Tesla CEO Elon Musk’s tweets gained a stout defense based on securities and constitutional law from his attorneys’ March 11 response to a Feb. 25 complaint by the Securities and Exchange Commission (SEC) that he violated a September 2018 fraud settlement.

The defense of Tesla CEO Elon Musk’s tweets claimed he “dutifully complied” with the September federal court order and a policy adopted by the company to honor it, arguing his single Feb. 19 tweet that drew the SEC’s ire was “immaterial” to investors. Tesla Inc. (NASDAQ:TSLA) stock has shown a tendency to fall when the SEC has accused Musk of missteps and the agency’s latest claims against him were followed by another share-price drop.

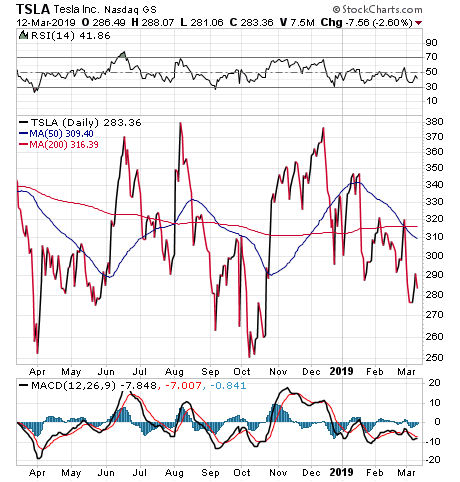

Tesla’s share price fell $7.56 a share, or 2.6 percent, on March 12, after Musk’s attorneys filed their response to the SEC’s complaint late the previous day. The stock price also could have been hurt by a March 12 research note from Morgan Stanley auto analyst Adam Jonas, who trimmed his price target on Tesla’s stock to $260 from $283 due to price cuts to as low as $35,000 for the auto maker’s Model 3.

Chart Courtesy of stockcharts.com.

Tesla CEO Elon Musk’s Tweets on Feb. 19 Showed ‘Diligence’

Musk’s Hueston Hennigan LLP legal team argued his Feb. 19 actions “demonstrated diligence” by checking with the company’s “disclosure counsel” after posting a 7:15 p.m. EST tweet, “Tesla made 0 cars in 2011, but will make around 500k in 2019” and, out of an abundance of caution, followed at 11:41 p.m. EST with a clarifying new one, “Meant to say annualized production rate at the end of 2019 probably around 500k, ie 10k cars/week. Deliveries for the year still estimated to be about 400k.” Tesla’s general counsel and disclosure counsel have been reviewing all of Musk’s tweets promptly in real time upon publication to “double-check compliance” with the company’s policy and to ensure any errors are caught and corrected quickly, according to his response.

“This is precisely the kind of diligence that one would expect from someone who is endeavoring to comply with the Order, and it is certainly not the type of ‘willful flouting’ of judicial authority that is often required to justify a contempt finding,” Musk’s attorneys argued.

Musk’s legal team also claimed the SEC’s “purported evidence” of lack of due diligence by Tesla’s CEO is “uncompelling” and falls short of meeting any burden of proof to warrant the judge to find him in contempt. The defense attorneys also asserted that critical comments Musk provided to the CBS 60 Minutes television program about the SEC prior to its Feb. 25 complaint against him suggests “retaliation and censorship.”

Tesla CEO Elon Musk’s Tweets More Than Halved Since Settlement

As evidence of Musk’s commitment to honoring the September 2018 settlement agreement with the SEC, he has significantly altered his Tesla-related communications with the public. Compared to the three months of May, June and July prior to his August 2018 tweets that the SEC found to be “false and misleading,” Musk responded to the Order by cutting his Tesla tweets nearly in half for November and December 2018 and January 2019.

In addition, Musk’s response argued that the SEC is seeking to “trample” his First Amendment rights and seize far broader powers than authorized by Congress. The SEC’s complaint and assertion that Musk must obtain pre-approval of any Tesla-related tweet is an “unconstitutional power grab,” his attorneys claimed.

“Musk never consented to and would not consent to such a sweeping gag order, and Tesla has not implemented such a policy,” his attorneys wrote.

Musk’s defense concluded by asking the U.S. District Court for the Southern District of New York to “discharge” its order to show cause why he should not be found in contempt of the September 2018 settlement.

