Investors seeking exposure to foreign currencies may be interested in learning about the Vanguard Total International Bond ETF (BNDX).

This exchange-traded fund (ETF) offers broad exposure to investment-grade bonds that are denominated in foreign currencies and hedged against currency fluctuations for U.S. investors. Conservative investors may appreciate that a majority of the fund’s investments are in sovereign bonds with AA ratings or better.

BNDX limits the impact of non-U.S. currency fluctuations on performance through the use of non-deliverable forward contracts. Transparency remains a concern for investors because Vanguard only publishes holdings on a monthly basis. However, the fund still offers a low cost and is the largest, most liquid fund in its segment. A newer fund entrant, iShares Core International Aggregate Bond ETF (IAGG), tracks a very similar index.

The Vanguard fund’s top sectors include government, corporate bond, agency/quasi-agency, covered bond and supranational. Its five top holdings are in agency bond (0.65%), France 1.0% 25-MAY-2027 (0.6%), Japan (0.55%), France 0.0% 25-MAY-2021 (0.51%) and Italy (0.48%).

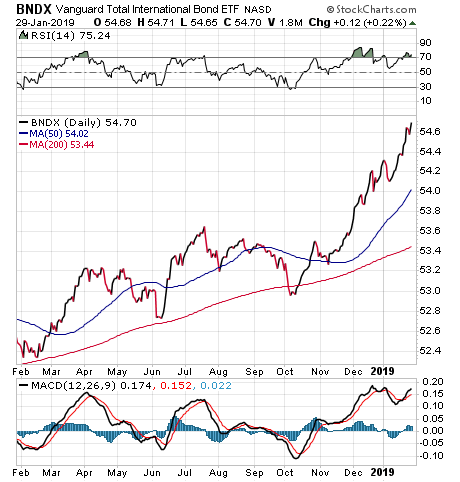

Courtesy of Stockcharts.com

Recently, shares of the Vanguard Total International Bond ETF crossed above its 200-day moving average, changing hands as high as $54.62 per share.

Net assets are over $110 billion. The fund has 5,434 bonds, a daily volume of $71.75 million and an average spread of 0.02%. The expense ratio is low at 0.11%, which means that it is relatively inexpensive to hold in comparison to other exchange-traded funds.

Investors who are looking to add international diversity to their portfolio should consider this fund. The exchange-traded fund (ETF) employs hedging strategies to protect against uncertainty in exchange rates. It provides a convenient way to get broad exposure to non-U.S. dollar denominated investment-grade bonds and is passively managed, using index sampling.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.