Tesla’s share price is exposed to further declines as the Securities and Exchange Commission (SEC) relentlessly pursues the company’s chief executive officer Elon Musk for his tweets that the agency claims could be misleading investors about “material” information.

Long-term investors should consider the real-world risk of SEC actions against Tesla and Musk in the future when deciding whether to buy, hold or sell their shares. Since Sept. 27, when the SEC charged Musk with tweeting “false or misleading” information on Aug. 7, Tesla’s share price has plunged 26.59 percent.

Tesla’s market value plummeted 18.62 percent last year on Friday, Sept. 28, the day after the SEC charged Musk with fraud for “recklessly” tweeting. The share price fell from $364.77 at the close of trading on Sept. 27 to $307.52 at day’s end on Sept. 28.

The SEC reached an Oct. 16 settlement with Musk that the agency claims required him to receive pre-approval for any written communications that reasonably could be considered “material” to investors. The agency filed a complaint on Feb. 25 that asked the U.S. District Court in Manhattan to find Musk in “contempt” for failing to meet that standard, while Musk and his attorneys claim he has diligently sought to comply.

Tesla’s Share Price Is Exposed to SEC’s ‘Interpretation’ of Order

Musk’s latest rebuttal on March 22 claimed the SEC is relying on a “radical interpretation” of the court’s previous order that would impose “sweeping restrictions” on him that he never consented to accept. The CEO’s attorneys contended in the response that Musk should not be held in contempt and that he never agreed to the SEC’s initial proposal that he face a strict “pre-approval” of all of the CEO’s Tesla-related tweets but that the company and its leaders resisted and agreed to less restrictive terms.

“The SEC’s position is wrong on almost virtually every level,” Musk indicated in his response. The key question is whether Musk complied with Tesla’s policy about tweeting, not whether the SEC agrees with the policy, the CEO’s attorneys wrote.

The SEC responded on March 26 asking the judge to rule in its favor, without holding a hearing, claiming that the court should have enough evidence to find Musk in contempt for his Feb. 19 tweet at 7:15 p.m. EST that “Tesla made 0 cars in 2011, but will make around 500k in 2019.”

Musk sought to correct the tweet with a new one at 11:41 p.m., stating, “Meant to say annualized production rate at end of 2019 probably around 500k, ie 10k cars/week. Deliveries for year still estimated to be about 400k.”

Tesla’s Share Price is Exposed to Further Declines

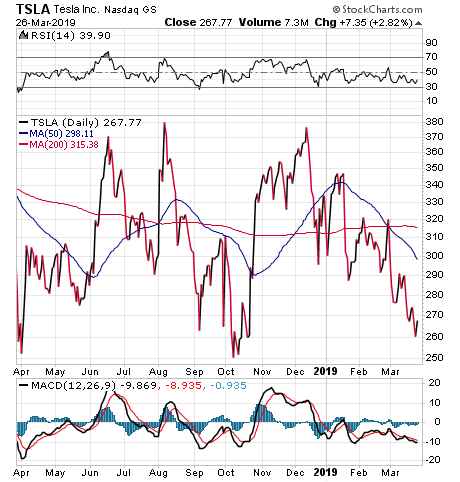

The share price of Tesla has dropped 28.93 percent since December 27, 2018, and is down 21.75 percent so far this year through March 26. Meanwhile, the S&P 500 has jumped 13.24 percent between Dec. 27 and March 26 and 12.43 percent year to date.

Tesla shareholders should beware that the SEC is showing no sign of backing off of its steadfast criticism of Musk and his tweets that the agency’s claims must be reviewed prior to posting, if any information reasonably could be “material” to investors.

Chart Courtesy of stockcharts.com

Tesla’s Market Value Falls While Ark Innovation ETF Climbs

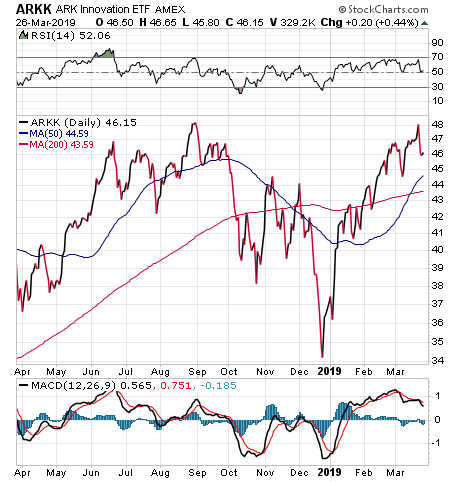

Ark Innovation ETF (NYSE:ARKK) still features Tesla as its largest holding, but the fund that focuses on investing in companies that introduce technologically enabled new products or services that potentially could change the way the world works is on the rise. That fund, recommended by Dr. Mark Skousen in his Forecasts & Strategies investment newsletter, is up 24.09 percent year to date.

Chart Courtesy of stockcharts.com

“Very few CEOs have the chutzpah to publicly challenge the SEC,” said Jim Woods, editor of Successful Investing, Intelligence Report and Bullseye Stock Trader. “Because Musk is a rule breaker in the pure sense of the word, he is being celebrated for his robust defense. I celebrate his defense as well, but if you own the stock you have to be prepared to suffer the occasional SEC headwind.”

A less flattering view of Musk was offered by Bob Carlson, who leads the Retirement Watch advisory service. Carlson told me the “continuing controversy” involving Musk’s tweets show that investors assume additional risk by owning shares in a public company in which he has a senior position.

“Musk appears to be using his position to provoke controversy and invite actions by the SEC and other regulators,” Carlson said. “While he might have strong arguments that the SEC is heavy-handed and over-reaching, the effort is diverting his time and company resources from the company’s operations at a critical time for Tesla.”

Musk Combats SEC in Court

Musk’s current practice of calling the SEC “wrong at virtually every level” is not the way to signal fund managers that they’re in for a smooth ride, said Hilary Kramer, a Wall Street professional who leads the Value Authority, GameChangers, Turbo Trader and Inner Circle advisory services for individual investors.

“The only real reason that hasn’t become a problem yet is that institutional investors quitting the company are being replaced with funds that were locked out of Tesla before it was profitable,” Kramer said. “When that flow stops, we’ll see more managers lighten their positions or simply abandon ship. As it is, conservative shops like T. Rowe Price, Bank of Montreal, Sumitomo and Janus have all dumped millions of shares in the last six months.

“I am not a securities lawyer, but as a show of good faith, it would be extremely useful for Tesla’s counsel to work with the SEC to test the limits of what they will and won’t approve. Musk is clearly working with a different framework for what constitutes new material disclosure than what the regulators want to see. Since the regulators make the rules, that’s a problem no matter how he wants to argue or whether his tweets move the stock.”

If the SEC opts to ban Musk from holding office in a publicly traded company, it would be “the kiss of death” for Tesla, Kramer said.

“So show some good faith,” Kramer said. “Send the SEC a bunch of hypothetical tweets that you can see yourself posting at some point in the future. Let them review and respond with a determination letter. After that, you know where they draw the line and they know you know. That’s a good thing for your shareholders and it’s ultimately a good thing for you, too.”

Until the SEC, Tesla and Musk find a workable solution, the federal court is left with a dispute to resolve that has big implications for each side but especially for the electric car manufacturer. Regardless of the court’s ultimate decision on the contempt claim, the SEC has put Musk on notice that he needs to exercise extreme caution when tweeting anything that could be considered “material” to the investing public.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. Follow Paul on Twitter @PaulDykewicz.

![[Tesla Motors]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_17994382.jpg)