Many investors actively seek out companies with high dividend yields because of several unique advantages, such as providing a source of steady income, offering reduced comparative risk, etc.

One example is the Fidelity International High Dividend ETF (FIDI), which is an exchange-traded fund (ETF) exclusively built to maximize gains from dividends. As a twist, however, FIDI holds a portfolio of 100 large- and mid-cap high-yielding stocks from developed markets that do not include the United States.

As a relatively new fund with an inception date of January 16, 2018, FIDI was designed by Fidelity Investments to cater to “an increased interest among Fidelity clients” who are seeking factor-based investments, as well as international exposure away from the United States.

The fund considers the following factors in selecting its equity holdings: dividend yield (70% weight), payout ratio (15%), and dividend growth (15%).

As a fairly new fund, FIDI has just $15.95 million in assets under management and an average daily trading volume of $180,000. Over its brief existence, FIDI has slid 8%. However, over the same period of time, the market has fared worse, falling 9.4%. The fund’s expense ratio of 0.39% is on the lower end, compared to other exchange-traded funds that focus on dividend-paying holdings. FIDI’s dividend payout is about 4%, which may well attract investors.

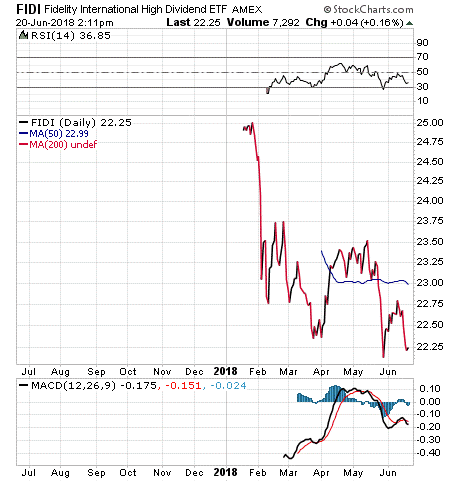

Chart courtesy of Stockcharts.com

FIDI’s top five holdings are Royal Dutch Shell PLC (RDSB), 3.27%; Vodafone Group PLC (VOD), 3.23%; Telstra Corporation Ltd (TLS), 3.14%; SSE PLC (SSE), 3.01%; and BT Group PLC (BT.A), 2.80%.

For investors seeking a dividend-paying fund with an international focus, Fidelity International High Dividend ETF (FIDI) could be worth your time to consider, especially after its recent pullback. As always, make sure to do your due diligence before making any investment decisions.

I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.