Despite a growth slowdown, the Intel Corporation’s (NASDAQ:INTC) stock might have the potential to return significant gains over the medium- and long-term time horizons.

During the trailing 12 months, the company has beaten Wall Street analysts’ earnings per share (EPS) consensus estimates every quarter. The company released its financial results for the fourth quarter and full-year 2018 on January 24, 2019. In the last quarter of the year, Intel’s revenues increased 9% to $1.8 billion over the $17.1 billion top line figure for the same period last year. While the company’s gross margin declined 3% from 63.2% last year to 60.2% for the most recent quarter, the company’s operating income of $6.2 billion was 15% above the $5.4 billion figure from one year earlier.

Due to tax implications for the previous year, the company booked a $0.15 loss per share in the last quarter of 2017, which is difficult to compare on an equitable basis to the current $1.12 EPS number. However, in non-GAAP terms, Intel increased its EPS 18.5% from $1.08 for the same quarter last year to a $1.28 amount for the most recent quarter.

Share Price

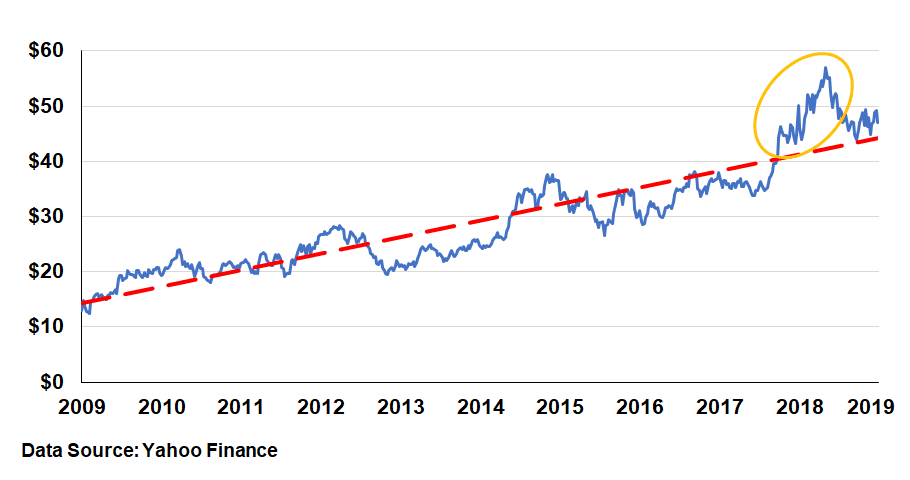

In the second half of 2018, the company’s share price experienced a sizeable decline relative to its performance in the first half of the year. Looking at that trend inside the frame of the trailing 12 months might make it seem like Intel’s share price is tumbling. However, expanding the time frame reveals a different picture.

As the graph below demonstrates, Intel’s share price surged nearly 70% from $33.75 in late June 2017 to its current 52-week high of $57.08 on June 1, 2018. After that spike, the share price declined and is currently a few percentage points lower than it was one year earlier. However, the recent decline represents just the share price’s return to its long-term trend. Over the past decade that trend saw a 360% share price increase, which corresponds to an average share price growth rate of nearly 5% per year.

Guidance for 2019

In its Jan. 24 earnings call, Intel also provided financial estimates for the first quarter and full-year 2019. The company anticipates revenues of $16 billion, an operating margin of 27% and a 7% EPS reduction to $0.81 versus the $0.87 result from the first quarter last year. While Intel’s projections also assume lower earnings per share for the entirety of 2019, the company expects better performance in the second half of the year and anticipates only a 3% EPS reduction for the entire fiscal year — $4.35 for 2019 versus the $4.48 that the company delivered in 2018. The full-year figures are based on a projected revenue increase of 1% to $71.5 billion for the year and a 32% operating margin.

The company lowered its revenue projections for the first quarter on an anticipated temporary slowdown in demand for chipsets designated for use in data center and online computing applications. While both segments are anticipated to grow, the orders for the first quarter might slow as the industry is working through its existing inventories of chipsets already in the supply chain.

Intel Corporation (NASDAQ:INTC)

Intel Corporation (INTC) designs and manufactures microprocessors that process system data and controls, along with other devices in the system, chipsets that send data between the microprocessor and various peripherals and accessories, as well as computer, networking and communications platforms worldwide. Additionally, Intel also develops and produces flash memory products primarily for use in solid-state drives, security software products, programmable semiconductors and related products for communications, data center, industrial, military and automotive market segments.

The share price began its current 12-month period with a decline of slightly more than 9%. After reversing direction in the second week of February, the share price advanced more than 25% to reach its 52-week high of $57.08 by June 1, 2018. However, the price gave back all those gains over the subsequent five months and bottomed out at $42.42 on October 24, 2018. Since the October low, the share price has gained nearly 10% and closed on January 29, 2019, at $46.54, which is nearly double the price from five years earlier.

Since embarking on its uptrend in late October 2018, the share price has tested the $50 resistance level twice. Investors should monitor the trend over the near term. A possible break above the $50 mark for a prolonged period could indicate an extended uptrend that would offer significant total returns on investment.

Summary

While Intel’s share price faced some headwinds and slowed its growth over the trailing 12 months, the company maintained strong dividend income distributions. Unlike many other companies that failed to deliver positive returns to its shareholders, Intel rewarded its shareholders with a combined total return of more than 7% for the trailing one-year period. Therefore, even a minor share price increase could take Intel’s total returns to levels similar to the company’s recent performances. Over the past three years, the company’s shareholders enjoyed a total return of more than 70%. Additionally, Intel’s shareholders more-than doubled their investments over the past five years with a total return rate of nearly 112%.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.