The Fidelity Dividend ETF for Rising Rates (FDRR) tracks an index that reflects the performance of stocks of large and mid-capitalization dividend-paying companies that are expected to grow their payouts and have a positive correlation of returns to increasing 10-year U.S. Treasury yields.

Although an increase in interest rates usually hurts dividend stocks, FDRR’s positive correlation to treasury yields and sector neutrality help protect investors’ returns. In particular, some analysts indicate that FDRR’s exposure to the financial sector reduces the risk associated with rate hikes.

Furthermore, U.S. dividend growth remains impressive even as interest rates are rising. Global consulting market IHS Markit is forecasting that quarterly dividends declared by firms in the S&P 500 will top $115 billion in the current calendar quarter to notch a 2.3% jump from the $112.5 billion declared in Q1.

The fund has a distribution yield of 3.03% and an expense ratio of just 0.29%.

FDRR selects from 1,000 of the largest U.S. stocks and the largest 1,000 developed-market international stocks by capitalization. These stocks then are scored according to their dividend yield, dividend payout ratio, dividend growth, etc. FDRR then invests at least 80% of its $298.6 million total assets in more than 100 qualified holdings. The fund invests primarily in U.S. stocks, with a 10% maximum on international stocks. As a means of diversification, FDRR also does not invest more than 35% in any individual sector.

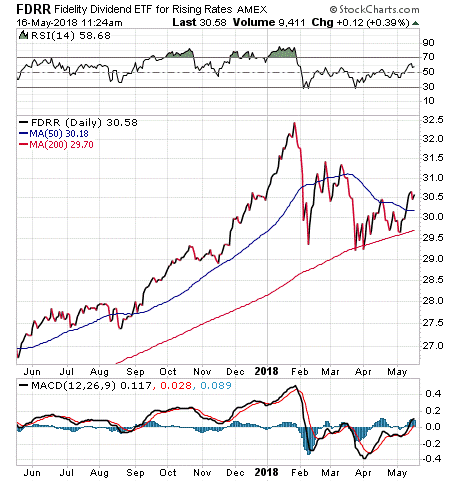

Over the last year, FDRR has returned 10.51%. Year to date, FDRR has returned 0.74%.

FDRR’s top five holdings are Apple (AAPL), 5.04%; Microsoft (MSFT), 4.13%; JPMorgan Chase (JPM), 2.36%; Johnson & Johnson (JNJ), 2.36%; and Intel (INTC), 2.31%.

FDRR is 25% invested in information technology. 15% in financials, 13% in health care, 12% in consumer discretionary and 10% in industrials. In addition, FDRR is largely skewered towards large- and mid-cap companies, as they make up approximately 95% of the fund’s portfolio.

For investors seeking an investment in a diversified fund built for a rising-rate interest environment, the Fidelity Dividend ETF for Rising Rates (FDRR) could be a great choice.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)