“Fiat money and fiduciary credit are the pillar and post of our age of inflation.” — Hans F. Sennholz

“The establishment of central banking removes the checks of bank credit expansion and puts the inflationary engine into operation.” — Murray N. Rothbard

When the Federal Reserve was created in December 1913, it had two purposes: (1) To defend the gold standard and the dollar against inflation, and (2) To be a lender of last resort during a banking crisis.

It turned out that in the first 30 years of the Fed, it kept its promise more with the #1 goal than the #2 goal. During the economic collapse of 1929-32, the Fed failed miserably to be a lender of last resort. It refused to bail out the Bank of the United States and allowed it to go bankrupt on December 15, 1930, which Milton Friedman calls “a day of economic infamy.” Afterwards, thousands of U.S. banks failed. Deflation and depression were the consequences.

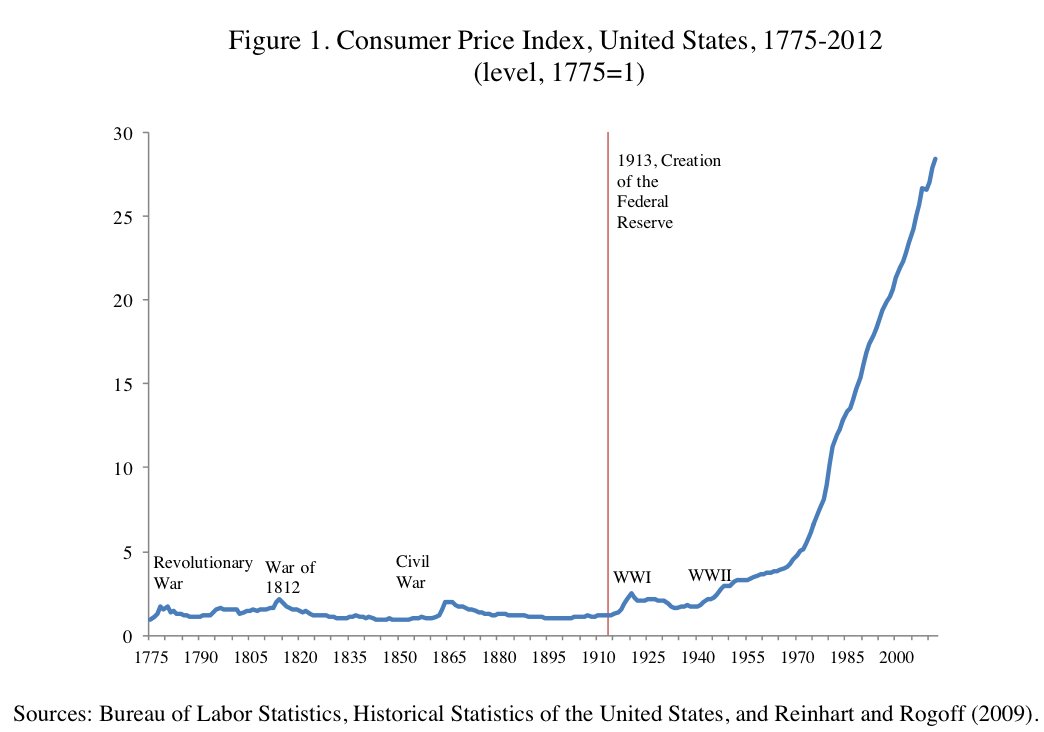

In 2009, Harvard economists Carmen Reinhart and Ken Rogoff published a paper with a dramatic graph showing consumer price inflation from 1775 to 2012. See the graph below:

What’s remarkable about this inflation graph is that until the end of World War II in 1945, war brought about temporary inflation, but after each war, deflation set in and prices fell.

In this graph, a line is drawn at 1913, when the Fed was created. But it’s clear that the Fed was not an engine of inflation for the first 30 years of its existence. It was only after World War II that inflation took off and never looked back.

What caused inflation to become a permanent part of American society?

Not the Fed. It instead was a new model adopted by the Fed, policy-makers and academia after World War II — Keynesian economics! It was Keynes who advocated that after war, the government should continue to inflate. Keynes convinced everyone in government, academia and the corporate boardrooms that a little inflation was good. Deficit spending and easy-money policies became common after the war, especially in the face of a recession. It was, as economists James Buchanan and Richard Wagner called it, “Democracy in Deficit.”

The result has been a little or a lot of inflation, and seldom deflation.

