Tesla debt financing poses a challenge early next year for the company’s investors. The recent actions of Chairman and CEO Elon Musk did not help matters any, as he appeared on a public podcast on Sept. 6 with comedian Joe Rogan while drinking whiskey and smoking marijuana.

Tesla Inc. (NASDAQ:TSLA) needs to return to the capital markets by the first half of 2019 to refinance at least a portion of its roughly $10 billion in debt amid pressure on the company to start turning a profit to help entice prospective financers. The importance of Tesla achieving its goal of becoming cash flow positive in the second half of 2018 is high due to the company’s net-debt position of $9.2 billion at the end of the second-quarter, rising from $8 billion at the end of the first quarter and $4.8 billion at the close of second-quarter 2017, according to investment firm Goldman Sachs.

Plus, Tesla has convertible debt maturing between this year and 2022 that includes $5.9 billion in recourse financing in which lenders may collect from the debtor, or the debtor’s assets in the case of a default. Tesla also has $1.6 billion in non-recourse financing due during the same period in which a lender is only entitled to repayment from the profits of a project that the borrowing is funding, not from the borrower’s other assets.

Convertible debt is a way to entice lenders to back a company such as Tesla that has strong potential in return for the financier to be able to exchange the debt for equity at a later date.

Tesla Debt Financing Is Affected by the Company’s Stock Price

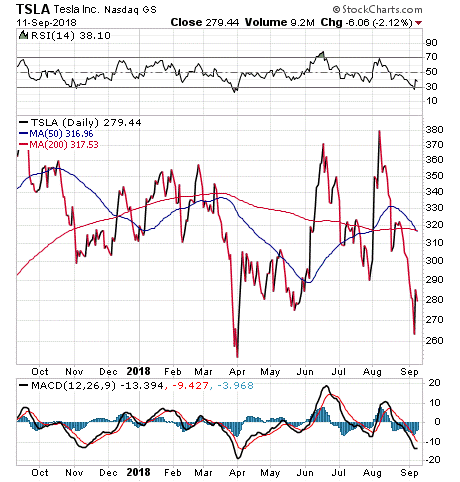

However, the conversion price from Tesla’s convertible debt is higher than the company’s current share price of $279.44 at the close of trading on Sept. 11. Despite Tesla’s management team seeking to avoid raising additional equity to fund its growth, the company’s net-debt levels likely will rise, depending on its cash flow.

“This could add incremental interest expense that weighs on cash generation and adds more risk,” said a Sept. 4 research note by Goldman Sachs’ analyst David Tamberrino, upon resuming coverage after suspending it on Aug. 15, when his firm became a Tesla “financial advisor” to help the auto maker explore going private. Tesla announced late on Friday, Aug. 24, that it had assessed its situation and planned to stay public, despite Musk’s continuing frustration with short sellers who seek to profit when the company’s stock price falls.

Goldman Sachs did not change its “sell” recommendation or raise its price target for Tesla shares from the $210 level it had before suspending coverage of the stock, but Nomura/Instinet automobile analyst Romit Shah slashed his price target on Tesla to $300 from $400 in a Sept. 11 research note. However, RW Baird affirmed his “outperform” rating for Tesla on Sept. 10 with a $411 price target.

Chart Courtesy of stockcharts.com

Tesla investors have watched the company’s share price trend down since Musk’s controversial and unexpected Aug. 7 tweet about considering privatization. Tesla’s share price has been volatile in recent months, as each Musk tweet, interview or statement receives media coverage and affects the stock’s price in one direction or another.

Tesla Debt Financing Could Be Affected by Management Changes

Dave Morton, Tesla’s chief accounting officer, departed the company on Sept. 4, only about one month after he joined it.

“Since I joined Tesla on Aug. 6, the level of public attention placed on the company, as well as the pace within the company, have exceeded my expectations,” Morton said in a statement included in an 8-K filing by Tesla on Sept. 7 with the Securities and Exchange Commission. “As a result, this caused me to reconsider my future. I want to be clear that I believe strongly in Tesla, its mission, and its future prospects, and I have no disagreements with Tesla’s leadership or its financial reporting.”

