While stocks have made a nice comeback from a crucial technical test of the 200-day moving average, there are some clouds forming on the horizon that I see as potential obstacles to clear for the market to rally above the prior highs.

A lot of attention is being given to the U.S.-China trade talks, the reworking of the North American Free Trade Agreement (NAFTA), the summit with North Korea, the tariffs on European imports and the U.S. pullout from the Iranian nuclear deal. As far as geopolitics go, this situation certainly deserves investor consideration to assess whether any news is good enough to lift the market or bad enough to provoke real downside risk.

At the present, the market is content giving the benefit of the doubt to the notion that cooler heads and rational dialogue and negotiation will prevail. We can see this in the persistently benign level of the volatility indicators. The level of worry by investors is not elevated, at least not now.

Beyond this mix of potential headline risks, I see three other factors as fundamental risks to the market’s near-term uptrend. They would be the strong dollar, spiking oil prices and rising interest rates. This could be a trifecta of trouble if they all continue to trend upward in a coordinated fashion. A stronger economy warrants higher energy prices from rising demand, a rising dollar computes when considering the Fed is shrinking its balance sheet and rising interest rates make sense when the Fed is tightening its fiscal policy after a decade of financial stimulus.

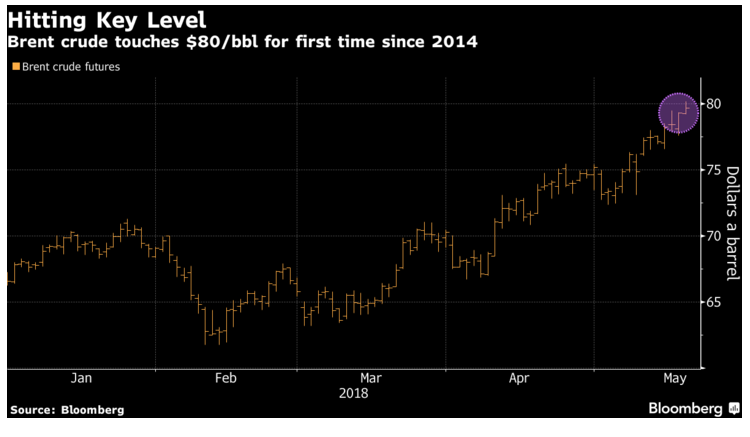

Crude oil this month has been touching levels last seen more than three years ago as global supplies tighten amid fears over the implications of the Iran nuclear accord break-up. As of Thursday, North Sea Brent traded up to $80.00/ bbl., while WTI crude hit $71.50/bbl. The summer driving season officially kicks off Memorial Day weekend two weeks from now. Average gasoline prices across the United States are fast approaching $3.00 per gallon, which is a serious budget item to contend with for many Americans who commute long distances.

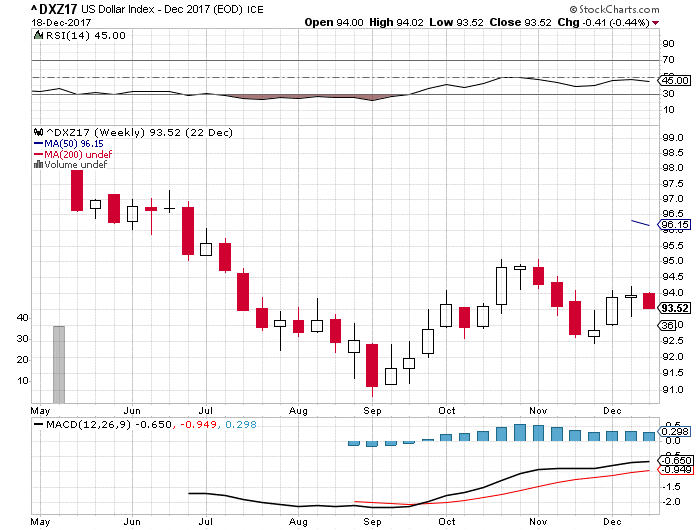

The sharp move up in the dollar of just over 5% has occurred in the middle of the second quarter and will surely show up as a foreign-exchange headwind to profits for most multi-national companies when they report Q2 earnings. Here too, companies have enjoyed “Goldilocks” conditions for so long that the market may react negatively if the dollar continues to climb. And from a technical standpoint, it looks very much like it will. The dollar index (DXY) currently trades at 93.44 with overhead resistance at 95.0. A move through that level opens the way for a further rally to 100.0, where that would prove to be very problematic for companies doing more than 50% of business overseas.

The sharp move up in the dollar of just over 5% has occurred in the middle of the second quarter and will surely show up as a foreign exchange headwind to profits for most multi-national companies when they report Q2 earnings. Here too, companies have enjoyed Goldilocks conditions for so long that the market may react negatively if the dollar continues to climb. And from a technical standpoint, it looks very much like it will. The dollar index (DXY) currently trades at 93.44 with overhead resistance at 95.0. A move through that level opens the way for a further rally to 100.0 where that would prove to be very problematic for companies doing more than 50% of business overseas.

