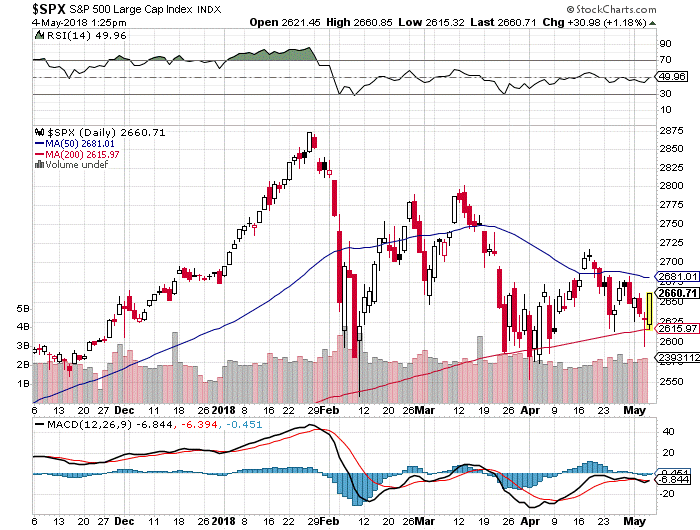

There is no shortage of hand-wringing in the current market landscape, especially with the S&P 500 retesting its closely followed 200-day moving average after breaking through it for a short while last week.

Volatility is running high right now and its effect is showing in the market. Despite the most robust earnings season since 2008, stocks are struggling to rally. The bearish camp has embraced the “it’s as good as it gets” mantra voiced during the Caterpillar (NYSE: CAT) earnings call, in which the company commented that the first quarter might be the “high water mark” for profit margins. That one-liner has had more influence on investor sentiment than any other data point or earnings surprise that has crossed the tape recently.

To the bull’s credit, all five of the so-called FAANG stocks have posted strong Q1 results. Facebook (NASDAQ: FB), Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL), Netflix (NASDAQ: NFLX) and Alphabet (NASDAQ: GOOGL) all beat on the top and bottom lines, but most of these earnings wins only received very modest enthusiasm. The exception to this trend was Amazon, which soared to a new all-time high on fantastic numbers.

Another report that helped to fortify the market lately was the news that Warren Buffett’s Berkshire Hathaway (NYSE: BRK.B) bought 75 million more shares of Apple in the first quarter. However, the pronounced weakness in several favorite sectors, namely semiconductors, aerospace/defense and financials, has erased gains from earlier this year and then some. There’s a growing feeling that there are few places for investors to hide, except for a select number of coveted names, amid evidence of broad technical damage in several former market leaders.

Then, there is the geopolitical and domestic political landscape, which includes the upcoming summit between the United States and North Korea, the likely undoing of the Iran nuclear deal, the reworking of NAFTA, the pending tariffs with China and Europe, the ongoing involvement with Syria and all the visceral drama taking place in Washington, D.C. While some of these hot spots and the related saber-rattling may indicate exogenous risk, most of it likely will be diffused in good time. It does, though, provide a basket of excuses to “sell first and ask questions later.”

The summer months are traditionally a weak time of the year for stocks, as if we needed yet another reason to be concerned. When one looks at the market from a purely technical standpoint, the S&P 500 is running the risk of a material breakdown if its 200-day moving average suffers a protracted breach. Because program trading dominates more than 70% of all daily activity on both the NYSE and NASDAQ, any high-volume, downside penetration of the 2,600 mark for the S&P will invite a 100-200 point sell-off for that benchmark index. Such an event could happen very quickly because of how these computer-generated sell programs can feed on themselves.

To this point, investors should have a defensive strategy to deploy when the caution flag is being waved. Just because we are in the month of May doesn’t mean we have to “sell and go away,” but the last thing you want to see on CNBC or Bloomberg is a trading floor full of panicked brokers yelling “May Day! May Day!” if the market drops through the S&P’s 200-day moving average like a hot knife through butter.

Any major crack at this level over a two-to-three-day period will invite a swift move lower that will cause great technical and psychological damage. The current 200-day moving average sits at 2,615, with the next near-term level at 2,585, after enduring a February low of 2,550. However, those second and third levels are soft and will only act as speed bumps to lower levels.

The problem I see is that, after three short breaches of this key line, a fourth breach could be a watershed event. Each rally attempt off this level has resulted in what chartists call a lower high. Friday’s rally came just in the nick of time, but the market is a long way from being out of the woods. Since late February, volatility has been very elevated, and I don’t see that diminishing any time soon. So, an action plan should be considered if the market takes a turn for the worse.

For many investors, a go-to-cash exit strategy can create a nightmare of a tax situation. Instead, I recommend utilizing a sound hedging strategy to protect portfolios of all sizes. This is a good way to mitigate downside risk in the event of a trapdoor sell-off where stocks drop like they are going over a waterfall. We all know the old saying, “if you fail to plan, you plan to fail.” Nothing could be truer than when it applies to our money in a frothy market.

Seeing how headline risk has played havoc with the major averages on so many trading days these past couple of months, I find it incredibly naïve of investors to not have a plan for portfolio insurance in place. As to what most investors can lay on in the form of portfolio insurance, I would look to a few potential instruments. They are the ProShares Short S&P 500 ETF (SH) and the iPath S&P 500 VIX Short-Term Futures ETN (NYSEArca: VXX).

This two-part portfolio hedge lets investors short the S&P 500 in an unleveraged exchange-traded fund (ETF), while playing the upside spike in market volatility if the S&P 500 tops its key 200-day moving average in a material way. This approach is a very simple way to insulate a certain measure of downside risk. Everyone has portfolios with varying degrees of risk and, therefore, has to determine what percentage of a portfolio should be weighted in hedging instruments versus long exposure and cash.

With that said, it’s good to see the market holding “the line,” per last Friday’s session, but the bears aren’t going away any time soon. Until the S&P 500 breaks above 2,750 on high volume, there is inherent risk of a downside break in the benchmark index. The best time to put on a hedge is when the market is bouncing higher. So, while the S&P has found a near-term bid, the cost of buying shares of SH and VXX is lower, making for more attractive entry points.

If the worst-case scenario does unfold and the S&P cracks lower, professional money will be buying both these instruments by the trainload. Having them already in place is like buying hurricane insurance when it is sunny out, then selling that same insurance policy to a beachfront homeowner just as a Category 5 hurricane is about to hit the coastline where that very beachfront home is located. The value of such insurance will spike sharply, as will the values of both ProShares Short S&P 500 ETF (SH) and the iPath S&P 500 VIX Short-Term Futures ETN (VXX) if the same situation arises when the majority of investors aren’t prepared.

The market is back in rally mode for the moment and one or two up days doesn’t make for a trend. It is a great time to buy some protection.