Ulta Beauty, Inc. (Nasdaq:ULTA), a seller of beauty products online and through a chain of stores in the United States, revealed financial blemishes during its May 31 first-quarter earnings call, which preceded a share-price pullback that offers potential capital appreciation.

The management team scaled back Ulta Beauty’s guidance amid reduced profit margins, despite reporting better-than-expected first-quarter 2018 results. The acknowledgement of thinning margins is an important factor for investors to weigh as shoppers increasingly go online to find and buy what they want.

Ulta Beauty, headquartered in Bolingbrook, Illinois, operates a chain of more than 1,000 beauty stores in the United States that sell cosmetics and skincare brands and men’s and women’s fragrances, along with haircare products. The company offers an interactive shopping experience by combining both mass market and prestige beauty products, but its growth has slowed along with the rest of the category amid increased competition, especially online.

The stock’s recent pullback now puts its share price below the $250 12-month target of Stifel, Nicolaus & Company’s retail analyst Mark Astrachan. His price target is based on 11 times estimated 2019 earnings before interest, taxes, depreciation and amortization (EBITDA).

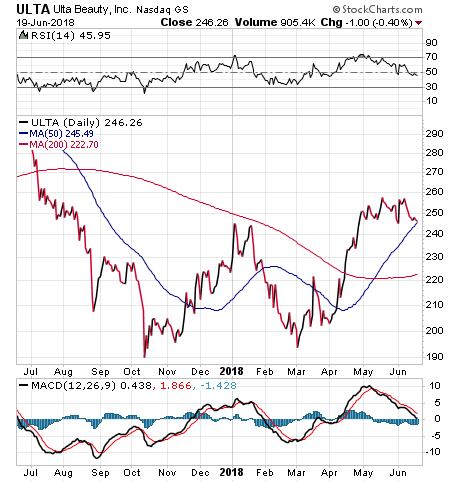

Chart courtesy of StockCharts.com

To outperform the $250 price target, Ulta Beauty would need to deliver greater-than-projected store expansion and opportunity, continued market share gains and profit margin expansion from supply chain improvements, Astrachan wrote in his May 31 research report. Downside risks to the stock include a slowdown in comparable store sales growth from a weaker cosmetics market, increased competition in the beauty business from online sellers such as Amazon.com, Inc. (Nasdaq: AMZN), profit margin pressure from promotional activity and lower-than-expected store openings, he added.

Ulta Beauty’s growth plan includes opening 100 new stores this year to build upon its existing 1,070 stores at the end of 2017. The company’s stores and website offer more than 20,000 products of both new and established brands. The loyalty of the company’s customers is shown by the fact that 90 percent of its revenues come from members of its Ultimate Rewards program. Indeed, loyal customers may be the key to Ulta Beauty’s sustained growth and survival in the face of online rivals.

Competition Reduces Sales Growth and Profit Margins

Ulta Beauty’s management is offering guidance of 6-8 percent comparable sales growth for 2018, down from 11 percent in 2017, with current consensus estimates from analysts of 7.4 percent this year. However, the management team still expects the company’s e-commerce growth to hit 40 percent. Management’s guidance indicates Ulta Beauty has a plan to spur growth beyond its brick-and-mortar stores.

The company’s two-year compound annual growth rate (CAGR) traffic for e-commerce and mobile reached 38 percent and 52 percent, respectively, compared to just 2.1 percent for retail. Stifel expressed concern about “potential cannibalization” of brick-and-mortar traffic, while company management stressed that its e-commerce sales thus far are largely incremental.

First-quarter e-commerce growth of 48 percent topped management’s outlook of 40 percent. The outperformance shows that Ulta Beauty’s management tries to provide realistic guidance, while allowing room to surprise on the positive side.

Stifel’s analysis also found:

- E-commerce and prestige brands are driving about 80 percent of comparable growth, while the rest of the company’s business seems to be weakening.

- Gross profit margins appear to be under pressure, as the strongest growth comes from lower-margin sales channels, including online.

- The company’s ramp-up of its Fresno distribution center will not be complete until the third quarter and not give a big second-quarter sales boost.

Investment guru Mike Turner has recommended Ulta Beauty profitably twice in the past year in his Quick Hit Trader advisory service. One trade led to a gain of 25.37% in just three months. Turner uses a proprietary trading system, based on fundamental and technical analysis, to analyze more than 6,000 stocks, exchange-traded funds (ETFs) and indexes in the market to recommend the three best investments each week.

Jim Woods, who writes the Successful Investing and Intelligence Report investment newsletters, is another stock picker who likes Ulta Beauty. Woods told me this week he is tracking the stock as a possible recommendation.

“ULTA has managed to carve out a kind of hands-on, try-on niche that Amazon and other online retailers simply can’t replicate,” Woods opined. “I mean, how is someone going to know what shade of eye shadow or what lipstick color looks best until they experiment? The ability to experiment with products with the help of a learned sales associate is the experience ULTA offers its loyal customers.”

Beauty truly is in the eye of the beholder and Ulta Beauty is no exception. For its loyal customers, the company offers a trusted place to shop for cosmetics, as well as an increasingly popular option for online purchases. Investors just need to be aware that the company has financial blemishes but at least does not seem to be trying to hide them.

![[happy investor up arrows]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_124509472.jpg)