Tesla short selling and the company’s failure to detail funding sources for a $420 a share privatization plan proposed by its embattled CEO Elon Musk have led to large stock-price swings after the little-reported but potentially important hiring of Goldman Sachs (NYSE: GS) and buyout firm Silver Lake as financial advisors.

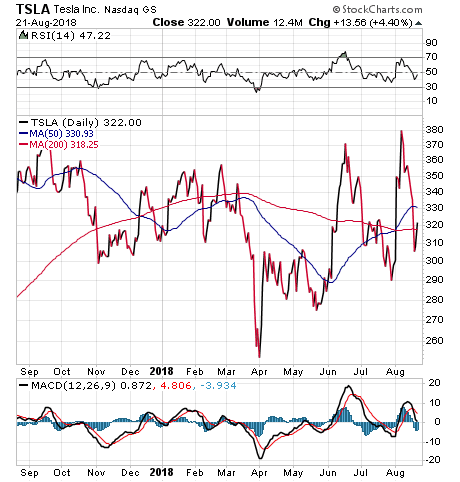

Shares of Tesla Inc. (NASDAQ:TSLA) closed up 4.3 percent on Tuesday, Aug. 21, after investment firm Morgan Stanley (NYSE:MS) moved its ranking of the auto company’s stock to “not rated” from “equal rated.” The change led to speculation among investors that Morgan Stanley may participate in raising funds for Tesla as a financial advisor, since white-shoe investment firm Goldman Sachs last week stopped coverage of the Silicon-based company and cited its new role in assisting the electric car maker.

The hiring of Goldman Sachs coincided with its auto analyst David Tamberrino, who previously had given at $210 price target on Tesla, announcing on Aug. 15 that the stock would be moved to “not rated.” As a financial advisor, Goldman Sachs is engaged in a matter that is “fundamental” to a reasonable analysis of its rating and price target for the stock, according to the company’s Americas Investment Review Committee.

Hilary Kramer, a Wall Street investment professional who sometimes recommends auto companies, expressed support for Tesla’s decision to hire Goldman Sachs.

“Tesla has the best adviser — not just on Wall Street — but in the entire world,” Kramer told me. “Hopefully, Goldman Sachs can achieve success in raising the funds for Tesla to go private. The key at this point is for action because the value of the bonds will continue to drop and the equity will be under severe pressure until confidence is restored in Tesla. At this point, the only way for confidence to be restored is for management support to be added to the C-Suite and for financing to be arranged in any number of different paradigms.”

Aside from potentially adding a chief operating officer or other C-Suite executive to help Musk, Tesla “desperately needs cash,” Kramer said.

Kramer recently recommended the sale of Ford Motor Co. (NYSE:F) in her Turbo Trader and Inner Circle advisory services.

Dr. Mark Skousen’s Forecasts & Strategies investment advisory service produced a 64.1% return in then-struggling Ford between December 2009 and January 2011, but he is steering clear of Tesla due to high risk as the company seeks to become profitable.

Also added to assist Tesla and its board of directors in taking next steps are legal advisors Wachtell, Lipton, Rosen & Katz and Munger, Tolles & Olson, Musk wrote in an Aug. 13 tweet. The shares of electric car company Tesla Inc. dropped 8.9 percent on Friday, Aug. 17, to mark its largest fall in two years.

JPMorgan Chase made news when it slashed its Tesla price target on Aug. 20 to $195 from $308, a 36.69 percent cut.

Tesla Short Selling Produces $1 Billion in Paper Gains on Aug. 17

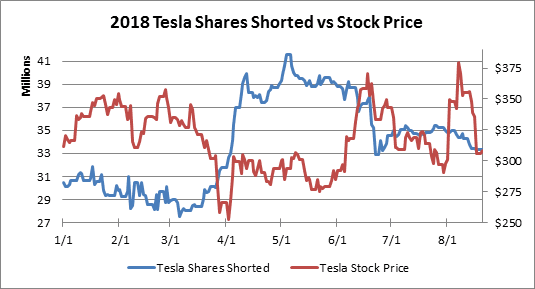

Tesla short sellers collectively watched their positions rise $1 billion on Friday, Aug. 17, after the publication of an interview by the New York Times in which Musk shared his personal struggles in leading Tesla among SpaceX and his other business ventures. Tesla’s stock plunged 9 percent to $305.50 that day.

Since Musk’s Aug. 7 tweet, short sellers are up $1.09 billion in mark-to-market profits, or 9.20%. The need for speculators to cover Tesla short selling positions has factored into the company’s volatile trading in recent weeks and months. Indeed, Tesla short selling trade interest is valued at $10.17 billion, according to S3 Partners, a financial technology company.

Short covering occurs when investors close out a short position by purchasing the same number of shares in Tesla that they sold short in a bet that the price of the stock would plunge. For instance, a Tesla trader may sell short 100 shares of the stock at $350 each but later cover the short position by buying back the shares at a much lower price, such as at $250. If a trader expects Tesla’s stock price to drop, he may opt to sell shares now and buy them back at a reduced price later to turn a profit.

Tesla shares shorted are 33.30 million shares, or 26.12% of its float, said Ihor Dusaniwsky, managing director and head of predictive analysis at S3 Partners.

Tesla shares shorted are up 2.9 million shares for the year, or 9.42%, but because its stock price is down, short interest is up just $796 million, or 8.40%, Dusaniwsky said.

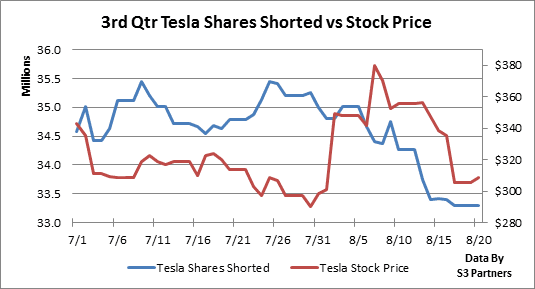

Tesla Short Selling Dips in Third Quarter

In the third quarter, Tesla short selling is down 1.3 million shares, or 3.7%, and dollar interest in short selling has fallen $1.59 billion, or 13.41%.

Since Musk’s controversial Aug. 7 tweet about taking the company private, the number of shares shorted has fallen by 1.4 million shares, or 4.0%, and the dollar short interest has slid $1.59 billion, or 13.38%, Dusaniwsky said.

On Monday, Aug. 20, Tesla had a volatile trading day, ending up $2.94 and the shorts finished with a down day, losing $99 million in mark-to-market losses, after having been up $575 million in mark-to-market profits at the day’s low of $288.20, Dusaniwsky calculated. A 0.79 percent uptick in Tesla’s Aug. 20 stock price added $99 million in mark-to-market losses to the shorts paper losses to boost their year-to-date mark-to-market loss to $611 million, or a fall of 3.20%, he added.

“Although there has a been a slow consistent decrease in shares shorted since the end of July, we have not seen significant net short selling or net short covering over the last week that would signify a ‘short squeeze,’ especially since Tesla’s stock price has been down over that time period,” Dusaniwsky said.

In addition, Friday, Aug. 17, saw short covering, while witnessing a slight increase in short selling Monday, Aug. 20, Dusaniwsky said.

Musk has not been able to resist using Twitter to take verbal shots at short sellers. Certain short sellers have filed lawsuits due to Musk’s tweets this month.

Chart courtesy of stockcharts.com

Tesla short selling is one of the many problems that Musk hopes to avoid by taking the company private. Tesla’s hiring of elite financial and law firms as advisers is the latest indication that Musk is seeking to explore his privatization plan zealously.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz.