“Gross Output provides an important new perspective on the economy and a powerful new set of tools of analysis, one that is closer to the way many businesses see themselves.” — Former Bureau of Economic Analysis director Steve Landefeld

Is the U.S. economic boom coming to an end?

The federal government last month reported that real gross domestic product (GDP) growth, the “bottom line” of national income accounting, slowed from 4.2% in the second quarter to 3.4% in the third quarter. Many pundits said that the slowdown will continue and that a recession is inevitable by 2020.

But today’s economic numbers suggest otherwise. Business spending, in particular, is rising at a faster pace.

Today, the federal government (Bureau of Economic Analysis in the U.S. Commerce Department) released third-quarter estimates of gross output (GO), the “top line” in national income accounting. It measures spending at all stages of production, including the supply chain.

The results were eye-popping. Total spending on new goods and services (GO) topped $45 trillion for the first time.

Real GO climbed at an annualized rate of 4.6% in the third quarter to grow much faster than GDP. Business-to-business (B2B) spending rose even faster, 5.8% in real terms, much more than consumer spending, up 3.2%.

Business — Not Consumers — Drives the Economy

Note: Contrary to what the media says, consumer spending does not drive the economy, and does not represent two-thirds of the economy. It represents two-thirds of GDP, but since GDP leaves out the value of the supply chain, it grossly underestimates the role business plays in the economy. Using GO as a better, more accurate measure of total spending in the economy, the business sector (B2B spending) is almost twice the size as consumer spending. Plus, consumer spending is the effect, not the cause, of prosperity (Say’s law).

As economist Larry Kudlow states, “Though not one in a thousand recognizes it, it is business, not consumers, that is the heart of the economy. When businesses produce profitably, they create income-paying jobs and then consumers spend.”

Spending throughout the economy was broad based. Every sector in the third quarter grew except utilities and agriculture. Government spending rose 4.4% in real terms. (Does it ever go down?) For more details, go to www.grossoutput.com for our press release.

Faster GO Means No Recession in Sight for 2019

GO is a leading indicator of what GDP will do in the next quarter and beyond. As David Ranson, chief economist for the private forecasting firm HCWE & Co., states, “Movements in gross output serve as a leading indicator of movements in GDP.”

Whenever GO is growing faster than GDP, as it has been doing in 2018, it’s a positive sign that the economy is still robust and growing. That’s what we are seeing.

Fourth-quarter GDP will be released next week, Feb. 28. I expect real GDP to growth faster than 3.4%.

All this is very positive for the stock market. I continue to be fully invested in Forecasts & Strategies.

For the full press release on third-quarter GO, and for more information on GO, go to my website, www.grossoutput.com.

Good investing, AEIOU,

![]()

Mark Skousen

Upcoming Conferences

CFA Society Book Club, Thursday, Feb. 28, Biltmore Court, Los Angeles: I’ll speak about my book, “The Making of Modern Economics: The Lives and Ideas of the Great Economic Thinkers” (Routledge, 3rd ed.) Find out why John Mackey (CEO, Whole Foods Market) has read it three times! The title of my talk: “Who’s Winning the Battle of Ideas: Keynes, Marx or Adam Smith?” The event includes dinner, 5:30-7:30 pm. The price is only $15 for my subscribers to attend. To reserve a spot, email info@cfala.org. You also can register at https://www.cfala.org.

Guess Who’s Coming to FreedomFest?

It took me eight years to get him, and now he’s coming!

Your editor poses with Penn & Teller after their Vegas show in the “Red Monkey Room.”

Penn Jillette of “Penn & Teller” fame (the longest-running headliner show in Las Vegas), Emmy-award winner and cultural phenomenon! Penn Jillette & Raymond Teller are famous for revealing many of the secrets of magic, a “no no” among magicians. In his special FreedomFest talk, he will reveal the “sleight of hand” behind the dangerous new “socialist” agenda in America. His presentation is not to be missed!

He will speak on Friday evening, July 19, 2019, on “The Magic of Liberty.” After his talk, I’ll be interviewing him about his incredible career, followed by Q&A from the audience, and a private reception (photo, autograph) with attendees and speakers (limited to 100 attendees).

I’m excited. I’ve seen “Penn and Teller” a half dozen times in Vegas and “Fooled Us!” on cable TV. Penn Jillette probably is the most famous libertarian today.

Between Penn Jillette and Kevin O’Leary of “Shark Tank” fame, I think we have the makings of a record crowd. Watch our three- minute video about this year’s big show: https://vimeo.com/311525927. Password: eastwood. Sign up today and take advantage of the “early bird” discount, which ends March 29, by going to https://www.freedomfest.com/register-now/ or by calling 1-855-850-3733, ext. 202. Save $200 off the retail price. You pay only $495 per person/$795 per couple. Be a part of “the greatest libertarian show on earth,” including our three-day financial seminar sponsored again this year by Eagle Publishing and Forecasts & Strategies.

Has Barron’s Drunk the Purple Kool-Aid?

You Blew It!

By Mark Skousen

Editor, Forecasts & Strategies

“Radical changes in energy generation and consumption will be required to prevent the earth from becoming uninhabitable by the end of the century.” — Matthew C. Klein, Barron’s

I see the new economics editor, Matthew C. Klein, warns in the latest issue of Barron’s that the sea level will rise by six FEET by the end of the century if something isn’t done about global warming/pollution. He states, “Under those conditions, global sea levels could rise at least six feet as polar ice melts. Many coastal areas would need to be evacuated. Droughts, fires, and heat waves would depress global crop yields.”

Apparently, my subscribers living in Miami are a big trouble, based on those warnings. Never mind that the city is building new skyscrapers along Miami Beach.

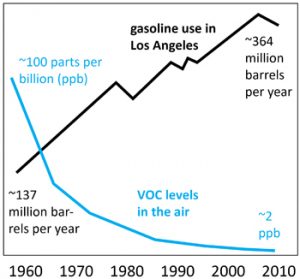

I have a more sobering view, as you probably can surmise from last week’s Skousen CAFÉ. Check out the chart on pollution in Los Angeles:

Barron’s should know better than to promote this kind of anti-growth agenda and hysteria. I say bring back Gene Epstein, the former economics editor of Barron’s.