“Good investment ideas are rare, valuable and subject to appropriation just as good product or acquisition ideas are.”

— Warren Buffett

The bull market is back! Wall Street has rallied sharply after the government reported a better-than-expected jobs report last Friday without generating more inflation. The unemployment rate fell below 4% for the first time in many years.

The good news came out the day before Warren Buffett’s annual “Woodstock for Investors” conference in Omaha, Nebraska, and shareholders are back in a festive mood.

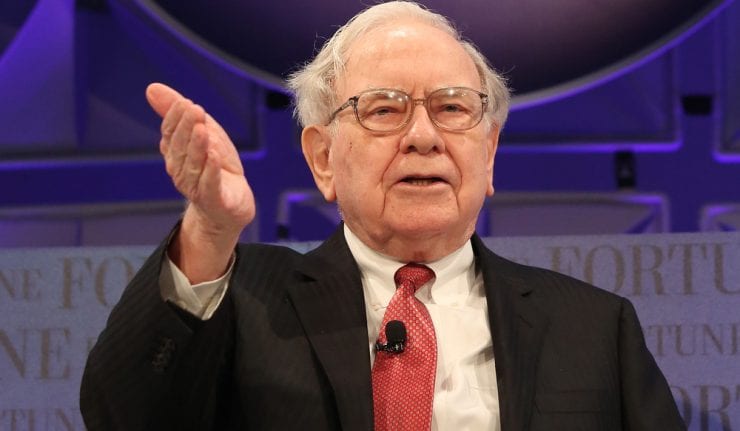

Ever since my son and I attended the 50th annual Berkshire Hathaway (NYSE: BRK.B) shareholder meeting in 2015, I’ve watched the proceedings on Yahoo! Finance TV. I met Warren Buffett several years ago (see photo) and have taken note of his financial wisdom ever since.

Warren Buffett talks with Mark Skousen and his wife Jo Ann.

Beware Gold Bugs!

One highlight at the shareholders’ meeting was an investor from San Francisco who said that he used to speculate in penny mining stocks, but was instead talked into investing in Berkshire Hathaway stock by his wife. It was a good move. Penny gold stocks have been a disastrous investment over the long run compared to Buffett’s investment company.

As Buffett himself noted last weekend, “if you had bought gold at the time of Christ and you figure the compound rate on it, it’s a couple tenths of a percent.”

Meanwhile, investing in successful businesses offers the potential of multiple returns. As Buffett himself noted: Just since 1942, an investment of $10,000 in an index of U.S. stocks would be worth $51 million today! No investment in gold or a gold stock index can match that kind of return.

Berkshire Hathaway Is an Incredible Money Machine

No doubt Buffett’s investment fund, Berkshire Hathaway, has been a big success. In fact, it has done substantially better than an index fund. If you had invested $10,000 in 1964, when Buffett took over the company, your investment would be worth $160 million today.

If you had invested $10,000 in 1990, it would be worth $45 million today.

However, there is a big “if” here, namely, if you had stayed invested the entire time up the present. Investors are always tempted to take profits along the way.

Compounded investing is also a great way to make money. If you had invested $1,000 in Berkshire every year since 1964, your total investment would be worth over $124 million today.

Is Buffett Too Big to Succeed?

However, though the company has a strong return over many decades, Berkshire Hathaway stock has consistently underperformed the market since the 2008 financial crisis. Even Buffett admits that his conglomerate firm has become too big to beat the market, so an index fund is more suitable.

Pay a Dividend?

One investor at the annual meeting asked if Buffett & Co. would pay a dividend. He said, “absolutely not.” This is one area where I disagree with Buffett. I prefer rising dividend-paying stocks, which have been proven to outperform the markets. Most of the stock recommendations in my Forecasts & Strategies advisory service fit into this category, and we’ve profited handsomely.

The Quotable Buffett: The Maxims of Wall Street

Buffett and his business partner, Charlie Munger, are big readers of books, newspapers and quarterly reports. “In my whole life, I have known no wise people who didn’t read all the time — none, zero,” said Munger. At the annual meeting, the company has a huge bookstore to encourage shareholders to read all kinds of books.

I’m pleased to report that my own “Maxims of Wall Street” is one of Buffett’s favorites. “I love your great little book. In fact, I plan to shamelessly steal some of the lines,” Buffett wrote to me. My book also has been endorsed by Jack Bogle, Dennis Gartman, Alex Green, Bert Dohmen and Richard Band.

It now is in its 5th edition, with more than 25,000 copies in print. If you would like a copy, the price is $20 for the first copy, and all additional copies are $10 each. I autograph every copy and mail it for free. If you order an entire box of 32 copies, the price is only $300 postpaid. The books make a great gift to friends, relatives, brokers and clients. To order, call Harold at Ensign Publishing, toll-free, at 1-866-254-2057, or go to www.miracleofamerica.com. (For orders mailed outside the United States, call Harold for additional mailing charges.)

Upcoming Appearances

Note: I’ll be at the Las Vegas MoneyShow next week, May 14-16, at Bally’s Resort, with a main stage appearance on the outlook for the economy and the stock market with Steve Forbes, Peter Schiff and others. My wife Jo Ann also will be speaking at the “Women on Wealth” summit on Monday. Other speakers include Mary Anne Aden, Marilyn Cohen and Kim Githler. Nine out of ten women will be solely in charge of their finances for at least a portion of their adult lives due to divorce, widowhood or choosing to be single. Here is more detail. See you there!

You Blew It! Buffett and Munger Miss out on Digital Money Revolution

“Nobody is more bearish than a sold out bull.” — “Maxims of Wall Street”

There’s no better example of the Wall Street saying above than Warren Buffett and Charlie Munger. They have missed out on one of the biggest stories in financial history — the development of digital currencies and the blockchain technology behind them.

Buffett first called bitcoin a “mirage” in 2014. At that time, it was selling for around $600. Now, it’s selling for more than $9,000, far outperforming the stock market indexes, Berkshire Hathway stock, or even Apple.

Many analysts, including myself, see cryptocurrencies as a major breakthrough in monetary economics. Like any new technology, digital currencies are subject to massive speculation bubbles, but the monetary revolution is real. It is not simply a “tulipmania” or “rat poison,” as Buffett called it recently.

“What I do find monumentally baffling is that two of the world’s most successful investors cannot see the intrinsic value of some form of cryptocurrency,” Nigel Green, CEO of financial consulting firm deVere Group, wrote in a recent report. “Do they honestly believe that there is no place for, and no value of, digital, global currencies in an increasingly digitalized and globalized world?”

Tech futurists like George Gilder recognized early on the revolutionary nature of bitcoin, the currency of the internet and how it gradually will become the new gold standard. He spoke favorably about bitcoin in 2014 at FreedomFest, the same year that Buffett dismissed bitcoin as a “mirage.”

We are going to have a major debate on “Revolutionary Technology or Tulipmania? The Big Bitcoin Debate.” Overstock CEO Patrick Byrne believes that the blockchain technology behind bitcoin is “more revolutionary than the Internet.” He and Jeffrey Tucker will make the case that cryptocurrencies are here to stay. Pomona College Professor Gary Smith calls bitcoin a speculation only — “stocks have true investment value, cryptocurrencies don’t.” He and Peter Schiff (Euro Pacific Capital) will argue against bitcoin as an investment. Naomi Brockwell will moderate. The event is not to be missed: www.freedomfest.com.

Use code EAGLE100 to get $100 off the registration fee.