM’s performance also trounced the 1.49 percent year-to-date total returns of its sector benchmark, the MSCI ACWI Ex USA NR index.

DEM’s dividend yield for the past 12 months reached 3.47 percent, its 30-day average daily trading volume is 305,426 shares and its expense ratio is 0.63 percent. That yield helps to boost the fund’s returns significantly, compared to non-dividend-paying investments.

The biggest sector weightings of DEM are financial services, 23.80 percent; energy, 19.31 percent; basic materials, 12.98 percent; technology, 12.57 percent; and communication services, 12.51 percent. All those sectors traditionally do well during periods of increasing economic growth.

An “important inflection point” in emerging market equities now may have been reached in which value stocks, especially those that pay high dividends, will start to outperform emerging market growth stocks, said WisdomTree’s Chief Investment Strategist Luciano Siracusano.

In contrast, the MSCI Emerging Markets Value Index underperformed the MSCI Emerging Markets Growth Index in four of the last five years. But year-to-date 2018 results have shown a reversal, with MSCI EM Value returns topping MSCI Emerging Markets Growth, while the MSCI Emerging Markets High Dividend Yield Index is beating both.

DEM, launched July 13, 2008, offers diversification for income investors by providing exposure to emerging market equities around the world, with 62.91 percent in Asia, 30.94 percent in Europe and 6.15 percent in the Americas. The countries that account for DEM’s largest holdings, as of March 12, are Taiwan, 25.54 percent; China, 16.54 percent; Russia, 13.86 percent; South Africa, 13.18 percent; and Thailand, 5.36 percent.

The fund’s top five holdings are Gazprom PJSC ADR, 3.99 percent; PJSC Lukoil GDR, 3.84 percent; Hon Hai Precision Industry Co. Ltd., 3.39 percent; China Construction Bank Corp. H, 3.25 percent; and China Mobile Ltd., 2.71 percent. DEM’s top 10 holdings compose 27.09 percent of its $2.3 billion in assets.

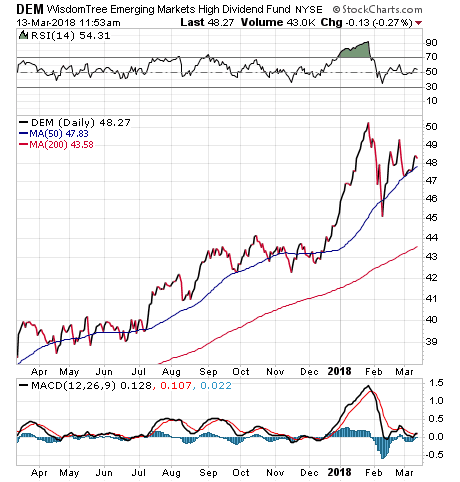

With a closing share price of $48.40 on Monday, March 12, DEM trades at a slight premium of 0.26 percent to its net asset value of $48.23. The following chart shows its performance for the past 12 months.

WisdomTree’s Siracusano recently reflected on the outlook for DEM and emerging markets broadly. His key points included:

- Compared to the S&P 500, emerging-market equities trade at a lower price-to-earnings (P/E) multiple, are growing earnings faster and seem poised to benefit from strong global gross domestic product (GDP) growth and a “relatively benign” U.S. dollar.

- After a period of relative underperformance, value is making a clear comeback in emerging markets, led by its higher-dividend-yielding stocks.

- One of the best ways to get exposure to both the value segment of emerging markets and its higher-dividend-yielding stocks is through DEM.

- Because the index weights components annually based on the U.S. dollar value of the cash dividends paid over the prior 12 months, it typically exhibits higher dividend yields than comparable cap-weighted indexes. In addition, DEM has generated excess returns compared to the MSCI Emerging Markets Index — and did so while exhibiting lower volatility.

- WisdomTree’s dividend-weighted strategies provide potential to boost dividend income, reduce volatility or increase long-term returns compared to traditional “beta” exposures.

DEM is one of the top current recommendations of Jim Woods, the editor of the Successful Investing investment newsletter. Woods described DEM to me as a “standout.”

With bonds, even those focused on emerging markets through iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), now “out of favor,” DEM is particularly appealing because it is spurred by rising global growth, a still-low U.S. dollar and improving demographic trends in many countries in that sector, Woods said.

For investors who crave income and want exposure to emerging markets in creating well-diversified portfolios, DEM is worth considering while it produces outsized returns that show no signs of slowing anytime soon.

Paul Dykewicz is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of a daily newspaper in Baltimore. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz.