Technology stocks were the clear market leaders in 2017, but the turbulence so far this year has made it difficult to find a truly strong sector in the stock market. Investors who are tired of trying to pick the next sector champion may want to consider “factor investing,” such as through funds like the Fidelity Core Dividend ETF (FDVV).

Unlike traditional stock, index and sector investing strategies, factor investing focuses on specific key equity attributes, including: value, size, momentum, quality and volatility. The strategy promotes portfolio diversification, but in a less defensive manner than is typical.

Rather than just trying to minimize risk through a good spread of investments, diversification through factor investing also offsets potential risk by targeting time-honored and broad drivers of historical returns. In theory, investors have less chance of a loss and a greater chance of more gains.

FDVV was launched in September 2016 along with six other brand new Fidelity factor-based exchange-traded funds (ETFs), and targets “large- and mid-capitalization dividend-paying companies that are expected to continue to pay and grow their dividends.” The fund takes the 1,000 largest stocks by market capitalization and calculates a score based on the following factors:

- Dividend Yield: 70%

- Payout Ratio: 15%

- Dividend Growth: 15%

While this score leans heavily on an individual company’s trailing dividend yield, the 30% of this score that is devoted to payout ratio and dividend growth serves to help weed out unhealthy companies that don’t have sustainable dividend payments.

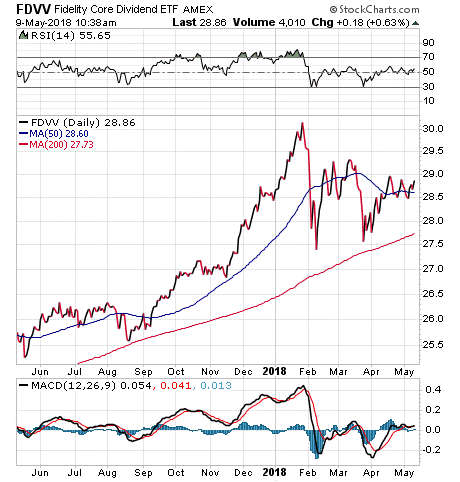

In the two-and-a-half years since its launch, FDVV has garnered over $129 million in net assets. Though by no means a huge amount, the fund has clearly received some mainstream attention. Its lifetime return, as of March 31, 2018, was 11.74%. Year to date, the fund is below its one-year high of $30.41 set on Jan. 26 and is about breakeven for the year. FDVV offers a reasonably cheap expense ratio of 0.29% and a 3.6% yield, one of the higher yields among well-known dividend ETFs.

FDVV is well diversified across all market sectors, but the fund’s biggest investments are in Financials, 32.77%; Technology, 15.01%; and Energy, 12.63%. The top 10 holdings make up 28.16% of all assets and read like a Who’s Who of household names. Some of the biggest investments include: Apple, Inc. (AAPL), 3.53%, Verizon Communications (VZ), 3.07%; and AT&T (T), 2.90%.

Until the market establishes a definite new trend — either bearish or bullish — volatility and uncertainty will continue to rule the markets. Factor-based investments like the Fidelity Core Dividend ETF (FDVV) could be a solid play for investors who are looking to balance risk management and potential gains in unexpected areas.