The PowerShares DB US Dollar Index Bullish ETF (UUP) marks the start of a series of currency funds that we will cover in our next several ETF Talks. UUP tracks an index of USDX futures contracts that rises in value as the U.S. dollar appreciates.

Currency trading can be highly volatile and is not suitable for all investors. However, currencies also don’t really follow the market ups and downs, and are instead driven by their own factors, such as interest rates and political instability on a global-macro scale.

Trading directly in foreign currencies also requires a foreign exchange (forex) account and a lot of dedicated work. This is where currency exchange-traded funds (ETFs) like UUP come into play by giving investors a hassle-free way to invest in currencies.

The objective of UUP is to provide investors with a cost effective and convenient way to track the value of the U.S. dollar relative to a basket of the six major world currencies – the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc. The fund accomplishes this with futures contracts by shorting these six currencies while going long in the U.S. dollar.

UUP is structured as a commodities pool and distributes K-1s, which complicate and investor’s tax return. With $500.28 million in total assets and an average daily trading volume of $29.22 million, UUP is very liquid, making it easy to trade.

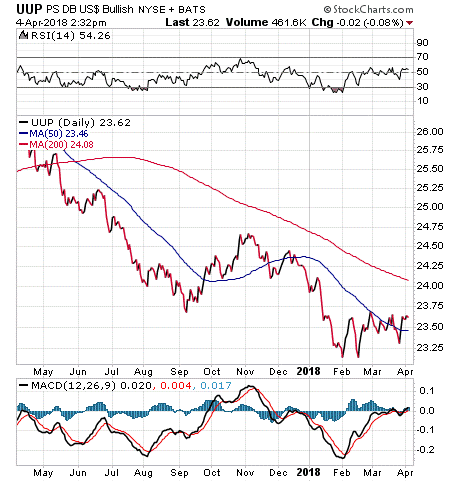

UUP has an expense ratio of 0.79% and a distribution yield of 0.10%. The fund rose strongly in late 2017, but recently has dropped due to a weakening dollar. Year to date, the fund is down 1.39%.

UUP’s portfolio of futures contract is 57.60% invested in the euro, 13.60% in the Japanese Yen, 11.90% in the British pound, 9.10% in the Canadian dollar, 4.20% in the Swedish Krona and 3.60% in the Swiss franc.

For advanced investors who believe in the strength of the U.S dollar, I encourage you to look into the PowerShares DB US Dollar Index Bullish ETF (UUP). It also may provide a useful hedge for experienced investors with positions in international stocks, as well as those who understand the dynamics of the forex markets.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)