The O’Shares FTSE Europe Quality Dividend ETF (OEUR) offers a relatively low-risk, low-volatility way to invest in out-of-favor international markets.

OEUR is an exchange-traded fund (ETF) designed to reflect the performance of publicly listed, large- and mid-capitalization, dividend-paying issuers in Europe. To be considered for inclusion in the portfolio, targeted issuers must exhibit three main attributes: high quality, low volatility and high dividend yields.

While OEUR seeks out companies with solid dividend yields, the additional emphasis on quality gives the ETF a kind of safety net. For dividend funds, the quality factor often can mean eschewing the companies that currently pay the highest yields, since these are often less stable than those that have track records of long-term dividend payout and growth. As such, OEUR’s respectable 3.7% yield is built on solid ground, even if the payout could be higher.

Additionally, due to its concentration on European countries and minimal weighting in technology (less than 1%), OEUR is well out of the way of most trade or tariff-related volatility that may occur. OEUR’s top three European allocations are the United Kingdom, 28.7%; Switzerland, 18.7%; and France, 16.2%. Its top three sectors by allocation are Health Care, 19%; Consumer Goods, 18.1%; and Industrials, 15.4%.

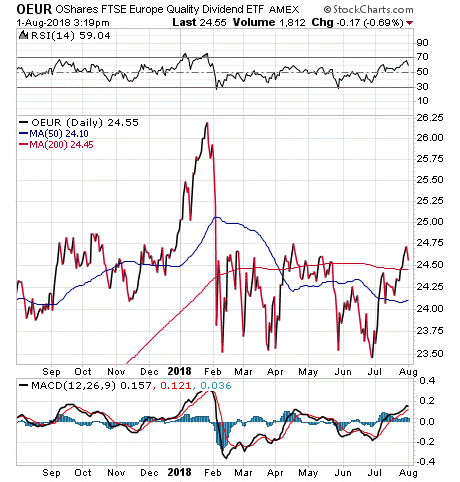

OEUR reached its all-time high of $26.90 on January 30, 2018, only to fall more than 10% in the week that followed. Since then, OEUR has traded in a pretty tight range of $23 to $24 per share. However, the fund’s share price rose above both its 50 and 200-day moving averages in July, as can be seen in the chart below:

Chart courtesy of Stockcharts.com

One point of concern to be aware of here is the low amount of outstanding shares and daily trading volume. According the fund’s website, OEUR only has 1.6 million shares outstanding and a volume of 5,500, which was a contributing factor in its addition to Seeking Alpha’s ETF Deathwatch List for June 2018, coming in at 22 out of 26 new ETFs. The fund’s expense ratio is a moderate 0.58%, its net assets total of $40 million. Plus, the fund pays dividends on a monthly basis, which could be attractive to income investors.

OEUR’s top 10 holdings comprise 33.1% of total assets. Some of the top holdings include Nestle, 5.16%; Roche Holdings (GENUS), 4.55%; and Novartis (REGD), 4.37%.

Investors interested in receiving a monthly dividend distribution through a low-volatility international fund may want to look into the O’Shares FTSE Europe Quality Dividend ETF (OEUR).