The Fidelity Low Volatility Factor ETF (FDLO) seeks to provide investment returns that correspond to an index that is designed to reflect the performance of large- and mid-capitalization U.S. stocks with lower volatility than the broader market.

FDLO hunts from the 1,000 largest U.S. stocks for those with low volatility in returns and earnings. The fund uses a scoring system, based on three metrics: low volatility of returns, low earnings volatility and low beta (a measure of volatility compared to the market). FDLO has $53.94 million in total assets in its holdings, which are rebalanced twice annually.

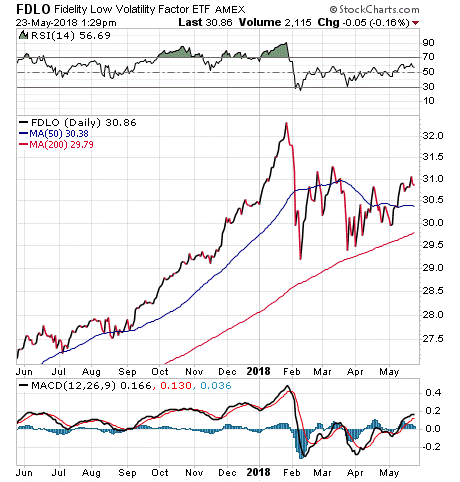

So far, 2018 has been a year of high volatility. As a result, low volatility ETFs are among the most popular “smart beta,” or factor-based, funds on the market. One of the cornerstones of factor investing is the low-volatility factor.

Factor investing is a strategy in which securities are chosen to achieve heightened returns. Two main types of factors, macroeconomic and style, can spur returns of stocks and bonds. Macroeconomic factors, such as credit, inflation and liquidity, are aimed at capturing broad risks across asset classes, while style factors, such as value and momentum, explain returns and risks within asset classes.

According to Zacks Research, the conventional wisdom of “higher risk, higher returns” does not always hold true in all cases. Low-volatility funds are designed to take advantage of this phenomenon and deliver higher risk-adjusted returns. Investors should not use low-volatility funds to hedge against sudden market breaks.

Over the last year, FDLO returned 15%. Year to date, FDLO has returned 2.18%. FDLO has an expense ratio of 0.29% and a distribution yield of 1.64%.

FDLO’s top five holdings are Apple (AAPL), 4.44%; Microsoft (MSFT), 3.59%; Alphabet (GOOGL), 3.07%; Berkshire Hathaway (BRK.B), 2.10%; and Johnson & Johnson (JNJ). In addition, FDLO is 25% invested in information technology, 15% in financials, 13% in health care, 12% in consumer discretionary and 10% in industrials.

For investors seeking a fund with low volatility, the Fidelity Low Volatility Factor ETF (FDLO) could be a good choice.