Gold as a Hedge Against Inflation

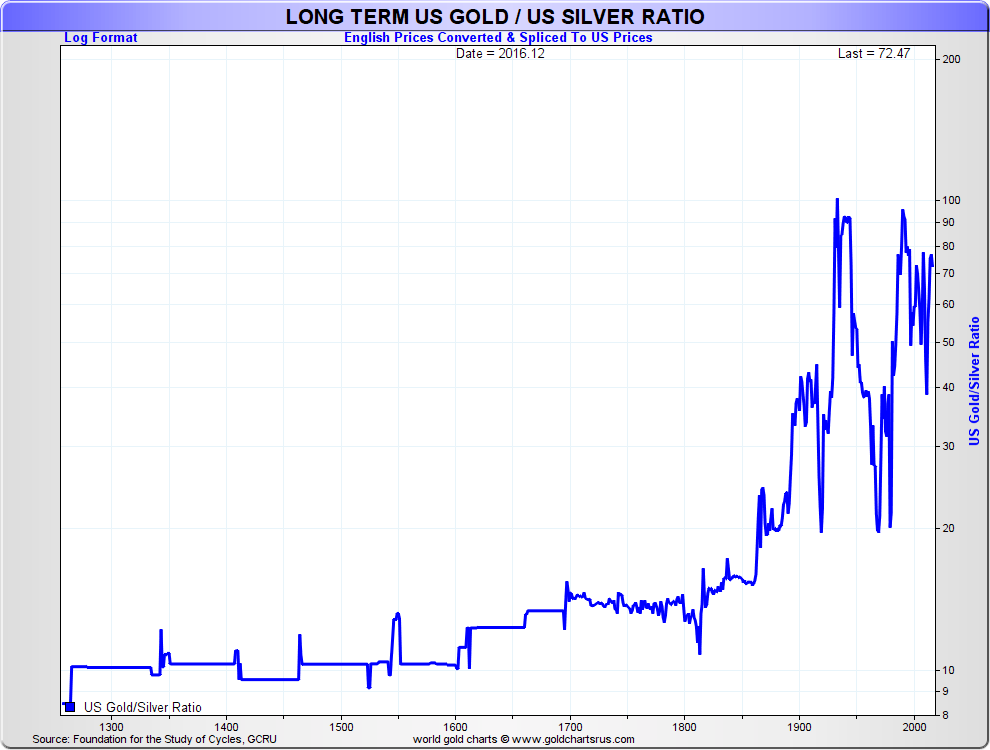

That’s why gold — the ultimate inflation hedge — is in a long-term upward secular trend since we went off the gold standard in 1971.

The downward cycle in gold appears to be over. We’ve added a gold position to our model portfolio in Forecasts & Strategies.

I expect 2019 to be a bit like the Wild West: dependent on the wily tweets of President Trump, gridlock in Washington, the never-ending trading war and the Fed threatening to raise rates again.

Introducing my ‘2019 Trade of the Year’

Join me online on Thursday, Jan. 10th at 2 pm EST as I share my 2019 Trade of the Year recommendation. Over the last 10 years, the best-performing stock of the year has led to an average gain of 2,265%. So I can’t wait to give you my #1 prediction, along with the chance to make 3X your money in the next 12 months. Click here to register for my 2019 Trade of the Year profit summit (online attendance is 100% free).

Good investing, AEIOU,

![]()

Mark Skousen

You Blew It!

NY Congresswoman Alexandria Ocasio-Cortez: The Dangerous New Face of Socialism

“I believe that every American should have stable, dignified housing; health care; education — that the most, very basic needs to sustain modern life should be guaranteed in a moral society.” — Alexandria Ocasio-Cortez.

Alexandria Ocasio-Cortez is the new congresswoman from New York who calls herself a “socialist democrat.” Like Bernie Sanders, she is popular for demanding a minimum standard of living for all Americans.

It reminds me of the difference between a Christian and a Socialist:

A Christian says to his neighbor, “All I have is yours.”

A Socialist says to his neighbor, “All that you have is mine.”

The first is voluntary; the other is force.

It is one thing to voluntarily engage in charity for poor people to help them overcome their desperate condition. It is quite another to force someone to pay for the needs of others.

Making food, housing, medical care and education a “right” of the “have nots” also means taking away the freedom of the “haves” to give or not.

It also destroys the incentives of the “have nots” to work, save and be good citizens.

Socialism is no way to build a civil society. Persuasion is better than force: http://mskousen.com/articles/politics-and-liberty/persuasion-vs-force-by-mark-skousen/.

Adam Smith, the founder of modern economics, said it best in the “Wealth of Nations” in 1776: “For though management and persuasion are always the easiest and the safest instruments of government, as force and violence are the worst and the most dangerous, yet such, it seems, is the natural insolence of man, that he almost always disdains to use the good instrument, except when he cannot or dare not use the bad one.”