VanEck Vectors Natural Resources ETF (HAP) is a fund that tracks an index of companies involved in the production and distribution of commodities and commodity-related products.

HAP tracks companies in the following six sectors: Agriculture, Alternatives (Water & Alternative Energy), Base and Industrial Metals, Energy, Forest Products and Precious Metals. Within each sector, HAP weights companies by their market caps and the fund takes sizable positions in the oil and gas industry, as well as the metals and mining space, while still offering decent overall exposure.

For a sector breakdown, HAP is 34% invested in basic materials, 25% in oil and gas, 21% in consumer goods and 13% in industrials. HAP is considered by many analysts to be a good guard against inflation, thanks to the nature of commodities and the fund’s capabilities to often generate better returns than fixed-income investments.

HAP has an expense ratio of 0.50% and pays an annual dividend, with a dividend yield of 2.04%. The last dividend of $0.75 was paid was in December 2017.

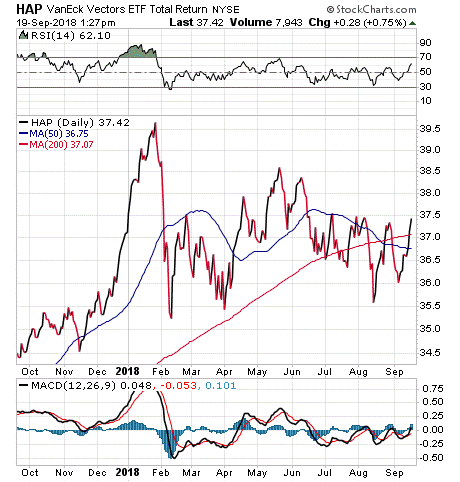

After rising 25% in 2016 and 17% in 2017, HAP started 2018 off on a strong note but experienced a sharp pullback in February before recovering and holding steady at around the $37 level. Year to date, HAP has returned down 0.32%. HAP has returned 10.34% over the last 12-month period.

As of Sept. 18, HAP is trading above both its 50-day and 200-day moving averages. Based on this and other technical indicators, several investment sites, such as investing.com, have rated HAP as a “buy.” However, at least one site also has indicated that HAP is in an overbought state, advising “caution” for investors who are considering going long in the fund.

Chart courtesy of Stockcharts.com

HAP’s total assets of $94 million are invested in nearly 300 different holdings. Top holdings are Deere & Co (DE), 8.34%; Nutrien Ltd (NTR), 6.54%; Archer-Daniels-Midland Co. (ADM), 5.05%; Tyson Foods Inc (TSN), 3.35%; and ExxonMobil Corp. (XOM), 3.08%.

An exposure breakdown by country shows that HAP is fairly diversified as well. Aside from having 47% of the fund’s assets invested in the United States, HAP is invested in many regions in the world. Currently, some of the fund’s other top exposures are: 12% of assets are invested in Canada, 5.5% in Australia, 5% in the United Kingdom, 4% in Japan and 3.5% in Norway.

Investors interested in a more diversified approach to commodities can do their diligence on VanEck Vectors Natural Resources ETF (HAP) to see whether it is a suitable fit for their portfolios.