Delta Air Lines’ stock price could be posed to gain lift if current financial headwinds ease from a slowing economy, the federal government shutdown and reduced fuel costs.

Airline stocks have been underperformers during the past couple of years and Delta Air Lines’ stock price (NYSE:DAL) has dropped during that time, too, even though it is continuing to post profits. The market appears to be focused on seeing additional growth before it rewards airline stocks and the wait could last a while longer before an upturn in their share prices occurs.

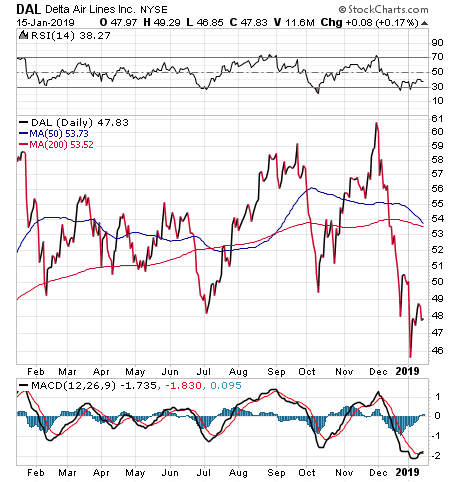

The prospects of Atlanta-based Delta Air Lines’ stock price taking off again should improve in the near term if the federal government shutdown ends soon and fuel prices dip, as some analysts expect in the months ahead. Delta Air Lines’ stock price rose slightly to $47.83, up 8 cents, or 0.17 percent, on Jan. 15 after its fourth-quarter earnings announcement early that morning seemed to appease the market. The company beat analysts’ earnings estimates slightly. The Jan. 15 share-price gain marked an improvement from the previous day, when its share price slipped 81 cents, or 1.67 percent, to close at $47.75.

Chart Courtesy of stockcharts.com

The airline reported fourth-quarter adjusted earnings per share (EPS) of $1.30, compared to FactSet consensus analysts’ estimates of $1.28. The company also reported Q4 revenues of $10.74 billion, versus FactSet consensus estimates of $10.72 billion.

However, Delta Air Lines’ management provided first-quarter EPS guidance between 70-90 cents that fell short of FactSet consensus estimates of 93 cents. For full-year 2019 EPS, management said it “remains confident” about producing $6.00-$7.00 vs. FactSet’s consensus estimate of $6.68. The airline’s management also offered pre-tax 1Q profit margin guidance of 6.5-8.5 percent.

Delta Air Lines reported respectable fourth-quarter 2018 Generally Accepted Accounting Principles (GAAP) pre-tax income of $1.3 billion, net income of $1.0 billion and earnings per diluted share of $1.49. Its full-year 2018 GAAP pre-tax income totaled $5.2 billion with earnings per diluted share of $5.67 and $1.3 billion in profit sharing for Delta employees. Full-year 2018 GAAP operating cash flow of $7.0 billion helped the airline strengthen its investment-grade balance sheet and fund $2.5 billion in dividends and share repurchases. DAL currently offers an enticing forward dividend yield of 2.87 percent to pay shareholders to stay patient until its stock price rebounds.

Delta Air Lines’ Stock Price Could be Aided by Sustained Revenue Growth

Despite concerns by certain analysts about the growth outlook for Delta Air Lines and its rivals, the company’s adjusted pre-tax income for Q4 2018 hit $1.2 billion, driven by over $700 million of revenue growth to let the company fully cover a $508 million increase in adjusted fuel expenses and produce an 11 percent adjusted pre-tax margin. Adjusted earnings per share soared 42 percent year over year to $1.30.

For full-year 2018, adjusted pre-tax income reached $5.1 billion, a $137 million decrease compared to 2017, as the company overcame approximately 90 percent of its $2 billion increase in fuel expenses during 2018. Full-year adjusted earnings per share climbed to $5.65, up 19 percent compared to the prior year, as it benefited from tax reform and a 4 opercent drop in its shares after company stock repurchases.

