This week’s featured fund, the O’Shares FTSE Russell International Quality Dividend ETF (ONTL), reaches out to international companies in pursuit of dividend income.

ONTL is a multi-factored fund designed to reflect the performance of publicly listed, large-capitalization and mid-capitalization, dividend paying issuers outside of the United States that exhibit high quality, low volatility and high dividend yields. The fund caps its constituent weights to 5% with quarterly rebalances in order to maintain diversification. For this exposure, ONTL charges an expense ratio of 0.48%, which is in line with the segment average.

ONTL’s portfolio exhibits a bias towards European countries, due to the outstanding dividend stability that many European companies are known for. As of June 30, 2018, ONTL is 17.58% invested in the United Kingdom, 12.86% in Switzerland, 10.98% in France, 10.74% in Japan and 8.10% in Australia.

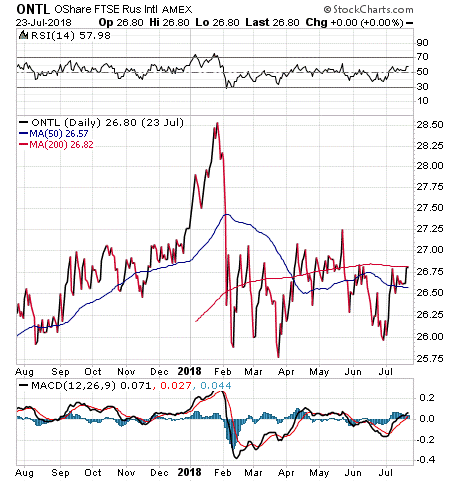

Year to date, ONTL is down 3.75%. This is correlated to the widespread poor performance of many international stock markets, which have come under pressure from slowed growth and political unrest. For example, The FTSE 100, which is an index that measures the 100 companies listed on the London Stock Exchange with the highest market capitalization, fell by 0.4% for the year. The Swiss Market Index (20 of the largest Swiss blue-chip stocks) is down 4.5% for the year and Japan’s market is down 3.7% year to date. These are some of the countries to which ONTL has the highest degree of exposure.

Since its inception on March 22, 2017, ONTL has return 8.81%. The fund offers a distribution yield of 3.05% and pays monthly. Management has advised investors that the fund’s combination of reduced volatility, high quality and strong dividend track records are geared to reward investors over the long term.

Top holdings in the fund are Nestle, 3.62%; Roche Holding, 3.26%; Novartis, 3.25%; GlaxoSmithKline, 2.40%; and Total S.A., 2.35%.

Because the fund’s objective is to seek out dividend income, it places a heavier weighting on sectors such as health care and real estate and much less on technology. A detailed breakdown of ONTL’s sector allocation is as follows: 16% in health care, 15% in industrials, 15% in consumer staples, 9% in consumer discretionary and 8% in real estate.

For investors who are looking for stable dividend income from overseas, make sure to do your due diligence on O’Shares FTSE Russell International Quality Dividend ETF (ONTL) before making any investments.

I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)