The genomics industry currently is working hard to develop treatments for Tay-Sachs disease, cystic fibrosis and other genetic scourges that still remain outside the scope of modern medicine to cure.

As this field of science continues to grow, investors might want to take note of the ARK Genomic Revolution ETF (ARKG), a multi-sector exchange-traded fund that is designed to give investors exposure to companies that are involved with the genomics industry.

While this ETF is theoretically identifying companies located around the world, ARKG currently only holds assets in companies that come from three countries: The United States (96.29%), France (3.52%) and Israel (0.20%).

Some of this fund’s top holdings include Invitate Corp. (NYSE:NVTA), Illumina, Inc. (NASDAQ:ILMN), Intellia Therapeutics, Inc. (NASDAQ:NTLA), Editas Medicine, Inc. (NASDAQ:EDIT), Veracyte Inc. (NASDAQ:VCYT), Medidata Solutions, Inc. (NASDAQ:MDSO), Crispr Therapeutics AG (NASDAQ:CRSP) and NanoString Technology (NASDAQ:NSTG)+.

The ETF’s top sectors are biotechnology (63.27%), advanced medical equipment (9.20%), medical equipment, supplies and distribution (7.77%), IT services and consulting (4.96%), pharmaceuticals (3.98%) and semiconductors (3.26%).

The fund currently has $379.76 million in assets under management and has a $3.72 million average daily volume of traded shares. ARKG also has an expense ratio of 0.75%, so it is more expensive to hold in comparison to other exchange-traded funds.

In short, while ARKG does have several advantages over some of its peer funds, its risks and costs are not zero. Furthermore, it would be wise to mention that the fund’s performance has been lackluster since its inception, even though the sector it is supposed to be following is still quite lively. Its liquidity is also quite thin, and it often has a very wide spread when compared to other ETFs in the same sector.

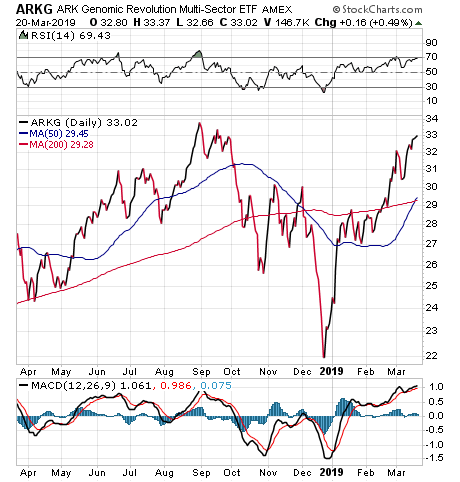

Chart courtesy of StockCharts.com

As the preceding chart shows, the fund has been on an upward trend so far this year. As always, interested investors should do their due diligence and decide whether the fund is suitable for their portfolios.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)