“As we move into 2019, we expect to drive double-digit earnings growth through higher revenues, maintaining a cost trajectory below inflation and the modest benefit from lower fuel costs,” Ed Bastian, Delta Air Lines’ chief executive officer, said in a statement. “Margin expansion is a business imperative and we remain confident in our full-year earnings guidance of $6 to $7 per share.”

Delta Air Lines ended the year with an 11.6 percent pre-tax margin and a return on invested capital of 14.2 percent, Bastian said during his Jan. 15 earnings call with analysts.

Delta Air Lines’ Stock Price Overcomes Fuel Price Hikes

“Notably, our $5.1 billion in pre-tax income was only 3 percent below 2017, despite a 30 percent increase in our fuel expense,” Bastian said. “The last time we saw a 30 percent annual fuel increase was 2011 and that year earnings fell approximately 25 percent.”

After 8 percent revenue gains last year, management is assuming a modest reduction in global economic growth rates for 2019. As a result, it expects revenue growth of 5 percent in Q1 and a similar rate for full-year 2019, as management reported last month at its Investor Day.

Revenues to China grew 27 percent in the fourth quarter and management offered guidance for similar gains in Q1. Most importantly, Delta Air Lines officials said its domestic revenue, which accounts for approximately 70% of its total passenger revenue, still is doing well.

Delta Air Lines’ Share Price Is Vulnerable to Government Shutdown

However, the federal government shutdown is pressuring the airline’s business, its leaders said. On the revenue front, the airline is losing about $25 million per month in reduced work-related travel from government employees. Plus, with non-essential work at the Federal Aviation Administration (FAA) shut down, the airline’s start date for new Airbus 220 aircraft likely will be pushed back due to delays in the certification process. The delays also are hampering the airline from putting seven new aircraft deliveries into service and causing longer lines at airport security for its passengers.

Management said it mobilized Delta employees to perform nonessential aspects of the security process and is strongly encouraging elected officials to do their “very best” to resolve their differences and reopen the federal government fully as quickly as possible.

Despite a $2 billion headwind from increased fuel costs, Delta Air Lines generated double-digit-percentage margins, topped $5 billion in profits for the fourth year in a row and expects to deliver strong returns for its stakeholders in 2019. Management said demand is solid and the airline’s cost base should be stable enough to improve earnings and cash flows for its owners.

The airline’s adjusted operating revenue of $10.7 billion in Q4 improved 7.5 percent, or $747 million, versus the same quarter a year ago. Total unit revenues, excluding refinery sales, rose 3.2 percent during Q4, driven by leisure and corporate demand offsetting an approximately 0.5-point headwind from unfavorable foreign exchange rates.

Delta Air Lines’ Stock Price Is Supported by Rising Unit Revenue Growth Globally

Delta Air Lines reported positive unit revenue growth in all geographic entities for the full year to achieve a “record revenue premium” for the industry and double-digit-percentage revenue growth from premium products and non-ticket sources, said Glen Hauenstein, Delta’s president.

In 2018, Delta Air Lines returned to its long-term target of keeping non-fuel unit cost growth below 2 percent, with Q4 non-fuel unit costs falling 0.5 percent, said Paul Jacobson, Delta’s chief financial officer. He voiced “confidence” in the company limiting its non-fuel unit cost growth to 1 percent in 2019.

Delta has no problem with cash, since it generated $1.3 billion of adjusted operating cash flow and $45 million of free cash flow during the quarter. For the full year, the airline generated $6.9 billion of adjusted operating cash flow and $2.3 billion of free cash flow.

Delta Air Lines’ Stock Price Ultimately Should be Helped by Investments in New Aircraft

The company invested $4.7 billion into its business in 2018, including $1.3 billion in Q4. This move enabled delivery of 68 new aircraft in 2018, including five Airbus A350s and four Airbus A220s. The company’s ongoing fleet transformation is improving its cost efficiency.

