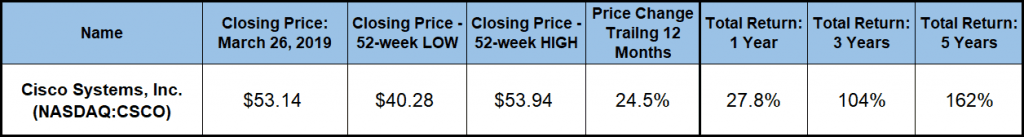

Cisco Systems, Inc. (NASDAQ:CSCO) managed to overcome a 17% share price correction in December 2018 and has rewarded its shareholders with capital gains of nearly 25% over the trailing 12-month period.

The current share price must gain nearly half of its value before contending with the company’s all-time high of nearly $80, reached in March 2000 during the dot-com bubble. However, disregarding the spike during the dot-com bubble, the share price has been trading higher than all of its previous price levels for nearly two years.

After losing nearly 90% of its value in the aftermath of the dot-com bubble, the share price bottomed out and began its current long-term rise from $8.60 in early October 2002. The share price doubled over the first decade that included the 2008 financial crisis and significant volatility. However, the share price embarked on a steeper and less volatile uptrend to rise four-fold since late 2012.

While the growth rate might slow down a little, the current share price still has room on the upside before it reaches the analyst’s current average target price of $55.13. Furthermore, the average analysts’ recommendation is a clear “Buy.” Out of the 27 Wall Street analysts currently covering the stock, 19 have either a “Buy” (11) or a “Strong Buy” (8) recommendation, with only eight analysts recommending a “Hold”.

The share price decline driven by the overall market pullback in December 2018 pushed the 50-day-moving average (MA) down to the 200-day MA level, but the 50-day average managed to keep pace with its longer-term indicator without falling below in a bearish manner. After moving in parallel during the entire month of January, the 50-day MA inched slightly above in February and took off higher as the share price uptrend continued. The 50-day MA of nearly $50 is currently more than 7% above the 50-day average and the share price is currently safely above both averages.

Financial Results

On February 13, 2019, Cisco Systems announced its financial results for the second quarter of fiscal-year 2019, which ended on January 26, 2019. Total revenues rose 5% year over year to $12.4 billion in the second quarter. Excluding last year’s sales, generated by the Service Provider Video Software Solutions (SPVSS) business — which Cisco Systems divested in the second quarter of fiscal 2019 — the year-over-year growth rate rises to 7%.

Additionally, the company generated net income of $2.8 billion for the period, or $0.63 per share. The adjusted income of $3.3 billion corresponds to a $0.73 per share and beat analysts’ expectation by a penny.

Cisco Systems, Inc. (NASDAQ:CSCO)

Founded in 1984 and headquartered in Silicon Valley’s San Jose, California, Cisco Systems, Inc. designs, manufactures and sells Internet Protocol (IP)-based networking and other products related to the communications and information technology industry. With nearly 16,000 employees in the San Jose area, Cisco Systems is the largest private employer in Silicon Valley and the second largest overall behind only the County of Santa Clara administration.

Cisco Systems is also the largest networking company in the world and offers switching, routing and storage products that provide connectivity to end users, workstations, IP phones, wireless access points and servers. Additional products in the company’s portfolio include private wireline and mobile networks, unified communications products, conferencing products and business messaging products. Cisco Systems also offers internet and e-mail security products, cloud storage technology, service provider video software and technical support services.

Share Price

The share price entered the trailing 12 months on a moderate uptrend that increased its slope in August 2018. During the first half of the current 12-month period, the share price gained more than 16% before reaching its temporary high of $49.14 at the beginning of October 2018. The uptrend paused and the share price moved mostly sideways until the beginning of December. Driven by the overall market correction, the share price dropped nearly 20% during the first three weeks of December toward its 52-week low of $40.28 on Christmas Eve.

However, the share price reversed direction immediately and resumed its uptrend. By mid-February, the share price had recovered all of the losses, exceeded its previous high and continued to gain another 10% before reaching its new high in nearly two decades of $53.94 on March 21, 2019.

Since that new peak, the share price pulled back slightly and closed on March 26, at $53.23. While only 1.3% lower than its recent peak, the March 26 closing price was 24.5% higher than it was one year earlier, as well as 32% above the 52-week low from late December. Furthermore, the current closing price was also 134% higher than it was just five years ago.

The robust asset appreciation over the past decade and a quick recovery from the December correction, combined to deliver to the company’s shareholders desirable total returns over the past several years. Just over the past 12 months, the 24%-plus capital gains combined with a 2.6% dividend income to reward Cisco Systems shareholders with a total return of 27.8%. In addition to abundant returns over the past year, the shareholders doubled their investment with a 104% total return over the past three years. Additionally, the total return over the past five years exceeded 160%.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.