Investors have been on a wild ride for the past four weeks. Literally one month ago, to the day, the Dow, S&P 500 and Nasdaq were trading at their respective all-time highs before enduring a brutal correction.

The sell-off levied heavy technical damage and damaged investor sentiment big time. What was a smooth ride for most of 2018 is no longer so smooth. The investing landscape has changed and investors need to respond accordingly, as rising volatility will make it harder to execute ideal entry and exit points.

Closing the books on the month of October couldn’t come soon enough for most investors. Roughly 90% of all stocks are trading well off the late September highs. Some high price-to-earnings (P/E) growth stocks are down as much as 40-50%. About the only asset classes that have worked have been going long in the dollar, utilities, a few health care companies and some other defensive plays like McDonald’s, Procter & Gamble and Phillip Morris. By and large, though, the sell-off inflicted heavy share price damage that is now under repair.

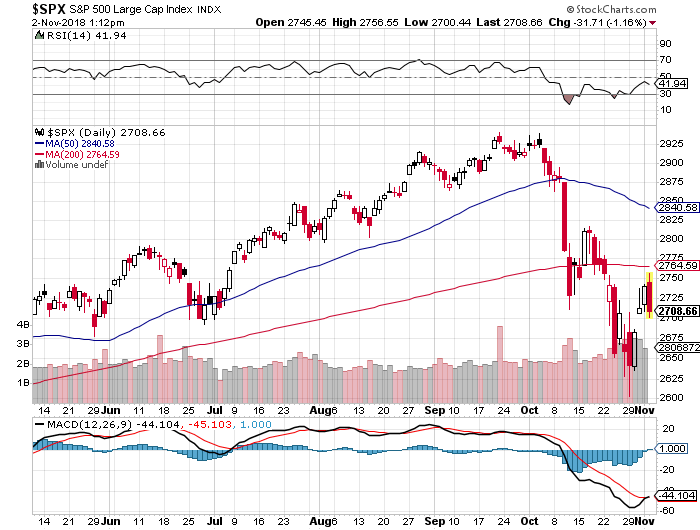

The oversold rally during this past week was inspired by the S&P 500 finding key support at the 2,600 level, coupled with some strong earnings reports and hints of fresh dialogue between the United States and China. A couple of Fed presidents also spoke out about how fiscal policy wasn’t a lock to raise rates if economic data softened over the next few weeks. Fear of rising rates has boosted the dollar back up to its 2018 highs.

Chart courtesy of StockCharts.com

With the 2-year Treasury Note yield at 2.89% and just off its high of 2.91%, the notion of a higher dollar and higher short-term rates is a definite headwind for the market. Until the S&P 500 clears its 200-day moving average, which sits overhead at 2,765, I think the market will chop back and forth at least through next week’s midterm elections to be held Tuesday. Assuming the Republicans hold onto the Senate, the market should attempt to add to the current rebound. November has proved to be the second-best month for stocks during the past five years. If President Trump gives any indication that trade talks can progress, the market will really warm up to that development.

So, with that said, the confluence of worries that engulfed investor sentiment in early October is getting addressed one by one. The PCE Price Index, which the Fed watches for inflation, came in at 2.2% versus a 2.3% estimate, and that reading should come down after WTI crude has fallen about $10 to $65/bbl. this week.

Additionally, the strong 3.5% GDP reading for the third quarter was attributed to inventory building by companies getting in front of the second round of tariffs, accounting for as much as 1.0-2.0% of the number. This implies the fourth-quarter read will be somewhere between 2.5-3.0%, giving the Fed room to consider waiting on a rate hike.

As to the ongoing concern over Italy’s beleaguered bond market, Standard & Poor’s this past week assigned Italy’s debt an investment grade. That rating takes into account the assumption the European Central Bank will backstop and support that market should it come under further distress. The updated rating alleviated, at least for now, widespread fear of systemic contagion surrounding emerging-market debt held by Italian banks.

The collection of these factors and well-entrenched caution about the slowing rate of global growth reflected in the slightly downward adjustment by the International Monetary Fund (IMF) to 3.4% from 3.6% in early October also gave the bearish camp another catalyst to take the market down. But now those concerns are lifting with stocks. And yet, I expect some consolidation after the S&P rallied up to its 200-day moving average that sits just overhead at 2,765, approaching near-term overhead resistance.

So, it’s hugely important to understand where new market leadership will emerge for not only the year-end but going into 2019. There is technical damage galore in many of the most coveted tech stocks such as Amazon.com (NASDAQ:AMZN), Alphabet (GOOGL), Nvidia (NASDAQ: NVDA), Facebook (NASDAQ:FB), Netflix (NASDAQ:NFLX) and Micron Technology (NASDAQ:MU), and they have all sliced down through their respective 200-day moving averages. Apple’s disappointing quarter only added more uncertainty to the big-cap tech risk-on trade that has led most of 2018.

While the aforementioned stocks are now in the technical doghouse, there is a short list of super-high-quality blue-chip tech stocks that will, in my view, drive the tech sector as money flows out of the prior leaders and into the new frontrunners. Investors don’t have to unload their technology exposure. But going forward, the big tech exchange-traded funds (ETFs) that own the FAANG stocks in a big way will likely underperform. On the flip side, shares of Adobe Systems (NASDAQ:ADBE), Microsoft (NASDAQ:MSFT), Salesforce.com (NYSE:CRM), Autodesk (NASDAQ: ADSK), Intuit (NASDAQ:INTU), Cisco Systems (NASDAQ: CSCO), Xilinx (NASDAQ: XLNX), Atlassian (NASDAQ:TEAM ) and NetApp (NASDAQ:NTAP) are poised to lead the market higher. One also could include the financial technology stocks of Visa (NYSE:V), MasterCard (NYSE:MA), PayPal (NASDAQ:PYPL) and WorldPay (NYSE:WP) within this new elite group.

My Hi-Tech Trader weekly advisory harnesses the power of artificial intelligence to select the crème-de-la-crème tech stocks that are fundamentally and technically best positioned to trade higher within the next 22 trading days. I’m currently recommending four of these stocks, along with corresponding call options. Once we’re past this week’s midterm elections, it should be up and away for my current trading picks. To get in on these trades before the post-election rally begins, click here and get signed up right away. We’re entering the best time of the year to be long in the market and especially the right tech stocks, but only at the right prices. Put the power of artificial intelligence (AI) into your trading portfolio today and get long in Hi-Tech Trader, right here, right now!