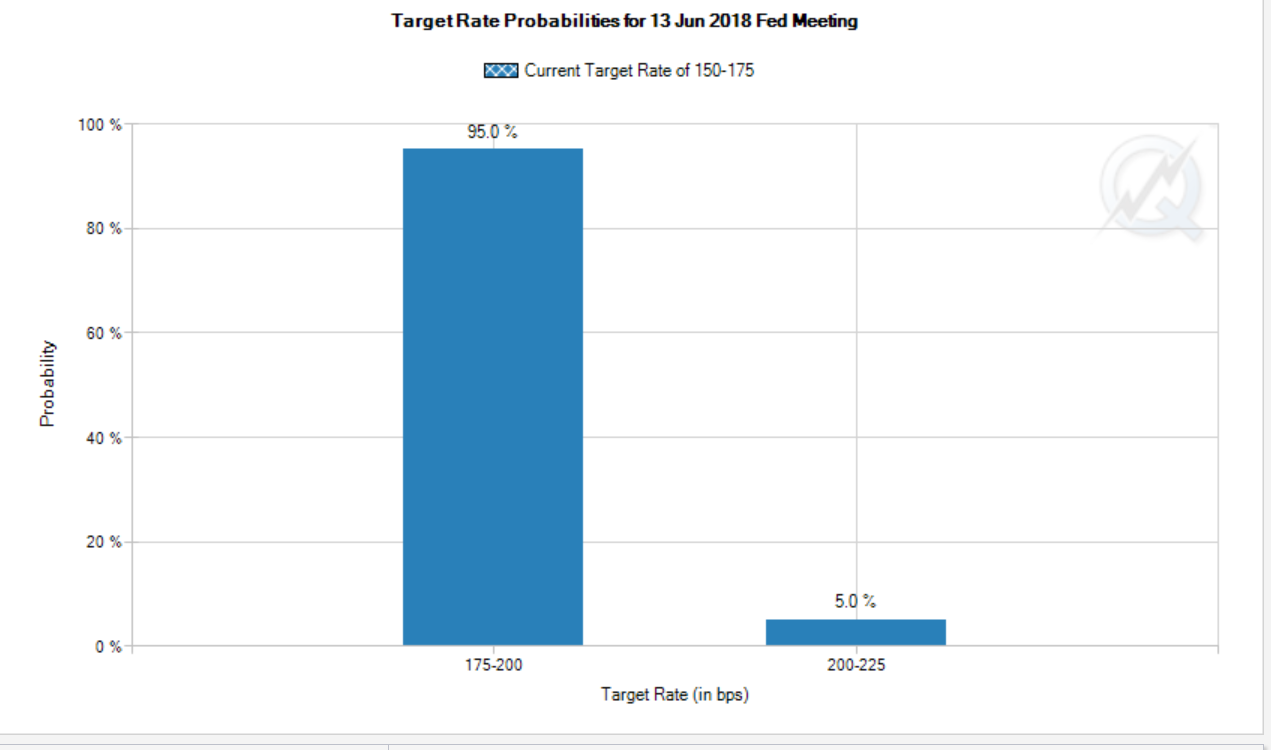

And while rising oil prices and the bullish move in the dollar are more apt to be affected by new supplies hitting the market and central bank injections to stem further price increases, there is little the market or outside forces can do to slow the rise in bond yields if the market senses inflation and a hawkish Fed. This is where I see the current rally running to some summer seasonality where volatility will pick up as we approach the next Federal Open Market Committee (FOMC) meeting slated for June 13. There is currently a 95% probability the Fed will raise Fed Funds by a quarter point to 1.75%-2.00%, according the CBOE FedWatch Tool site.

Such a boost would be the second hike this year with Fed Chairman Jerome Powell openly suggesting that there could be four rate hikes in 2018. That would imply another hike in September and then again in December. With the domestic economy expanding at a 3.0%-plus clip for gross domestic product (GDP), inflation indicators ticking higher and second-quarter corporate sales and earnings growth looking to exceed that of the first quarter, the market being a forward discounting mechanism will start taking into account the longer-term effects of higher bond yields on businesses and consumers.

To that point, I think the market can transition to these eventualities, but not without some bouts of volatility along the way that will test the mettle of investors similar to what occurred during February and March. Essentially, I do not expect a smooth ride for the stock market during the summer months and investors should maintain a cautiously optimistic stance on how they manage their portfolios.

With this scenario as a back drop, the financial sector stands to benefit as one of the go-to sectors for garnering potential profits. The issue for income investors to contend with is that banks are a natural winner in this scenario, but they pay little, if any, dividend yields to satisfy the needs of income investors. So, while interest rates benefit the financial sector, investors must look outside traditional banks to find the kind of income stream that makes a significant difference. Thankfully, there are choices.

Within my Cash Machine model portfolio, I’ve recommend one real estate investment trust (REIT) that is the largest owner of mortgage service rights paying over 11.0%, a business services company paying 8.6%, two private equity firms paying 8.7% and 7.9% and two floating-rate business develop companies paying yields of 8.4% and 9.8%. To find out what these companies are, click here and supercharge your income portfolio with stocks that are in a favorable sector in which rising rates are a tailwind and not a headwind. There are excellent streams of income to be had. You just have to know where they are. Check out Cash Machine, the home of high-yield income.