After recovering some of its share price losses from December 2018, Johnson & Johnson (NYSE:JNJ) offers potential for strong asset appreciation.

While Johnson & Johnson experienced share price volatility like other equities, the JNJ stock has been a good safe haven for investor’s long-term capital growth. The overall market pullback at the end of 2018 forced a share price decline even for Johnson & Johnson. Share prices of many equities declined in 2018 and many are still below their own level from one year earlier. However, Johnson & Johnson saw its price recover fully from a pullback in 2018 and surge ahead to reward the company’s shareholders with small capital gains over the trailing 12 months.

Additionally, Johnson & Johnson combined its capital gains with its dividend income distributions to continuously reward its shareholders with steady total returns over long time periods.

Financials

Johnson & Johnson presented its fourth-quarter financial results, as well as the full-year 2018 performance, on Jan 22, 2019. The company reported last quarter sales of $20.4 billion which corresponds to a 1% increase over the same period of last year. More than half of JNJ’s sales (52%) came from the U.S. domestic market, with the remaining 48% generated by international markets.

The company also reported $3 billion in corporate earnings, which translated to Earnings per Share (EPS) of $1.12. The adjusted earnings of $4.8 billion for the fourth-quarter are equivalent to a $1.97 adjusted EPS – a 13.2% improvement over previous year – and beat the $1.95 consensus figure anticipated by analysts. JNJ’s adjusted EPS figures beat market expectations in every quarter for 2018.

In addition to the positive results for the last quarter, Johnson & Johnson also rewarded its shareholders with good results for the entire year. Full-year sales of $20.4 billion were 6.7% above 2017 and the EPS for the entire year came in at $5.61. The adjusted EPS figure of $8.18 compared even better than the total sales increase and rose 12.1% versus the previous year. Additionally, Johnson & Johnson bolstered its share price by completing more than 80% of its $5 billion share repurchase program.

Johnson & Johnson also provided guidance for the current calendar year. The company estimates that total sales for 2018 will be in line with the 2018 figure of $81.6 billion on the low end or increase 1% to $82.4 billion on the high end. Additionally, the company is looking for slight improvements on the adjusted pre-tax operating margin, as well as lower levels of debt and higher anticipated interest income.

These projections translate to an anticipated adjusted EPS in the $8.50 to $8.65 range for the full-year 2019, which corresponds to EPS growth rates between 3.9% and 5.8% over 2018 actual results.

Johnson & Johnson (NYSE:JNJ)

Founded in 1885 and headquartered in New Brunswick, New Jersey, Johnson & Johnson researches, develops, manufactures and sells health care products worldwide. The company operates through three segments: Consumer, Pharmaceutical and Medical Devices. The Consumer segment offers baby care, oral care, women’s health products and beauty products under multiple brands, which include Johnson’s, Listerine, Clean & Clear, Stayfree, Carefree, Band-Aid, Neosporin, Neutrogena and more. Additionally, the company manufactures and distributes Tylenol, Sudafed, Benadryl, Zyrtec, Motrin IB, Pepcid and other over-the-counter medicines. Through its Pharmaceutical segment, the company offers various products in the areas of immunology, infectious diseases and vaccines, neuroscience, oncology, cardiovascular and metabolic diseases. The Medical Devices segment provides orthopedic, general surgery, sterilization and disinfection and electrophysiology products, as well as disposable contact lenses.

Share Price

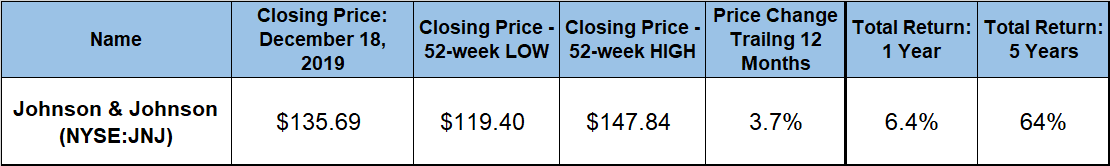

JNP’s share price entered the trailing 12-month period on a downward trend that began after the price reached its all-time high of 148.14 in late-January 2018. After declining steadily during the first half of the year, the share price reached its 52-week low of $119.40 on May 29, 2018. However, the price reversed direction at the end of May and rose nearly 24% before reaching its 52-week high of $147.84 on December 13, 2018. This 52-week peak was just $0.30, or 0.2%, short of the all-time high from January last year.

Unfortunately, JNJ’s share price declined at the end of the year like most other equities along with the overall markets. However, unlike most other equities that reached their 52-week lows on December 24, 2018, JNJ’s share price reversed direction on that date while still nearly 3% above its actual 52-week low from two weeks earlier.

Since that most recent trend reversal, JNJ’s share price recovered nearly 55% of its December losses to close on February 19, 2019 at $135.69. This closing price was 3.7% higher than one year earlier and more than 13.6% above the 52-week low from late May 2018. Additionally, the current closing price is nearly 50% higher than it was five years ago.

The company’s share price recovery over the past six months combined with the dividend income distributions to deliver a 6.4% total return over the past year. Long-term investors enjoyed even better performance with total returns of 44% and 64% over the past three and five years, respectively.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.