The ProShares Russell 2000 Dividend Growers ETF (SMDV) tracks an index of U.S. small-cap stocks with a 10-year record of increasing dividends.

The stocks are equally weighted in the fund, which seeks companies that are growing their dividends. The fund can contain as few as 40 stocks, but it strives to spread its exposure across all market sectors.

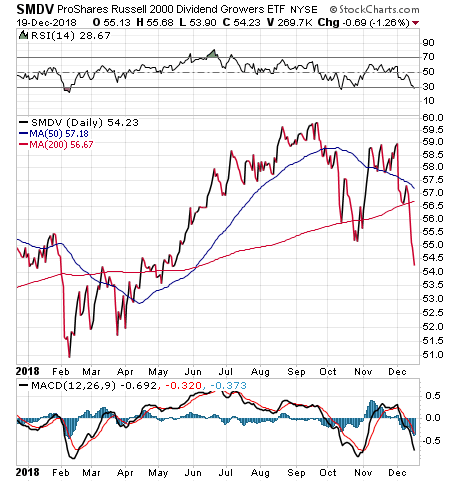

SMDV rose 2.7% in 2017 and is up 8.46% year-to-date in 2018. In addition, SMDV aims for strong total returns via a concentrated basket of small-cap stocks, each with a long history of increasing dividends.

The investment thesis is that small stocks with a proven record of increasing dividends deliver stable growth. The fund culls only about 50 names from a broad 2,000-stock universe, which indicates how few make the cut. SMDV competes most directly with WisdomTree’s DGRS, but strictly only invests in stocks with growing dividends, while DGRS holds dividend-paying stocks with quality and growth traits.

SMDV is the only ETF that tracks the Russell 2000 Dividend Growth Index. The fund also offers historical outperformance of dividend growers, the longest available records of dividend growth and is a part of the largest collection of dividend-growing exchange-traded funds (ETFs).

The top SMDV sectors include utilities, industrials, financial services, consumer defensive and basic materials. Among the funds top 10 holdings, 19.73% are in Atrion Corporation (ATRI), Tootsie Roll Industries, Inc. (TR), Middlesex Water Company (MSEX), Lancaster Colony Corp. (LANC), California Water Service Group (CWT), Black Hills Corp. (BKH), Ensign Group, Inc. (NGSG), Lindsay Corporation (LNN), ALLETE, Inc. (ALE) and NorthWestern Corp. (NWE).

SMDV currently has $443.5 million in net assets, a 1.82% yield and an average 0.14% spread, which is the difference between the bid and asking prices of a security. The fund also has an expense ratio of 0.40%, so it is relatively cheap to hold in comparison to other exchange-traded funds.

In short, the fund targets a narrow slice of the small-cap market — currently with a huge bias toward utilities — rather than broad coverage of the entire small-cap space. If you are interested in Russell 2000 equities that consistently pay rising dividends, consider SMDV. However, its liquidity is weak. As a result, investors should, as always, exercise their own due diligence to decide whether or not SMDV is a worthwhile investment.

I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.