Tesla CEO Elon Musk’s Tweets Do Not Solve Business Problems

Musk also revised his plans to close all of Tesla’s 378 stores, likely since existing lease agreements remain in force unless the company seeks Chapter 11 bankruptcy court protection. Instead, management closely evaluated every Tesla retail location and decided to keep “significantly more stores open” than previously announced.

“When we recently closed 10 percent of sales locations, we selected stores that didn’t invite the natural foot traffic our stores have always been designed for,” Musk explained in a press release. “These are stores in high visibility locations that were closed anyway, even if in-store sales made up our entire sales model. A few stores in high visibility locations will be reopened, but with a smaller Tesla crew.”

An additional 20 percent of the retail locations are under review and, depending on their effectiveness during the next few months, may be closed or kept open, Musk announced. As a result of keeping significantly more stores open, Tesla will need to raise vehicle prices by an average of 3 percent worldwide to shore up its finances, he added.

Tesla CEO Elon Musk Tweets Cannot Prevent Cost Cutting

The previously planned cost savings only will yield half the intended amount by keeping more than half the company’s stores open, so the remainder of the financial shortfall will need to be bridged by increased sales revenues, Musk explained.

“Potential Tesla owners will have a week to place their order before prices rise, so current prices are valid until March 18,” Musk stated. “There will be no price increase to the $35,000 Model 3. The price increases will only apply to the more expensive variants of Model 3, as well as the Model S and X.”

Musk clarified that sales worldwide will be done solely online and that Tesla customers entering the stores will be shown how to order the company’s vehicles on their smartphones within just a few minutes. He added there will be no change to the company’s previously announced policy to allow returning a vehicle within the first 1,000 miles or seven days.

Tesla CEO Elon Musk Tweets Did Not Stop Debt Financing with Chinese

Tesla also helped itself financially by amending a credit agreement with a syndicate of lenders in China for an unsecured 12-month term debt facility to build the company’s Gigafactory in Shanghai. The revised agreement increased the lender commitments to $2.425 billion, up by $500 million, and will permit Tesla to obtain $200 million in additional commitments.

Plus, the vast majority of that financing will be extended to 2023 to give Tesla additional time to repay the loans, according to an 8-K filed by the company with the SEC.

“The recent policy changes and the new credit facility in China are positive moves for Tesla,” said Bob Carlson, who leads the Retirement Watch advisory service. “But it’s disturbing that a company could reverse such major strategic moves so soon after announcing them. The company needs experienced managers to take over operations while Elon Musk is bumped up to a less active role in daily operations. Until that happens, Tesla is a speculation and investors should expect continued controversy and volatility.”

Tesla CEO Elon Musk Tweets Do Not Ensure Financial Success

“Tesla says paying off $920 million in bonds with cash instead of stock on March 1 was all part of the plan, but I can’t help but suspect Elon Musk was looking forward to covering half that obligation with stock.,” said Hilary Kramer, a Wall Street professional who leads the Value Authority, GameChangers, Turbo Trader and Inner Circle advisory services for individual investors. “There’s definitely a hint of a squeeze as Model 3 production ramps up. In the meantime, expanding the company’s Chinese line of credit should provide all the cash it needs to build its factory there.

“The real question is where Tesla goes from there. Will demand for the Model 3 deliver the efficiencies of scale and the margins Musk promised? He seems to think the low-end car will be more profitable than the luxury models that have taken the company where it is today. Maybe that will ultimately be the case, but how long will that take? The company is carrying $10 billion in debt now and another $1.3 billion in convertible bonds mature in 2021. That’s going to blow a big hole in Tesla’s remaining cash position.

“At the end of the day, do the numbers line up? In theory, the rewards for changing global transportation are huge, but the risk Tesla shareholders take on in the meantime is also on the high side. It’s still a gamble. Team Tesla is betting on Musk. The SEC can take that away with one ruling.”

The multi-pronged legal defense that Musk’s attorneys presented in their March 11 response on his behalf could a provide a critical buffer against the SEC if the judge rules in his favor. But the risk of further Musk missteps or an unfavorable decision by the court could hurt his chances of leading Tesla to financial success in the years ahead.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. Follow Paul on Twitter @PaulDykewicz.