Tesla also announced a key promotion on Sept. 7 with the naming of Jerome Guillen as president, automotive, who will report directly to Musk. With Tesla seeking to rachet up its Model 3 production to become profitable in the third quarter, Guillen could be instrumental in overseeing all automotive operations and program management, as well as coordinating its automotive supply chain.

In addition, Chris Lister, who joined Tesla last year and helped to solve its production woes at its Gigafactory and boost Model 3 production, received a promotion on Sept. 7 to vice president, gigafactory operations. The elevation of production savvy leaders to assist Musk could prove crucial to help the company with its cash flow.

With Tesla expected to achieve a positive free cash flow (FCF) in the second half of 2018 due to a “large working capital benefit” from ramped up production of the electric car company’s Model 3, Golden Sachs forecasts the auto maker will end the year with about $3 billion in cash. However, the investment firm expects Tesla’s capital expenditures to resume growing in 2019, requiring the auto maker to obtain further financing in the first part of 2019.

Tesla “desperately needs cash,” said Hilary Kramer, a seasoned Wall Street professional who recently recommended the sale of Ford to subscribers of her Turbo Trader and Inner Circle advisory services.

The debt market has driven down the value of Tesla’s bonds. Specifically, $1.8 billion of Tesla bonds due in August 2025 sank to a record low on Sept. 7, trading for just 84 cents on the dollar, compared to 98 cents a year ago. The yield, which moves in the opposite direction of bond price, almost doubled to 8.6% during that span.

Tesla Debt Financing May Include Additional Convertible Securities

Tesla is going to have to “raise equity,” Kramer said.

“Debt would be embarrassingly expensive, perhaps 8% to 9%,” Kramer said. “My very rough guess would be a $2.5 billion offering, at a price of $225 a share for 11.1 million shares. It would dilute current shareholders by 6.5%. The way the market is going, he [Musk] better act fast.”

Another convertible debt offering also is possible, Kramer said.

“There is a lot of money dedicated to convertible hedging, long the bond and short the stock,” Kramer said. “This seems like a good bet. Tesla stays in business, but at a much lower market value. Financing could be more favorable.”

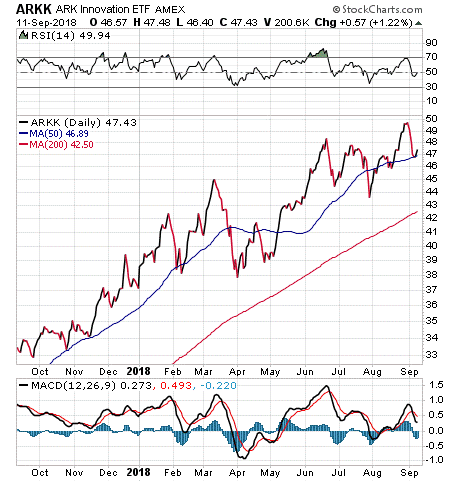

“I say Tesla is going to pot!” said Dr. Mark Skousen, whose Forecasts & Strategies investment advisory service earned a 64.1 percent return in Ford between December 2009 and January 2011 when the auto company struggled. However, he is not investing directly in Tesla or any auto company right now. Skousen is recommending ARK Innovation (NYSE: ARKK), which recently hit an all-time high and has soared more than 30 percent so far this year. He advised his Forecasts & Strategies subscribers to buy the fund on December 18, 2017, and Tesla currently is ARKK’s top holding.

Chart Courtesy of stockcharts.com

“I listened to the Joe Rogan podcast with Elon Musk, and I found him to be as brilliant as he’s ever been,” said Jim Woods, editor of Successful Investing and Intelligence Report. “If people are going to sell TSLA shares because of what he drank or smoked on a podcast, that only makes me more inclined to pick up the stock at a bargain.”

Tesla debt financing will gain increased attention in the months ahead as the company seeks to shore up its finances. The company’s management changes to strengthen its automotive production processes with key promotions could prove critical in helping it achieve its goal of producing 5,000 Model 3s a week to achieve profitability as soon as later this year.

_________________________________

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)