Edison International (NYSE: EIX) — one of the largest investor-owned utilities in the country — has been growing its capital gains since a substantial share price drop in mid-November 2018 and the trend seems to have enough steam to continue into the second quarter of 2019.

The company was named as a plaintiff in a lawsuit alleging that its Southern California Edison subsidiary was at least partially responsible for causing the Woolsey Fire. The fire burned nearly 100,000 acres and destroyed more than 1,600 structures in early November 2018.

In the aftermath of this announcement the share price dropped nearly 23% during the last two trading sessions of the week. Furthermore, the share price also traded lower in two out of the three trading sessions the following week. Over those five trading sessions, the share price lost nearly one-third of its value. However, after bottoming out in mid-November, the share price has been on a relatively steady uptrend and has gained back more than three-quarters of those losses.

Despite the shareprice decline, the company still managed to deliver to its shareholders a positive total return for the year. While the share price managed to gain a few percentage points over the past year, the company’s dividend income compensated for the share price troubles and contributed more than half of the total returns over the past 12 months while the share price is recovering.

The 50-day moving average broke back above the 200-day moving average and was rising nicely when the November pullback forced a trend reversal and the 50-day moving average was back below the 200-day average by early December. While still below the long-term moving average, the 50-day moving average has reversed direction and has been rising since January 25, 2019. Over the past 60 days the 50-day moving average has closed the lag below the 200-day moving average from more than 11% in late January to less than 5% by the end of trading on March 25, 2019.

Financial Results

Edison International’s most recent financial report on February 28, 2019, disclosed a 6.6% reduction in fourth-quarter revenues on a year-over-year basis to $3.01, which beat analysts’ expectations by nearly 4%. However, quarterly earnings per share (EPS) of $0.94 missed analysts’ expectations of $0.96 by 2.1%.

Full-year 2018 revenues of $12.66 billion marked a 2.7% improvement over the previous year and were also within 0.6% of analysts’ expectations. Additionally, the $4.15 adjusted EPS was just one cent short of expectations and 7.8% below last years $4.50 amount per share.

Edison International (NYSE: EIX)

Based in Rosemead, California, and founded in 1886, Edison International generates, transmits and distributes electric power, with its operations being based through two divisions. Southern California Edison (SCE) is one of the nation’s largest investor-owned utilities, and the company’s service area includes approximately 430 cities and more than 50,000 square miles in central, coastal and southern California. Through more than five million residential and commercial accounts, the company provides electric power to approximately 15 million people, more than the entire population of Pennsylvania — the fifth most populous state in the United States. The other division, Edison Energy, is based out of Irvine, California, and is an independent advisory and service company for commercial and industrial energy users. Edison Energy helps companies reduce energy costs, improve environmental performance, ensure energy resiliency and manage exposure to energy price risk.

Dividends

Edison International’s current $0.6125 quarterly dividend amount reflects a 1.24% hike over the previous period’s $0.605 distribution. This new payout amount corresponds to a $2.45 annual distribution amount and a 3.8% forward dividend yield. The steady supply of annual dividend hikes over the past several years drove this current dividend yield 30% higher than the company’s own 2.9% average yield over the past five years.

In addition to advancing against its own dividend yield average, Edison International managed to outperform the average yields of its competitors as well. With its current 3.8% dividend yield, Edison International outperformed the 2.21% average yield of the overall Utilities sector by more than 70%. Additionally, Edison International’s current yield was also nearly 31% higher than the 2.91% average yield of its peers in the Electric Utilities industry segment. Furthermore, even compared to the 3.6% simple average yield of the much narrower group of the Electric Utilities segment’s only dividend-paying companies, Edison International’s current yield is still nearly 6% higher.

While distributing dividends for more than a century, the company went through a serious financial downturn and eliminated dividend distributions from 2001 through 2003. However, Edison International tripled its total annual dividend distribution amount since reinstating its dividend payouts in January 2014. This level of dividend advancement corresponds to an average annual growth rate of 7.7% per year over the last decade and a half of consecutive annual dividend hikes.

Share Price

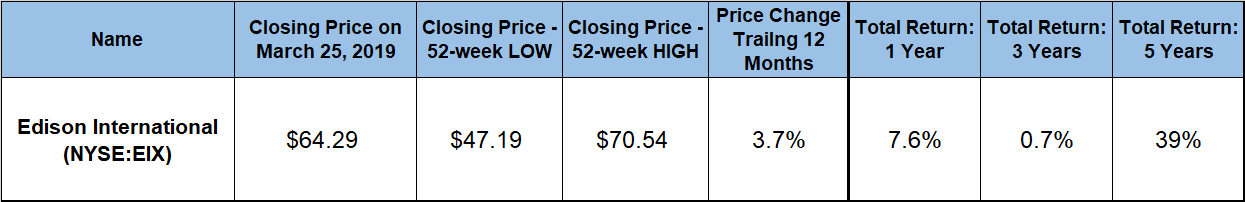

Riding a slow uptrend that began in February 2018, the share price gained nearly 14% over the first seven months of the trailing 12-month period. However, the share price reached its 52-week high of $70.54 on October 24, 2018, which was just two weeks before the sharp price drop. The share price fell 33% over the next three weeks to reach its 52-week low of $47.19 on November 15, 2019.

However, the share price reversed direction immediately after that drop. By the end of trading on March 25, 2019, the share price had recovered 77% of its November losses and inched above the price level from one year earlier to close at $64.29. While still almost 9% below the 52-week high from October 2018, this closing share price was 3.7% higher than it was 12 months earlier and 36% above the November low. Furthermore, combined with the dividend income over the past 12 months, the share price delivered a one-year total return of 7.6%. The two share price dips in 2017 and 2018 limited the three-year total return to less than 1%. However, the total return over the past five years was nearly 40%.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.