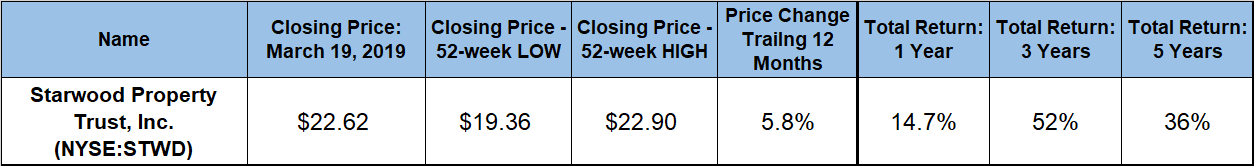

While experiencing increased volatility and a growth rate slowdown over the past few years, Starwood Property Trust, Inc. (NYSE:STWD) still managed to deliver its shareholders capital gains of nearly 6% and double-digit percentage returns over the past 12 months.

Despite a moderate level of volatility, the trust’s share price rose more than 50% between the 2009 initial public offering and its all-time high in April 2015. However, after peaking in early 2015, the trust’s share price lost nearly one-third of its value before reversing trend at its five-year low in February 2016. While the share price recovered a large portion of those losses quickly, the share price could have more room to grow.

The current share price has almost 8% room on the upside before reaching the analysts’ current average target price of $24.31. Additionally, the analysts’ average recommendation is currently a “Buy”, with six out of the eight analysts currently covering the stock holding that same recommendation. The two remaining recommendations are one “Strong Buy” and one “Hold.”

While not immune from the overall market correction in late December 2018, Starwood Property Trust’s share price recovered quickly. The December pullback drove the share price’s 50-day moving average (MA) below the 200-day MA before the end of 2018. However, after declining for nearly 60 days, the 50-day MA reversed direction and has been rising since February 28, 2018. Although, the 50-day MA still has not crossed above the 200-day MA, the 50-day average closed the gap from 2.5% below the 200-day average two month ago to just 0.14% below the 200-day average today.

Financial Results

On February 28, 2019, the Starwood Property Trust reported its financial results for the last quarter and full-year 2018. On total revenues of $293 million, the trust reported a $92.1 million net income, which is equivalent to $0.33 earnings per diluted share (EPS). Adjusted earnings were $155 million or the equivalent of $0.54 per diluted share. This adjusted EPS figure beat Wall Street analysts’ expectations of $0.53 per share. In addition to this quarter, the trust’s EPS outperformed analysts’ expectation in the first three quarters as well.

For the full year, the trust earned $1.1 billion in revenue and delivered net earnings of $386 million, which correspond to earnings of $1.42 per diluted share. Adjusted earnings of $608 million were equivalent to $2.19 per diluted share, which was 3.3% higher than analysts’ expectations.

Starwood Property Trust, Inc. (NYSE:STWD)

Headquartered in Greenwich, Connecticut and formed in 2009, the Starwood Property Trust, Inc. operates as a REIT in the United States and Europe. The trust operates through three business segments — Real Estate Lending, Real Estate Property and Real Estate Investing and Servicing. The Real Estate Lending segment originates, acquires, finances and manages commercial first mortgages, subordinated mortgages, mezzanine loans, preferred equity, commercial mortgage-backed securities (CMBS), residential mortgage-backed securities, residential mortgage loans and other real estate-related debt investments. Furthermore, the trust’s Real Estate Property segment acquires and manages equity interests in commercial real estate properties, including multi-family properties. Lastly, the Real Estate Investing and Servicing segment manages and works out problem assets; acquires and manages unrated, investment grade and non-investment grade rated CMBS. This segment also originates conduit loans for the primary purpose of selling these loans into securitization transactions and acquires commercial real estate assets. The company chooses to operate as a REIT to take advantage of favorable tax provisions. However, as required for all REIT, the company must distribute at least 90% of its taxable income to its stockholders to maintain the favorable tax status.

Share Price

The share price entered the trailing 12-month period on a mild uptrend and gained more than 7% before reaching its 52-week high of $22.90 on August 1, 2018. After a small pullback, the share price traded mostly in the $21 to $22.50 range before dropping more than 15% during December and reaching its 52-week low of $19.36 on Christmas Eve.

The share price recovered nearly half of those losses by the end of the first week in January and continued to rise. By March 19, 2019, the share price recovered all of its December 2018 losses and closed at $22.62. Just 1.2% short of the 52-week high from August 2018, the current closing price is 5.8% higher than it was 12 months earlier and nearly 17% above the Christmas Eve low. The current share price growth combined with the trust’s 8.5% dividend yield to deliver a 14.3% total return over the past year. Additionally, the shareholders enjoyed a 36% total return over the past five years and a 52% total return over the past three years.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.