After its share price took a significant hit in 2018, BlackRock, Inc. (NYSE:BLK) saw the price embark on a recovery path and maintain a steady uptrend since the beginning of the year.

However, the question whether this uptrend can continue remains as the firm works through its current mix of positive and negative developments. On one side, the firm missed revenue and earnings guidance for the last quarter of 2018, as well as fell marginally short on total revenues for the full-year 2018.

Additionally, while the share price continues to rise, corporate filings indicate that the company’s Chairman and CEO Laurence Fink sold $18.2 million of shares on Feb. 11. Including three additional transactions, Mr. Fink sold almost a total of 89,000 shares for nearly $37 million since January 22, 2019. However, on the positive side, there was no other major selling activity from the firm’s other top management.

While the company’s revenues lagged to prior year, the firm managed to reduce its expenses, which mitigated some of the revenue shortfalls and still delivered overall positive results for the full year. BlackRock published a positive outlook for 2019 and announced a $4 billion joint investment with KKR & Company, Inc. (NYSE:KKR) to acquire a 40% share of a newly-created business entity with the Abu Dhabi National Oil Company (ADNOC) that owns and leases nearly 500 miles of midstream pipeline infrastructure with crude oil throughput capacity of 13 million barrels per day.

Financials

After outperforming earnings per share (EPS) consensus estimates in the first three quarters of 2018, the company’s adjusted EPS of $6.08 for the fourth quarter came in 2% lower than in the same period last year and fell short of the $6.39 analysts’ estimates. The main drivers of the performance shortcoming in the previous quarter was a 5% decline in assets under management (AUM), as well as a 9% quarterly revenue shortfall compared to the same period last year.

However, unlike the fourth quarter, the company managed to advance some of the results for the full-year 2019. While falling 1.3% short of the $27.29 consensus expectation, BlackRock delivered a $26.93 full-year EPS, which marked a 20% improvement over the previous year.

Net income was down 13% to last year but still much better than the 60% net income decline in the last quarter of the year. However, BlackRock delivered a 4% growth in total revenue and operating income for the year. With a record performance of $81 billion in 2018, the iShares® segment accounted for three quarters of the company’s $124 billion net inflows for last year.

BlackRock returned a total of $3.6 billion to its shareholders in 2018 — $1.7 billion through share repurchases and $1.9 billion through dividend distributions. The company’s Board of Directors also approved a 5% dividend increase to its quarterly dividend payout for the current year.

BlackRock, Inc.(NYSE:BLK)

Based in New York City and founded in 1988, BlackRock, Inc. is a publicly owned investment management company. The firm primarily provides its services to institutional, intermediary and individual investors including pension plans, insurance companies, third-party mutual funds, endowments, public institutions, governments, foundations, charities and banks. Additionally, the company provides global risk management and advisory services.

The firm manages separate client-focused equity, fixed income and balanced portfolios, as well as launches and manages open-end and closed-end mutual funds, offshore funds, unit trusts and alternative investment vehicles including structured funds. Furthermore, the firm launches and manages mutual funds, exchange-traded funds (ETFs) and hedge funds, as well as invests in the public equity, fixed income, real estate, currency, commodity and alternative markets across the globe. The company uses fundamental and quantitative analysis with a focus on both bottom-up and top-down approaches to make its investments. In addition to its head office in Manhattan, the company operates approximately 70 additional offices in 30 countries.

Share Price

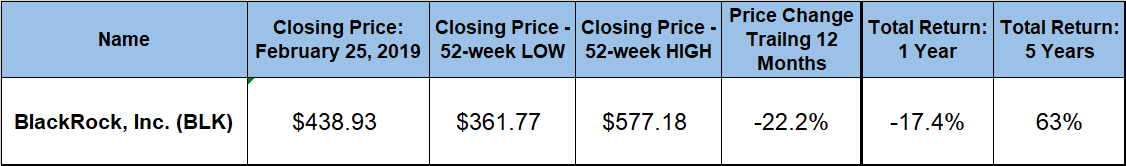

After nearly doubling between late 2015 and January 2018, BlackRock saw its share price reach its all-time high before reversing trend and embarking on nearly one-year-long pullback. Entering the trailing 12-month period on this downtrend, the share price reached its 52-week high of $577.18 on March 9, 2018. From that peak, the price gave back more than 37% of its value before it reached its 52-week low of $438.93 on December 24, 2018.

Like many other equities that bottomed out on Christmas Eve last year, BlackRock’s share price reversed direction and has been regaining some of its losses ever since then. Since bottoming out in late December 2018, Black Rock’s share price advanced to regain almost 36% of its total losses during 2018. On February 25, 2019, the share price closed at $438.93. While still significantly down against the 52-week high (-37%) and over the trailing 12 months (-22%), the February 25, closing price was 21.3% above its Christmas Eve low, as well as 41% higher than it was five years ago.

BlackRock continued to reward its shareholders with a steadily growing dividend income, which managed to offset more than one-fifth of the share price losses and reduced the total loss over the past year to 17.3%. However, long-term investors enjoyed a total return on their investment of nearly 63% over the past five years.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.