Delta Air Lines’ shareholders benefitted from $325 million in Q4 share repurchases and $238 million in dividends. For the full year, Delta Air Lines returned $2.5 billion to shareholders through $1.6 billion of share repurchases and $909 million in dividends.

“The bull case here is really built on the premise that fuel prices are heading back to 2016 levels,” said Hilary Kramer, a seasoned Wall Street money manager who also leads the Value Authority, Turbo Trader and Inner Circle advisory services for individual investors. “Revenue growth is unlikely to turn a lot of heads, but consensus sees the net margin swelling from 8.5 percent last year to at least 9.6 percent. That doesn’t happen unless oil recedes to $46 a barrel and takes the companies’ fuel cost down to $1.90 a gallon.”

Delta Air Lines paid about $2.40 a gallon in the recent quarter, so it’s possible fuel prices could drop another 50 cents, Kramer said. However, she added such a decline would be unlikely without “significant global economic upheavals.”

Delta Air Lines’ Stock Price Gains May Be Limited by Modest Growth

Even in a perfect scenario for airline investors, top-end growth may be limited to 10 percent, Kramer said.

“That’s not a big return to compensate for the risk of fuel prices failing to cooperate,” Kramer said. “If I had to pick a carrier, I’d take something more dynamic like Alaska Air (NYSE:ALK), which is coming off a tough couple of years, is eager to expand fast and make shareholders happy.”

Bob Carlson, who heads the Retirement Watch advisory service, said the “full-service” airlines such as Delta finally seem to have “figured out” how to make money consistently.

“It isn’t pleasant for passengers,” Carlson said. “There’s less room in the standard seats, and there are many extra fees for services and items that used to be included in the airfare. But passengers seem to have accepted the new world of flying. Airline capacity has been at high levels consistently for several years.”

Delta Air Lines’ Stock Price May Suffer in a Recession

The airline industry still is vulnerable to recessions, but not as much as in the past, Carlson continued. Airlines now have multiple sources of revenue due to fees for checking bags, providing meals and offering other amenities that once were provided at no charge, he added.

In addition, airlines are “more flexible” in adapting to changes in demand better than in the past, Carlson said. Oil prices also can be a concern for airlines. Fuel typically is an airline’s largest expense.

“Airline stocks still are likely to rise and fall with expectations for economic growth, because most investors haven’t accepted that there are changes,” Carlson said. “Investors can profit from this by buying some airline stocks when investors become concerned about economic growth.”

Such concerns are starting to arise, according to recent economic data and consumer surveys from the University of Michigan, which found respondents expressing their “greatest concern” about job and income prospects.

“Airlines are one group you do not want to own in a recession; they just bleed cash,” Kramer said. “However, the stock is finding good support just under $46, so bottom fishers are willing to make the bet the economy is going to re-accelerate. If that happens, Delta and all airlines can do well from current prices.”

Delta Air Lines’ Stock Price Offers a Buying Opportunity

Joseph DeNardi, the airline analyst at Stifel Nicolaus, wrote in a Jan. 15 research note that Delta Airlines remains worth buying at its current price. He has a $95 target on the airline, which is about double its current share price.

Delta’s combination of “peer-leading operating margins,” an investment-grade balance sheet, structural advantages due to the location of its hubs and great labor flexibility make it the highest quality airline stock among the industry’s three biggest, DeNardi wrote. His valuation of the company includes $40 a share for its loyalty program and $55 a share for the core airline, based on 9x 2019 estimated earnings before interest, taxes, depreciation and amortization (EBITDA).

For investors seeking income from a dividend yield of almost 3 percent and the chance for capital appreciation in the months ahead, Delta Air Lines’ current valuation seems modest for its potential total return to shareholders. With technology stocks showing much more volatility in recent months, the purchase of a quality airline with short-term catalysts ahead may well be a ride worth taking for investors seeking portfolio diversification.

Paul Dykewicz, www.PaulDykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz.